Online bill payment provides a convenient way to ensure your bills get paid on time without writing checks and buying stamps. Wells Fargo offers bill pay as a feature within its online banking platform. What does this service cost? Here’s an overview of the fees associated with using Wells Fargo’s bill pay.

No Monthly Fee for Bill Pay

The good news is Wells Fargo does not charge a monthly fee simply for accessing the bill pay service You can use their online bill payment at no cost beyond your regular monthly service fees for your checking or savings account

This makes Wells Fargo’s bill pay more affordable than some other banks that levy an additional monthly bill pay charge on top of regular account fees

Underlying Account Fees Still Apply

While bill pay itself is fee-free keep in mind you still have to pay the monthly maintenance fees for whichever Wells Fargo account you use to fund bill payments.

For example, if you pay bills from your Wells Fargo checking account that has a $10 monthly service charge, you’ll still pay that $10 fee separately even when using bill pay.

Be sure to choose a funded account that matches your needs. A fee-free checking account avoids those monthly charges altogether when paying bills.

No Fees for Electronic Payments

Wells Fargo won’t charge you any fees for sending electronic bill payments to companies and service providers.

This is the preferred bill payment method that instantly debits your checking account and transfers funds. Wells Fargo does not charge for sending electronic payments.

You’ll simply pay the regular fees associated with your funded checking or savings account.

Check Payments Incur Check Fees

While electronic payments are fee-free, there are costs associated with paying bills by check through Wells Fargo bill pay.

You’ll pay your regular checking account fees for each check written, the same as if you wrote the check manually. Expect to pay:

-

Checkwriting fees if your account charges per check

-

Overdraft fees if checks overdraw your account

-

Stop payment fees if needed

To avoid extra check-related fees, opt for electronic bill payment when available. Wells Fargo won’t charge additional costs above your account’s fees.

No Extra Fees for Expedited Payments

Some bill pay services charge extra if you need to expedite a payment to avoid a late fee with the payee.

Wells Fargo does not levy express or expedited payment fees, even for rushed same-day or overnight electronic transfers. You can send last-minute payments as needed at no added cost.

Just make sure your account has sufficient funds to cover expedited payments to prevent overdrafts. Schedule payments early when possible to allow processing time.

Set Up Recurring Auto-Pay for Free

The most convenient way to pay bills through Wells Fargo is by scheduling recurring auto-pay rules. This automatically sends your payments each month on the date you specify.

Wells Fargo does not charge any fees to set up or maintain auto-pay. You can schedule automated payments to as many payees as needed at no extra cost.

Auto-pay prevents late fees by ensuring your bills get paid on time every month, with no effort on your part. It’s a free time saver.

Mobile Bill Pay Has No Extra Fees

In addition to their online bill pay portal, Wells Fargo offers a full-featured mobile app for bill management.

You can conveniently pay bills on-the-go directly from your smartphone or tablet without incurring any additional fees from Wells Fargo.

The mobile functionality is totally free – the bank won’t charge extra to use their apps versus the online bill pay site. Download and start paying bills from anywhere.

No Fee for eBills

Wells Fargo also lets you view electronic bills from participating payees directly within your bill pay dashboard.

Accessing and managing eBills does not cost anything extra. Wells Fargo doesn’t charge activation fees or incremental fees based on how many eBills you receive each month.

Sign up for as many paperless eBills as you want to simplify bill organization. It’s a free feature when you use Wells Fargo bill pay.

Bill Pay Cost Considerations

To recap, Wells Fargo provides full online and mobile bill pay capabilities with:

- No monthly service charge for bill pay access

- No extra fees for electronic payments

- No express payment fees for last-minute payments

- No activation or usage fees for auto-pay set up

- No incremental fees based on number of payments

The only costs you’ll incur are the underlying maintenance fees associated with the checking or savings account used to fund payments. And any applicable check fees for rare check payments.

Overall, Wells Fargo’s bill pay fees are quite reasonable compared to other banks. Convenience comes at an affordable price!

Esta página solo está disponible en inglés

Selecione Cancele para permanecer en esta página o Continúe para ver nuestra página principal en español.

Pay your bills without the hassles of writing checks and buying stamps Bill Pay set-up is easy. Take control over when your bills are paid.

No more checks to write, envelopes to find, or stamps to buy. Set up your bill amount, and we’ll pay it. Initial set-up is quick and easy.

View your payment history, and help stay in control by knowing who’s getting paid and by when. If you want, we’ll send you an email confirmation of your payments.

✅ How To Set Up Wells Fargo Bill Pay

FAQ

Does Wells Fargo charge to use Bill Pay?

Is Wells Fargo business Bill Pay free?

Does Wells Fargo charge fees?

How much is the Wells Fargo automatic payment fee?

Does Wells Fargo charge a fee?

A fee will be charged for each debit card purchase in a foreign currency that a network converts into a U.S. dollar amount. The Wells Fargo ExpressSend Service is a person-to-person remittance (money transfer) service that offers you more options to send money home to family or friends in 12 countries.

How much does Wells Fargo Bill Pay cost?

There is no fee for Direct Pay payments made to Wells Fargo personal bank accounts. Direct Pay payments to non-Wells Fargo personal bank accounts are $0.50 per payment. Direct Pay payments made to business bank accounts are $3 each. Receive online versions of your paper bills through Wells Fargo Bill Pay.

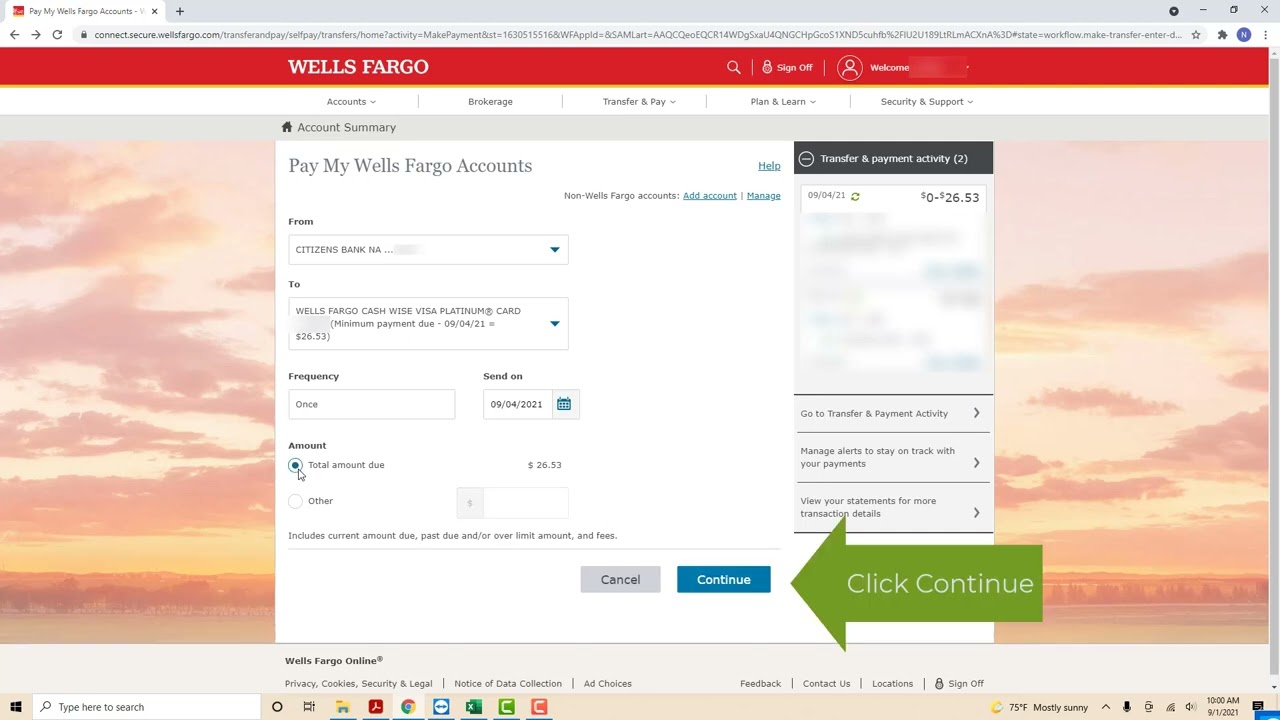

How do I pay a Wells Fargo credit card?

In addition, you can pay online, by mail, or at a Wells Fargo ATM. Paying online will generally be the fastest method. When you make your payment, you will be able to specify the amount you want to pay – the full balance or any amount that’s at least the minimum due. You will also need to specify the date you want the payment to be made.

Does Wells Fargo charge late fees?

Yes, Wells Fargo does charge late fees when cardholders don’t make the minimum payment by the due date. Thanks to the CARD Act of 2009, the Wells Fargo late fee can never exceed the minimum payment amount.

How do I access bill pay if I don’t have a Wells Fargo account?

You can access Bill Pay for the first time, from either your desktop or mobile device, if you have a Wells Fargo checking account and are enrolled in Wells Fargo Online. If you don’t have a Wells Fargo Online username and password, enroll now to get started. Then, just sign on to Wells Fargo Online to access Bill Pay.

Does bill pay charge a monthly fee?

Pay your bills and invoices online from your business or personal accounts. There’s no monthly service fee to use Bill Pay. Account fees (e.g., monthly service) may apply to your account (s) that you make Bill Pay payments from. We don’t charge overdraft fees on Bill Pay transactions, but Bill Pay transactions can contribute to overdrafts.