Having an auto loan with PNC Bank offers the convenience of flexible payment options In this comprehensive guide, I’ll walk through everything you need to know about paying your PNC auto loan each month

Overview of PNC Auto Loans

PNC Bank is one of the largest lenders for new and used auto loans in the U.S. They offer competitive interest rates to finance vehicles purchased from dealerships or private parties.

As a PNC auto loan customer, you’ll make fixed monthly payments over the loan term to repay the amount financed PNC reports your payment history to credit bureaus, so staying current helps build your credit

Now let’s review the various ways to pay your monthly PNC auto loan bill,

Ways to Pay Your PNC Auto Loan

PNC Bank offers several payment options to fit your needs:

Online Banking

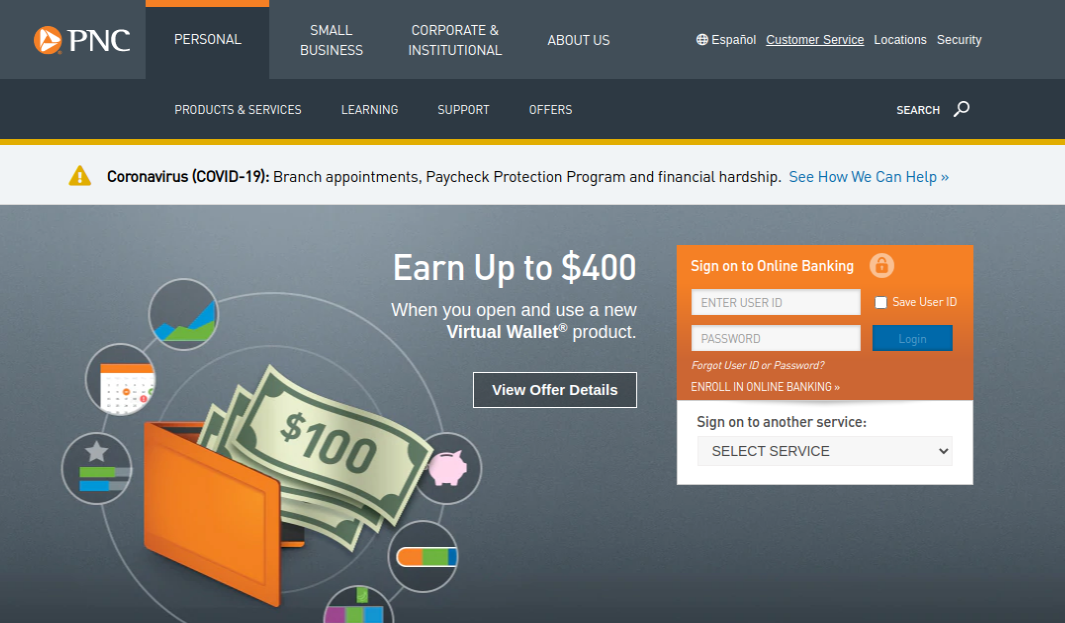

The easiest way to pay is through PNC Online Banking. You can make one-time or recurring payments from your PNC Bank account. Or link external accounts to pay from other banks.

To enroll, just visit www.pnc.com and click on “Online Banking” to create your account. The site is secure and lets you manage payments anytime.

Mobile Banking App

Use the PNC mobile app on your smartphone or tablet to pay on the go. Download the app and log in to make quick one-time payments from your PNC accounts.

Automated Payments

For hands-free payments, enroll in PNC’s Automated Payment Program. Your monthly auto loan payment will be automatically deducted from your checking account.

To enroll, complete the authorization form online or at a branch. Payments will be made on your due date each month.

Pay Online

Make one-time payments as a guest through PNC’s online payment portal. No enrollment needed. Just have your account number and debit/credit card details.

Visit www.pnc.com and click on the “Pay My Loan” link to access the payment portal.

Pay by Phone

Call PNC at 1-888-762-2265 and use their automated Voice Banking system. It’s available 24/7 for quick phone payments using your bank account or credit/debit card.

Pay by Mail

Mail your payment to:

PNC Bank PO Box 747066 Pittsburgh, PA 15274-7066

Be sure to include your loan account number and payment due date. Allow 5-7 days for mailed payments to process.

Pay at a Branch

Visit any PNC Bank branch during business hours to make a payment in person. Payments made at a branch are effective immediately.

Prepay

To avoid monthly bills, prepay your loan by making extra principal payments. This will reduce your overall interest costs and help you pay off the loan faster.

Tips for Paying Your PNC Auto Loan

Here are some tips to help you manage your monthly PNC auto loan payments:

-

Pay a few days early to avoid late fees if mailing payments.

-

Set payment alerts through online banking so you don’t miss due dates.

-

Enroll in autopay to have payments automatically deducted each month.

-

Monitor your account balance and payments in online banking to avoid surprises.

-

Update your contact information so PNC can reach you about any payment issues.

-

Contact PNC immediately if you can’t make a payment and need assistance.

Avoid Late Fees and Repossession

It’s crucial that you pay your PNC auto loan on time each month. If you cannot pay by the due date, call PNC right away to ask about hardship assistance programs or payment extensions.

Here’s what happens if you fail to make payments:

- A late fee is charged after a 15-day grace period

- Your credit score will be damaged from missed payments

- PNC can report the delinquency and repossess the vehicle

- You may owe additional fees for collection, legal costs, and repossession

Avoid these costly consequences by keeping your account current. Reach out to PNC if you anticipate any difficulty with making monthly payments.

Get Payment Assistance if Needed

If you’re struggling due to job loss, medical bills, or other financial hardship, PNC wants to help. They offer customized assistance programs for auto loan customers facing difficulties.

Some relief options include:

- Payment extensions

- Temporary hardship forbearance

- Lower interest rates

- Modified payment plans

- Deferrals to bring account current

Contact PNC right away if you need assistance. Their representatives will evaluate your situation and match you with the appropriate hardship program. Keeping the lines of communication open is key to getting back on track.

Pay Off Your Auto Loan Early

One of the best ways to pay your PNC auto loan is to pay it off early. This reduces the total interest paid over the loan’s term.

You have two options to pay off your loan ahead of schedule:

1. Pay extra each month

Adding any extra amount to your regular monthly payment goes directly toward principal. This reduces the interest charged each month and shortens the payoff timeline.

2. Make a lump sum payment

You can pay down the principal by making one-time extra payments. This works well if you receive a tax refund, bonus, or other windfall.

Check PNC’s website or call to get your current payoff amount before making an early payment. Then send the payoff funds to PNC and they will close out your auto loan.

Closing Thoughts

Be sure to pay on or before the due date and reach out for hardship help if necessary. With responsible repayment, you can build credit and pay off your loan successfully.

How to Use Online Bill Pay on the PNC App

FAQ

How to set up bill pay on PNC?

How do I auto pay my PNC credit card bill?

How do I Manage my PNC auto loan online?

Take advantage of the tools in Online Banking to help you manage your loan. Log in to Online Banking. Select your auto loan account and choose Make a Payment. Select a From account, choose your Frequency, Start Date, End Date and Payment Amount. Review disclosure and hit Submit. These alerts will notify you of key activity on your PNC Auto Loan.

How do I make a payment on my PNC auto loan?

Log in to Online Banking. Select your auto loan account and choose Make a Payment. Select a From account, choose your Frequency, Start Date, End Date and Payment Amount. Review disclosure and hit Submit. These alerts will notify you of key activity on your PNC Auto Loan. Access the Alerts Tab in Online Banking. Select auto.

When will I receive my PNC auto loan payment statement?

You will receive your statement 15 days before your payment due date and your payment will be due by the due date indicated on your statement. Payment reflects the amount currently due on your PNC Auto loan. You are responsible for paying this amount by the due date specified. Late payments may incur a late fee and accrue daily interest.

What does payment mean on a PNC auto loan?

Payment reflects the amount currently due on your PNC Auto loan. You are responsible for paying this amount by the due date specified. Late payments may incur a late fee and accrue daily interest. If you are enrolled in AutoPay, your payments will be made automatically on the agreed upon due date.

How do I make a payment through PNC online banking?

You can always make your payment through PNC Online Banking by making a one-time payment or set up recurring payments. Review your payment history by the amount of principal and interest that you have paid throughout the life of your loan, along with the remaining balances.

Does PNC offer online bill pay?

All online banking services are subject to and conditional upon adherence to the terms and conditions of the PNC Online Banking Service Agreement. Online Bill Pay is a service within PNC Online Banking that is available for residents within the US who have a qualifying checking account.