Paying your monthly cell phone bill is a regular occurrence for most people nowadays. We all rely on our cell phones for communication, work, entertainment and more. But have you ever stopped to think about the function of money that is being utilized when you pay that bill in cash? In this article, we’ll break down the role cash plays in that transaction and the specific function of money that is highlighted.

An Overview of the Functions of Money

Before diving into the specifics, it helps to understand the basic functions that money serves in an economy. There are generally considered to be four main functions of money

-

Medium of exchange – This refers to money’s role as an intermediary that can be exchanged for goods and services, Money facilitates transactions by providing a common unit of account rather than relying on bartering various items directly

-

Store of value – Money maintains its worth over time. Unlike commodities which can spoil or deteriorate, money retains purchasing power into the future. This allows people to save money for later use.

-

Unit of account – Money provides a common metric for assigning value and determining prices. It allows the value of different items to be compared against a standard unit.

-

Standard of deferred payment – Money allows people to buy and sell on credit. Debt and loans can be issued and repaid with money over time.

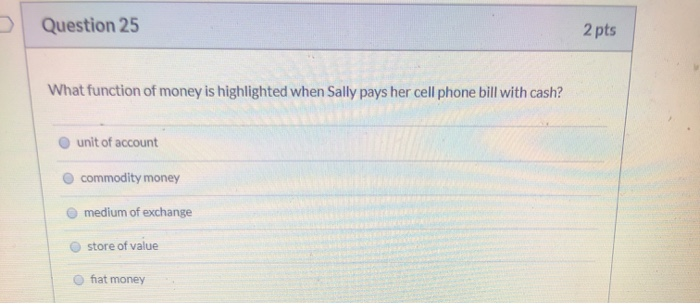

Paying With Cash Emphasizes Money’s Function as a Medium of Exchange

When you use cash to pay your cell phone bill, it emphasizes money’s role as a medium of exchange. The medium of exchange function refers to money’s ability to act as an intermediary instrument that can be exchanged for goods, services or items of value. It facilitates transactions between buyers and sellers.

Instead of having to rely on bartering your own possessions and services directly for what you need, money allows you to indirectly exchange your time and labor for an agreed upon monetary unit. This money can then be exchanged by the receiver for whatever items or services they desire. The transaction is more flexible, divisable, portable and convenient with money as the medium instead of physical goods.

When you hand over cash to pay your monthly cell bill, you are utilizing money’s most essential function – its ability to act as a medium you can exchange for the service provided by the cell phone company. The use of physical currency in the transaction clearly exemplifies the exchange process.

Why Cash Emphasizes This Function

Using paper cash to pay a bill emphasizes the medium of exchange role because it clearly represents money changing hands directly in return for goods or services. The exchange is tangible – you hand over the cash and receive the service. There is no third party or promise to pay later involved.

Compare this to other methods of payment like checks, credit cards or electronic transfers. With something like a credit card, you are essentially making a promise to pay the money later after being granted the service immediately. The credit card network acts as an intermediary facilitating the transaction.

With cash, the process is executed in full right on the spot. The cell phone company immediately receives the medium of exchange (cash) from you, the buyer, in return for giving you cell service for the month. It powerfully demonstrates money’s use as a medium that can be directly exchanged.

Benefits of Cash as a Medium of Exchange

Using physical cash to make transactions has some key benefits related to its status as a medium of exchange:

-

Immediacy – The exchange is settled on the spot when cash changes hands. There is no waiting for checks to clear or electronic payments to process.

-

Tangibility – Cash has a physical presence and hands-on feel that enhances its use as a medium of exchange. The transaction feels real and finite.

-

Anonymity – Paper cash doesn’t identify the buyer or seller, allowing for anonymous exchanges. Credit cards and checks reveal more personal information.

-

Accessibility – Cash is universally accepted within an economy and parties don’t need access to banks or technological infrastructure to exchange it. This makes it ideal for small, everyday transactions between all people.

-

Low fees – Transacting with paper cash allows buyers and sellers to avoid processing fees associated with electronic payments. The exchange has minimal third-party costs involved.

Of course, cash has downsides too regarding security, storage and the inability to build credit or rewards. For most routine transactions though, paying with paper currency spotlights the foundational process of exchanging a medium directly for goods or services.

Examples of the Medium of Exchange in Action

Beyond just cell phone bills, people utilize physical cash for all types of everyday exchanges that embody the medium of exchange function:

- Paying for a morning cup of coffee

- Buying movie tickets at the box office

- Tipping servers, baristas or valets

- Renting bikes, scooters or other items

- Paying tolls, parking meters and public transit fares

- Purchasing food from farmers markets or street vendors

- Filling up the gas tank at a service station

- Dropping coins in arcade games or laundromat machines

Anytime you hand over paper bills and coins to obtain an item or service directly, you are tapping into physical currency’s fundamental ability to act as a medium of exchange. This versatile function is essential to facilitating transactions and enabling economic activity at many levels.

The Takeaway

So the next time you pay your cell phone bill with cash, take a moment to recognize that you are utilizing one of the most vital and definitive functions of money. Through that simple transaction, money is acting as an intermediary medium of exchange that lets you obtain the service you want with the currency you hold. Appreciating the roles and properties of money leads to a greater understanding of economics as a whole.

The use of physical bills and coins clearly exemplifies money’s medium of exchange function, allowing buyers and sellers to trade currency for goods, services and more. This essential role of money is highlighted and reinforced whenever cash changes hands. Keep this in mind as you use money throughout your daily economic life.

Step 2

Select Pay & Transfer to get started.

Step 15

Select your “From” account for the transfer and then your “To” recipient. Enter the amount you want to send; the transfer will be sent in the currency you selected for the recipient. If needed, click Change default currency to update currency.

Note: There are no outbound wire transfer fees if sent in foreign currency. Markups are included in Bank of America exchange rates, which are determined by Bank of America in its sole discretion. You may be prompted to request an Authorization Code when your transfer exceeds a certain amount.

9 Ways to Save Money on Your Cell Phone Bill

FAQ

What function of money is cash?

What function of money is highlighted when TSAI pays her water bill with cash?

When I use money to pay my cell phone bill, which function of money is being used?

What function of money is highlighted when I put cash under my mattress to have on hand for unexpected emergencies?