If you have a relative who recently moved in with you in Michigan, you may be wondering how that impacts your auto insurance. Michigan requires an attestation for resident relatives on your policy. This confirms they actually live with you full-time.

In this comprehensive guide, we’ll explain what the resident relative attestation involves. You’ll learn the attestation rules how to complete the form, penalties for false attestations, and more. Read on for a full understanding of this important requirement for Michigan auto insurance.

What is the Michigan Resident Relative Attestation?

The resident relative attestation is a form required by Michigan’s auto insurance laws It applies when an adult relative moves into your household.

On the attestation you confirm

- The relative’s name and relation to you

- Their previous address where they were insured

- The date they began residing with you

- That they live with you full-time, not just temporarily

This attestation must be submitted to your auto insurance company. It ensures your relative is covered as a resident on your policy, not just a visitor.

Why Michigan Requires This Attestation

The main reason for the resident relative attestation is to prevent fraud. In the past, people would falsely add relatives to their policies to get lower insurance rates.

By making you formally attest they actually live with you, it helps stop these abusive practices. The penalty for false attestations also discourages dishonesty.

Beyond anti-fraud, the attestation also clarifies insurance coverage. Relatives only get certain benefits if they are residents. So the attestation eliminates confusion on who qualifies for what.

Attestation Requirements in Michigan

Michigan law sets specific requirements on completing resident relative attestations:

- Must be submitted to your auto insurer within 30 days of the relative moving in

- Must be signed by a named policyholder who is age 18 or older

- Must include relatives name, relation, old address, and move-in date

- Applies to relatives who are age 18 or older

- Does not apply if the relative is your spouse

You can face fines if you don’t report a relative within 30 days. Some insurance companies offer online reporting to simplify the process.

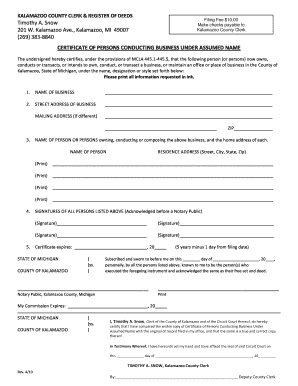

How to Complete the Michigan Attestation

Completing the resident relative attestation only takes a few minutes:

- Get the attestation form from your auto insurance company

- Fill in all fields:

- Your policy number

- Relative’s full name and relation

- Their old address

- The date they moved in

- Review the fraud penalties statement

- Sign and date the attestation

- Submit it to your insurance company by email, mail, or online filing

Make sure to keep a copy for your records in case any questions come up. Also attest promptly — waiting risks fines if there’s an accident.

Impact on Insurance Rates

Adding a resident relative may or may not impact your insurance rates. Michigan insurers consider:

- The relative’s driving record

- Their previous insurance history

- The total number of drivers now on your policy

With a good record, rates often don’t change much. But significant violations on their history could increase your premiums.

Shopping around helps find the best pricing if your costs will rise. An independent agent can quote multiple companies.

Penalties for False Attestations

Intentionally letting a relative use your address for cheaper insurance is illegal. Michigan cracks down hard on false attestations.

The penalties for providing false information include:

- $50,000 in fines

- 5 years in prison

- Felony fraud conviction on your record

Your insurance company will also cancel your policy. And you may struggle to find coverage again for years.

Simply put, it’s not worth the massive risks to lie on the attestation. Only report truly full-time resident relatives.

Who Needs to Complete the Attestation

The resident relative attestation must be completed by a policyholder when:

- An adult relative (age 18+) moves in with you

- That relative had a different prior insurance policy

For example, if your 25-year-old son moves back home from out-of-state, you’ll need to complete an attestation.

Situations when it is NOT required:

- Relatives under 18 years old

- Relatives who previously lived with you

- Student relatives away at school

Check with your insurer if you’re unsure whether an attestation is needed for your situation.

What Is Resident Relative?

Resident relative refers to spouses and other relatives with whom an insured party shares a residence. When it comes to insurance policies, relatives who live in the same house have special rights, and in some cases, they are automatically added as an insured party. This coverage applies, even if the resident relative is not a named insured. Homeowner, property, casualty, auto, and personal liability policies often contain language outlining who qualifies as a resident relative.

Understanding Resident Relative

Resident relatives include individuals, typically immediate family members, who share a residence with a policyholder. If the insured person lives in the house and is related to them, most likely the insurance will cover them, unless the policy specifically excludes them.

An important part of figuring out insurance coverage is figuring out if a person is a resident relative or not. To give you an example, a Class 1 auto insurance policy would cover the brother of someone who has bought auto insurance. The brother is provided uninsured motorist coverage in all locations at all times. A family friend who does not live with the insured, however, would not be covered. Similarly, a live-in girlfriend or boyfriend does not qualify for resident relative status under homeowner insurance. But if things go well and they end up in a domestic partnership or marriage, they are still covered by the same insurance.

- Resident relatives are covered by certain policies in insurance contracts.

- Resident relatives are usually spouses or other family members who live with the insured. However, the policy contract’s definition is a key part of figuring out who is covered and whether they are included.

- When you get auto insurance, make sure that all of the people who drive your car are listed so that they are covered.

Lawyer Explains Resident Relative Insurance Coverage

FAQ

Can someone drive my car if they are not on my insurance in Michigan?

Do all household members need to be on car insurance in Michigan?

What is a resident relative in insurance?

What is the new Michigan insurance law?

Who qualifies as a resident in an insurance contract?

The language of the insurance contract will define who qualifies as a resident. Typically contracts require that an individual should physically reside at the same domicile, or permanent home, as the named insured. Resident relatives do not have to be a sibling or child.

Does Michigan Law apply to auto insurance policies issued or renewed?

The law applies to auto insurance policies issued or renewed after July 1, 2020. This FAQ will be updated to provide the latest information to Michigan auto insurance agents. Disclaimer: The information contained within this website pertains to Public Acts 21 and 22 of 2019.

Who are resident relatives in a car insurance policy?

While resident relatives are typically spouses or other relatives who live with the insured, the definition in the policy contract is an important factor in determining their inclusion and coverage. It is important to name all drivers for a car in an auto insurance policy to include them for coverage.

Are resident relatives covered by insurance?

Resident relatives are covered by certain policies in insurance contracts. While resident relatives are typically spouses or other relatives who live with the insured, the definition in the policy contract is an important factor in determining their inclusion and coverage.