Ocwen is one of the largest non-bank mortgage servicing companies in the United States If you have a mortgage through Ocwen, you likely receive a monthly statement with payment due dates and account information Paying your Ocwen mortgage on time each month is essential to avoid late fees and potential credit damage. This guide will overview the various ways Ocwen customers can submit their monthly mortgage payments.

Ways to Pay Your Ocwen Mortgage Bill

Ocwen offers several options for mortgage customers to make their monthly payments conveniently and securely

-

Online – Pay instantly on Ocwen’s website Create an account or pay as guest

-

Phone – Call 800-746-2936 to pay via Ocwen’s automated system or speak to a representative.

-

Mail – Send a check or money order with your payment coupon to Ocwen’s payment address.

-

Auto pay – Set up recurring automatic monthly payments from a bank account.

-

In person – Visit an authorized Ocwen payment location.

Paying online provides quick confirmation that your payment was received. But choose the pay option that best matches your needs each month.

Tips for Paying Your Ocwen Mortgage Bill Successfully

Follow these tips when making your monthly Ocwen mortgage payments:

-

Open statements promptly to avoid missing due date

-

Review payment amount needed and account number

-

Pay a few days early to account for mailing time

-

Contact Ocwen if account or payment info changes

-

Set payment reminders on your calendar

-

Utilize autopay or online payments for convenience

-

Include payment stub if paying by mail

-

Save payment confirmations and receipts

Paying on time can help avoid late fees being added to your account. Make monthly payments a priority.

What To Do If You Can’t Pay Your Ocwen Mortgage

If you are struggling to make your full Ocwen mortgage payment, take action right away:

-

Call Ocwen – Discuss repayment or assistance options to avoid default.

-

Payment plan – Set up smaller installment payments over time.

-

Loan modification – Adjust loan terms to reduce monthly payment.

-

Forbearance – Have payments reduced or suspended temporarily.

-

Refinance – Obtain a new loan with lower interest rate.

-

Hardship options – Request exceptions if facing financial hardship.

Letting your mortgage become delinquent can negatively impact your credit and lead to foreclosure. Stay proactive on past due accounts.

Estimate Your Ocwen Mortgage Payment

Use Ocwen’s online mortgage calculators to estimate what your monthly mortgage payment could be based on your loan amount, interest rate, loan term, and other factors:

- Helps estimate initial mortgage payment

- Models different loan scenario payments

- Factors in property taxes and insurance

- Calculates principal, interest, and escrow

- Allows customizing loan details

Getting an idea of potential mortgage payments can aid budgeting and planning. Explore payment options.

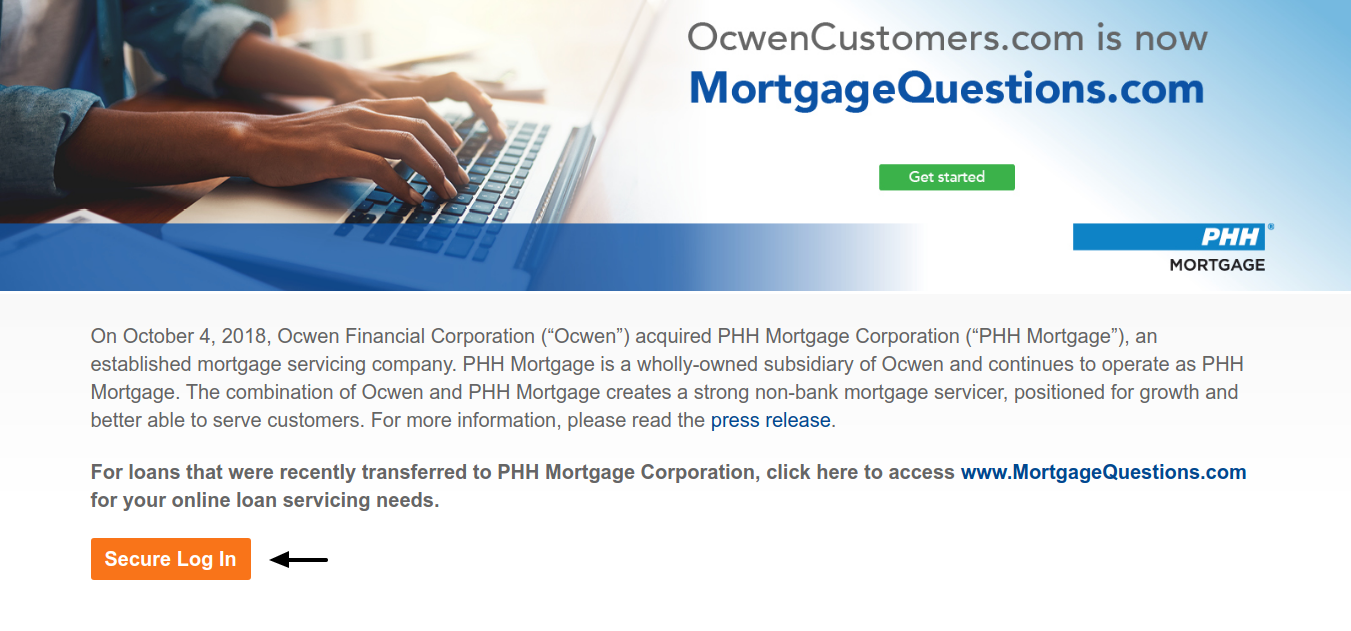

Set Up Ocwen Online Account Access

Setting up an online account at Ocwen.com provides benefits like:

- Paying your mortgage online

- Viewing mortgage statements

- Updating account information

- Enrolling in auto payments

- Managing escrow accounts

- Receiving paperless statements

- Accessing tax documents

Create a username and password to conveniently access your Ocwen mortgage details 24/7.

Avoid Ocwen Mortgage Default and Foreclosure

To avoid mortgage default or foreclosure by Ocwen, be sure to:

- Pay at least the minimum monthly payment

- Contact Ocwen immediately if struggling to pay

- Discuss mortgage assistance programs you may qualify for

- Set up a repayment plan or loan modification

- Explore options to lower your interest rate

- Prioritize paying mortgage over other expenses

Keeping your Ocwen mortgage account current is key to maintaining positive credit and avoiding costly foreclosure. Act quickly on past due accounts.

Ocwen Customer Service Contact Information

If you need assistance with your Ocwen mortgage account, you can reach their customer service team:

Phone: 800-746-2936

Email: Visit Ocwen.com and log into your account to email customer support

Mail: Ocwen Loan Servicing, P.O. Box 24736, West Palm Beach, FL 33416

Website: Ocwen.com

Contact Ocwen promptly if you have questions about your bill, are struggling to make payments, or need account assistance.

Managing mortgage payments can feel confusing and stressful for many homeowners. But understanding your Ocwen mortgage statement, selecting convenient payment methods, and reaching out for support can greatly simplify the process. Pay your Ocwen mortgage bill on time each month to maintain positive credit and your good standing as a homeowner.

Onity Mortgage – FAQs

We are excited to announce that PHH Mortgage will be changing its name to Onity Mortgage.

Learn more about when youll receive your Form 1098 or refer to the Taxes and Year-End Frequently Asked Questions for more details.

Find answers to frequently asked questions about mortgage transfers.

Mortgage Questions Mobile App

Download or upgrade to the latest version today. Weve completely redesigned our mobile app interface. Enjoy simpler and more intuitive navigation, improved functionality and other mobile-friendly enhancements. Managing your account on the go has never been easier!

This is a carousel with several slides summarizing different articles. Use Next and Previous buttons to navigate, or select the link at the bottom of each slide to open the article.

Ocwen/PHH: How you MUST handle their mortgage mistakes

FAQ

How do I make a payment on my PhH loan?

Is Ocwen still in business?

Who is onity mortgage?

What is the phone number for Mortgagequestions payments?