Staying on top of paying bills on time can be a challenge, especially when you have multiple bills coming due at different times each month. A late payment can result in fees and damage your credit score. That’s why having a system to track your monthly bills is so important.

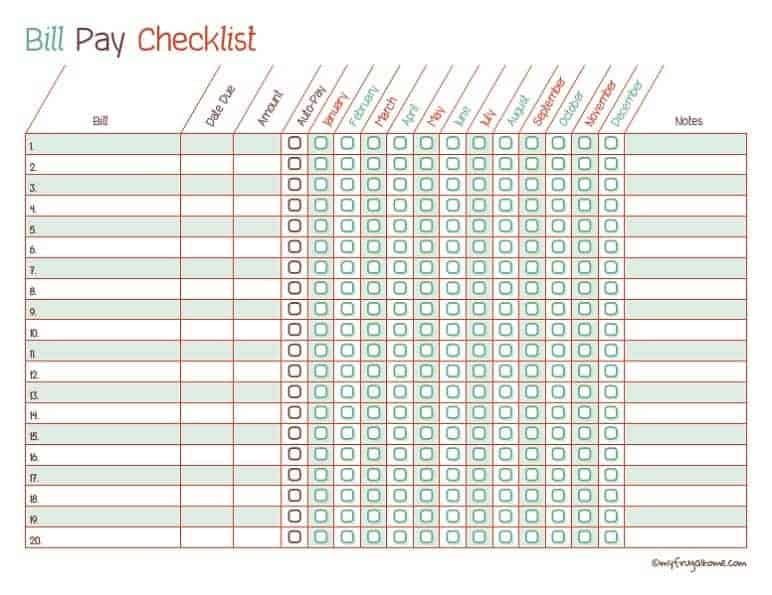

The My Frugal Home Bill Pay Checklist is the perfect solution to keep your bill payments organized. This handy printable checklist allows you to log all your recurring bills in one place and check them off as you pay them each month. It ensures you never miss a payment or pay the same bill twice.

Why You Need a Bill Pay Checklist

Without a system, it’s easy to lose track of bills and when they are due. You may find yourself scrambling at the last minute to make payments or missing due dates entirely. A bill checklist eliminates those issues by

- Keeping all your bills in one place so you can view them all at once

- Allowing you to note due dates and payment amounts for each bill

- Providing a visual reminder and tracking mechanism as you pay each bill

- Helping you avoid late fees and interest charges

- Ensuring you don’t pay the same bill twice by mistake

Staying current on bills is important for your budget, credit score and peace of mind. A checklist reduces the stress of keeping up with payments.

Features of the My Frugal Home Bill Pay Checklist

The My Frugal Home Bill Pay Checklist is free to download and customize. Here are some of its useful features:

-

12-month view: See your bills for an entire year all on one page.

-

Full customization: Add your specific bill names, due dates and payment amounts.

-

Payment tracking: Check off when you pay each bill to avoid duplicates.

-

Notes section: Record confirmation numbers or other payment details.

-

Different formats: Available as a PDF to print or fill out digitally on your device.

-

Access anytime: Save the checklist file to reference from your computer, phone or tablet.

-

Easy editing: Fill in your info right in the PDF form fields. No special software needed.

The checklist is carefully designed to be comprehensive, flexible and simple to use. It suits both paper and digital bill pay styles.

How to Use the Bill Pay Checklist

Using the My Frugal Home Bill Pay Checklist takes just a few easy steps:

-

Download the free printable PDF file from the My Frugal Home website.

-

Customize it by adding your specific bills, due dates and amounts owed.

-

Print the checklist to have a paper copy or save it to your device to reference digitally.

-

As you pay each bill, check it off on the list or make a digital note.

-

Refer to the checklist before due dates to see what payments are coming up.

-

Start a new checklist each year or print additional pages as needed.

The checklist has a simple table format with columns for the bill name, due date, amount owed and notes. Fill it in with your fixed recurring bills that are the same each month like mortgage, utilities, insurance, loans, subscriptions, etc.

For variable bills like credit cards that differ monthly, list the bill name and check it off each month without entering a set amount. The notes column can be used to record the actual monthly amounts for these types of bills.

Customizing the Checklist for Your Specific Needs

One of the key benefits of the My Frugal Home Bill Pay Checklist is you can fully edit it to match your personal billing details.

-

Add or delete rows as needed to fit all your bills.

-

Adjust the due dates if your billing cycles don’t start on the 1st.

-

Leave amounts blank for bills that vary each month.

-

Change the column headers if needed.

-

Add pages to the PDF to fit additional bills.

-

Type in the specific bill names you use like “Citibank MasterCard” instead of just “Credit Card.”

-

Rearrange the order of bills or group by due date.

The flexibility makes it easy to fully optimize the checklist to fit your unique needs and situation.

Extra Tips for Bill Payment Success

Use these tips in addition to your checklist to stay on top of bills:

-

Keep your checklist someplace convenient like your desk, planner or budget binder so it’s always accessible.

-

Review the list a few days before each due date as a reminder to pay outstanding bills.

-

Schedule bill payments through your bank account to go out automatically before the due date.

-

Set up payment alerts through companies to receive notices when bills are due.

-

Check off bills as soon as you pay them to avoid accidental duplication.

-

Note which bills allow a grace period if paid late. Prioritize those first.

-

Use a calendar or planner to record due dates if you prefer a visual schedule.

Why the My Frugal Home Checklist is a Must-Have

Staying on budget and maintaining good credit is hard without an organized system to manage bill payments. The My Frugal Home Bill Pay Checklist makes it easy.

It’s a simple, effective tool to record all your bills in one place and track payments. The customizable format suits any bill pay preference. Best of all, it’s free!

Reduce your monthly stress while avoiding late fees and interest charges. Get your bill payments on auto-pilot with the My Frugal Home Bill Pay Checklist.

Prefer to Keep Things Digital?

Just save a copy of this file to your preferred device, and update it each time you pay a bill. Easy!

3 WAYS TO SAVE ON GROCERIES THAT NO ONE TALKS ABOUT!!! #shorts #budget

FAQ

What information do I need to use bill pay?

How do I keep track of paying bills?

Is there an app that I can pay all my bills?

How to make a bill list?