Navy Federal Credit Union offers its members a convenient bill pay service to easily pay bills online. However, members may have many questions about how bill pay works and its features. Here are answers to some frequently asked questions about using Navy Federal bill pay for payments.

What is Navy Federal bill pay?

Navy Federal bill pay is an online service that lets you pay your bills directly from your Navy Federal checking account to companies or individuals. You can pay one-time or set up recurring payments to thousands of billers.

How does Navy Federal bill pay work?

-

Add payees – Enter names and addresses of companies or people you want to pay.

-

Schedule payments – Set up one-time or recurring payments to payees

-

Make payments – Navy Federal processes electronic or check payments to payees per your instructions.

-

Get notifications – Get email/text alerts when payments are processed or if a payment fails

What are the benefits of bill pay?

Paying bills via Navy Federal bill pay provides many advantages like:

-

Convenience – Pay all your bills from one place online 24/7

-

Save time – No more writing checks or visiting biller websites

-

Avoid late fees – Set up timely recurring payments

-

Track payments – Online history and confirmation of completed payments

-

Paperless – Reduce paper bills and checks with electronic payments

So bill pay makes managing and paying your bills quick and easy.

What types of payments can I make with bill pay?

You can use Navy Federal bill pay to pay almost any company, merchant or individual including:

- Mortgage, rent

- Utilities – electricity, water, cable, phone

- Credit cards

- Insurance – auto, health

- Memberships – gym, streaming services

- Retail stores – department stores, gas stations

- Schools, daycare

- Doctors, dentists

- Contractors, lawyers

- Friends, family (Pay a Person)

As long as you have the payee name and address, you can use bill pay to pay virtually any bill or expense.

What accounts can I pay bills from?

You can pay bills only from your Navy Federal checking account using bill pay. Savings accounts or credit cards cannot be used.

The payment will debit your checking account based on when you schedule it. Ensure your account has sufficient funds when the payment is processed.

How long does it take for bill payments to reach payees?

- Electronic payments via ACH take 2-3 business days.

- Check payments can take up to 4 business days.

- Same Day payments reach payees within 1 business day for a fee.

Plan payments accordingly keeping this processing time in mind so your bills are paid on time.

Is there a limit on bill payment amounts?

Bill payments have these limits per transaction:

- Electronic payments – $100,000

- Check payments – $10,000

You can schedule multiple transactions to pay higher amounts. But each individual payment has the above limit.

Is there a fee for bill pay?

There is no fee for standard electronic and check bill payments. Same Day payments cost $10 per transaction. Other fees include:

- Overnight check delivery – $25

- Charitable donations – $1.50 per item

Keep an eye out for any special offers waiving these fees.

Can I set up automatic recurring payments?

Yes, you can schedule automatic recurring payments with Navy Federal bill pay for bills with fixed regular amounts. Simply set the:

- Payee

- Payment amount

- Frequency – weekly, bi-weekly, monthly etc.

And bill pay will automatically send the payment on the due date without you having to remember it.

How do I add a new payee?

Adding a new payee is easy:

-

Sign in to Navy Federal online banking

-

Access Bill Pay and click Add a Payee

-

Enter payee name, address, account number etc and submit

-

The payee will be added to your list

-

You can then schedule one-time or recurring payments

You must provide the full name, address, and account number to successfully add a payee.

How can I edit or cancel a scheduled payment?

- Log in to your Bill Pay account.

- Click on Scheduled Payments.

- Choose the payment you want to edit or cancel.

- Make your changes by 11:59 pm EST the day prior to payment date.

You cannot edit or cancel a Same Day Payment on its scheduled date.

How do I get bill pay alerts and reminders?

You can set up alerts for key events like:

- Successful payments

- Failed payments due to insufficient funds

- Approaching due dates for recurring payments

- eBills received from payee

To set up alerts:

- Go to Services > Alerts

- Select types of Bill Pay alerts

- Choose to get alerts via email, text or in-app

How do I get help with Navy Federal bill pay?

If you need any assistance with bill pay, you can:

- Call 1-888-842-6328 for phone support 24/7

- Live chat via online banking

- Visit a local Navy Federal branch

- Email support via Messages in online banking

What number will the security code come from?

The message will come from 739-49.

What’s security code verification?

It’s a security feature that adds an additional layer of protection when enrolling in digital banking. Composed of random numbers, we’ll send you this unique code to enter during your enrollment session to further verify your identity. Please make sure the mobile phone number we send to is able to receive text messages.*

Navy Federal Mobile Banking: Bill Pay | Alaska

FAQ

How long does nfcu bill pay take?

How does a bill paying service work?

How do I pay my Navy federal bills?

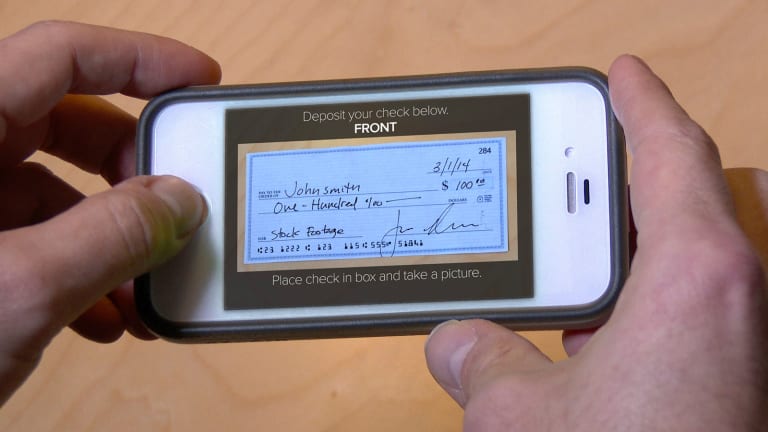

With Bill Pay, you can pay all your external bills and send money to accounts outside Navy Federal from your mobile device* or online. Get Started Bill Pay is best for third-party payments. Use Transfers for Navy Federal accounts and loans. If you’re using the new mobile app, you can find step-by-step instructions here.

How do I pay my Navy federal loan online?

If you have a mortgage through Navy Federal Credit Union, using HomeSquad (our mortgage portal) to set up online payments is your best bet. For other Navy Federal loans, such as credit cards, you can use the Transfers feature through online banking to schedule customer payments up to a year in advance.

How do I use transfers for Navy Federal accounts & loans?

Use Transfers for Navy Federal accounts and loans. If you’re using the new mobile app, you can find step-by-step instructions here. Select Bill Pay from the bottom navigation bar. Tap the + in the top right to add a new biller. Indicate if the biller is a Person or Company, or search for them in our list of suggested billers.

How do I use bill pay?

Bill Pay is best for third-party payments. Use Transfers for Navy Federal accounts and loans. If you’re using the new mobile app, you can find step-by-step instructions here. Select Bill Pay from the bottom navigation bar. Tap the + in the top right to add a new biller.

Will Navy Federal call me if I have a security code?

No, Navy Federal will never call you to ask you for your code. What number will the security code come from? The message will come from 739-49. How much time do I have to complete the verification? You’ll have 6 minutes to successfully complete the verification. If you run out of time, tap or click the link to resend your code.

Should I use nfcu bill pay?

Don’t use it for small companies, especially if you manually add the billers info. It will be sent as a draft check & can get lost in the mail. No tracking #. I use NFCU bill pay for literally all of my bills and have had no issue. I also work on the digital team for a local credit union and have to deal with these bill pay issues all the time.