If you have a Discover credit card you’re undoubtedly familiar with getting a monthly statement detailing your charges, payments interest, and the total balance owed. But when exactly is your Discover card payment due each month? Read on to learn more about Discover card billing cycles, payment due dates, and how to avoid late fees.

Discover, like all major credit card companies, has established monthly billing cycles Your individual billing cycle is based on when you first opened your account. Here’s an overview of how the billing cycle works

-

Your billing cycle starts on the same day each month, which is called your statement date. This is the day your monthly statement is generated.

-

During the billing cycle, all your new purchases, payments, credits, and interest accumulate.

-

At the end of the cycle on your statement date, Discover tallies up all the activity into your statement balance.

-

Your payment due date is 25 days after the statement date. This is the deadline to pay at least the minimum amount due.

-

If you don’t pay by the due date, you’ll incur a late fee and interest may accrue.

How the Discover Card Payment Due Date is Determined

For a real example, let’s say your Discover statement date is the 15th of each month. That means:

-

On May 15th, Discover will generate your statement for the billing period of April 16 – May 15.

-

The payment for your May 15th statement will be due 25 days later on June 9th.

-

On June 15th, your next statement will be created and the payment for that statement will be due on July 10th.

And so on each month. Your statement date remains the same, and your due date is 25 days later.

Discover clearly prints the due date on each monthly statement. So when your paper or online statement becomes available, simply check for your individual payment due date that month.

How to Avoid Late Fees on Your Discover Card

To avoid getting hit with a late fee, your Discover card payment must be received by 11:59pm ET on the payment due date each month. Here are some tips to ensure on-time payment:

-

Pay online – Discover offers free online bill pay through your account dashboard. Payments post instantly when made before 8:00pm ET on the due date.

-

Setup autopay – Enroll in Discover autopay to have payments withdrawn automatically each month by the due date.

-

Pay early – Submit your payment several days before the due date to account for mail time.

-

Use your bank’s bill pay – Scheduling one-time or recurring payments through your bank ensures on-time delivery.

-

Set reminders – Mark your calendar and set email/text alerts to remember the due date.

-

Pay more than the minimum – Paying the full balance avoids interest and keeps your credit utilization low.

As long as your minimum payment is received by the due date, you’ll avoid a $40 late payment fee. Discover does offer a one-time waiver of the first late fee as a courtesy if requested.

Discover Payment Requirements to Keep Your Account in Good Standing

Here are a few other key points to remember about Discover card payments:

-

Discover requires that you pay at least the minimum payment shown on your statement by the due date. The minimum is typically 2% of the balance or $35, whichever is greater.

-

If you consistently pay more than the minimum, you’ll pay less interest and pay off your balance faster.

-

There is no penalty for prepaying your account or paying off the balance early.

-

If you can’t pay on time one month, call Discover immediately to discuss payment options and avoid a late fee.

-

Discover charges a returned payment fee of $35 if your bank doesn’t honor the payment for any reason.

How Soon Can I Pay After My Statement Closes?

Since your payment isn’t due for 25 days after your statement date, there’s no rush to pay immediately. However, you can make a payment as soon as your statement is issued.

Some reasons you may want to pay early include:

-

Paying the statement balance in full to avoid interest on new purchases

-

Keeping credit utilization low before applying for a loan

-

Paying down a large balance to save on interest

-

Avoiding forgetting the due date by paying early

Just know that if you pay before your statement is issued, that payment will be applied to your next statement, not the current one.

Can I Pay My Discover Card Bill On a Different Day Each Month?

Discover bills you on the same statement date and requires payment on the same due date each month for consistency. However, when you pay within a billing cycle doesn’t really matter as long as it’s received by the due date.

You can pay on a different day each month based on when you have the available funds. Just be sure to schedule payments to arrive on time. The one exception is if you enroll in Discover autopay – that will always pay on the due date.

In Summary…

Hopefully this breakdown demystifies when your Discover card payment is due each month and how to avoid late fees. Check your monthly statement for the exact due date each month. Schedule payments to arrive by 11:59pm ET on that date and you’ll remain in good standing. Reach out to Discover customer service if you ever have questions about billing and payments.

How to Pay Your Discover Credit Card (Correctly)

FAQ

How do I know when my Discover card payment is due?

When should I pay off my Discover credit card?

What day is best to pay a credit card?

Do you have to pay Discover card in full every month?

How do I make a Discover credit card payment?

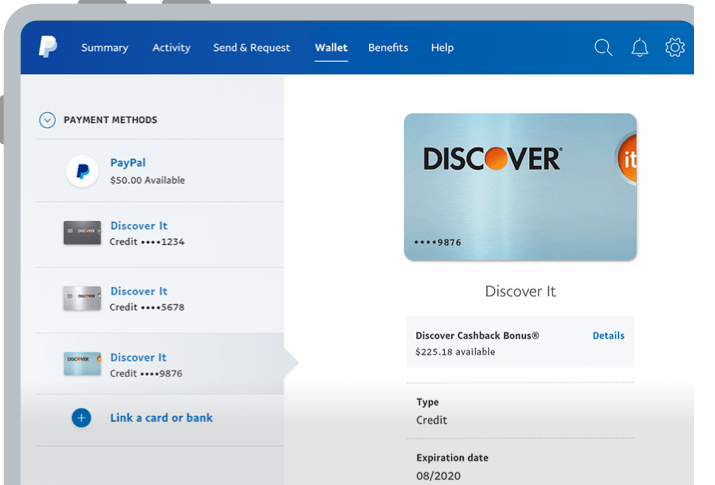

You can make a Discover credit card payment online, by phone, through the Discover mobile app, by mail or at a branch. To pay a Discover credit card bill online, log in to your online account and click on “Make a Payment.” Then, choose how much to pay, when to pay it, and where the payment is coming from.

When should I pay my credit card bill?

The best time to pay your credit card bill is by the due date. But, if you’re looking for ways to improve your credit score, save on interest, or reduce your credit utilization ratio, the earlier you can pay your credit card bill, the better. There are a few reasons to consider making payments on your credit card bill before the due date.

How do I cancel a Discover Card payment?

If you are enrolled in autopay, your payment will be processed on the date you have selected. And if you wish to cancel an automatic payment, you can do so online or by phone until 5:00 p.m. ET on the payment posting date. How do I make a Discover card payment?

Does discover process payments on the same day?

Discover will usually process payments on the same day if you pay before midnight Eastern Time, except for payments you make on your cycle date. Cycle date payments post the same day when you make them before 5:00 p.m. ET. If you are enrolled in autopay, your payment will be processed on the date you have selected.

Does discover offer a balance transfer credit card?

Discover has balance transfer credit card offers for eligible individuals who qualify. This may help you combine other credit card debt on one card for one monthly payment and may save you money on credit card interest.

Where is my Discover credit card payment address?

The Discover credit card payment address is based on your current address. You can review the address listed on your periodic statement to ensure your payment is received at the correct location: Discover Financial Services, PO Box 71242 Charlotte NC 28272-1242