Juggling due dates for all your monthly bills can be a hassle. Mailing checks or paying in person takes time too. That’s why many people love the convenience of online bill pay through their bank. Landmark Bank offers online bill pay services to account holders. Read on to learn all about paying bills online with Landmark Bank.

Overview of Landmark Bank

Landmark Bank is a community bank founded in 1908 and headquartered in Manhattan Kansas. They provide a full range of personal and business banking services. With over 30 branches across Kansas, Missouri, and Oklahoma Landmark focuses on relationship banking and local decision making.

Online and mobile banking are key offerings that provide customers with anytime access and self-service options Bill pay is included with Landmark checking accounts to simplify payments

Benefits of Paying Bills Online with Landmark

Landmark Bank’s online bill pay platform delivers many advantages:

-

Convenience – Pay bills 24/7 without stamps, checks, or driving to a payment location

-

Efficiency – Payments process faster electronically than by mail

-

Organization – View bill history and scheduled payments in one place

-

Control – Set up one-time or recurring automatic payments

-

Reminders – Get email notices when bills are due

-

Security – Encrypted payments protect your account information

-

Cost savings – Avoid late fees by scheduling payments for your due date

-

Flexibility – Pay bills from multiple Landmark checking accounts

-

Simplicity – User-friendly website and mobile app

Online bill pay checks off all the boxes for an easy, secure bill payment experience.

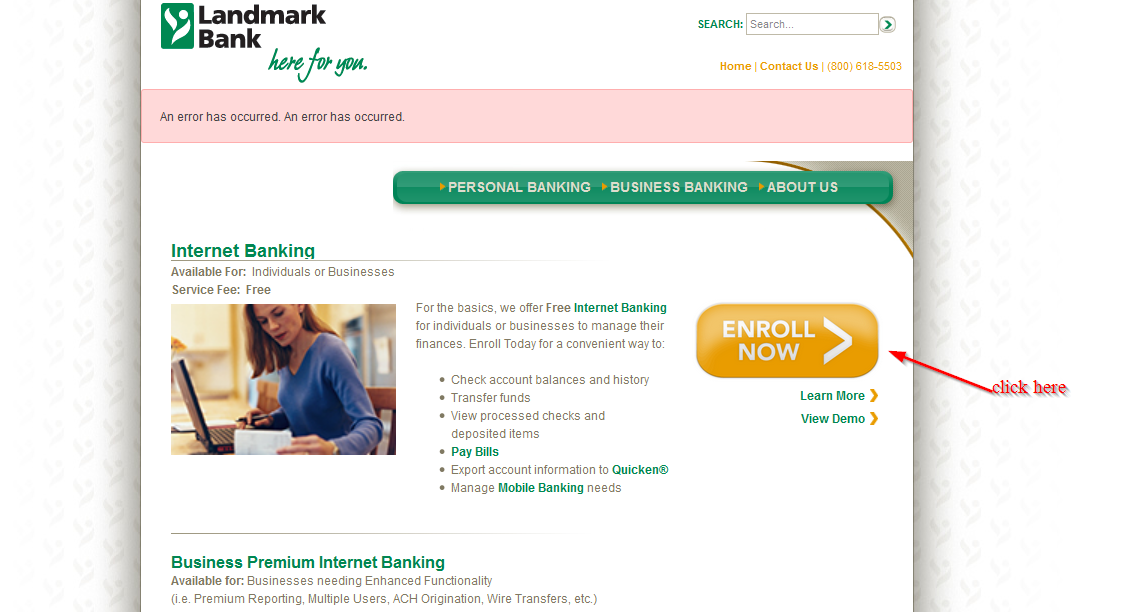

How to Enroll in Landmark Bank’s Bill Pay

Follow these simple steps to begin paying bills online with Landmark Bank:

-

Have an eligible Landmark Bank checking account

-

Log into online banking or mobile app

-

Click “Bill Pay” and accept terms and conditions

-

Add payees by searching names or entering account numbers

-

Schedule one-time or recurring payments to payees

-

Approve and submit payments

-

Payments will be debited from your linked checking account

Once enrolled, the online bill pay dashboard allows you to manage all payees and payments from one place.

Paying Bills with Landmark Bank

When paying bills through Landmark’s platform, you have options:

-

One-time payments – Choose date and amount to pay a bill once

-

Recurring payments – Set up automatic payments for fixed regular bills

-

Expedited payments – Pay instantly with an added fee (within minutes)

-

Mobile payments – Pay bills on the go through Landmark’s mobile app

-

eBills – Receive and view electronic bills within bill pay

Regular bills like utilities, cable, loans, and more can be paid automatically, while one-off bills are easy to handle as needed.

Sending Money with Landmark Bank

In addition to paying established billers, Landmark Bank offers the ability to send money to others:

-

Use Zelle® – Send money to friends, family and others using just an email address or U.S. mobile number

-

Pay non-billers – Add individuals as payees to pay for services, rent, etc.

Landmark Bank checking account holders can conveniently send money to almost anyone they need to pay.

Get Started with Online Bill Pay

Paying bills online allows you to ditch stamps, paper checks, and trips to payment dropboxes. Instead, take advantage of Landmark Bank’s secure online and mobile bill pay options. Sign up through your online banking account to start paying bills electronically from anywhere in just minutes. Automate recurring payments or quickly handle one-off bills – online bill pay offers flexibility, convenience, and organization. Contact Landmark Bank to learn more and enroll in online bill pay services today.

What type of Home Loan are you looking for?

Buy or Refinance a home

Build a new home or make renovations to an existing home.

Make a Loan Payment

Its easy to make your loan payment within Digital Banking, online or through our mobile app. You can even “set it and forget it” by scheduling recurring payments. Not registered for Digital Banking? No worries! You can make a one-time guest payment using an external account from another financial institution or a debit card.

- Free

- Same-day processing

- Option to set up recurring payments

- Free

- Same-day processing

- Option to set up recurring payments

- $5.95 processing fee

- Same-day processing

How to Send Money with Zelle® in the Landmark App

FAQ

Does Landmark National Bank have Zelle?

What is paying bills online?

Does Landmark Bank offer online banking?

Landmark Bank Online Banking offers convenient, flexible and secure access to your accounts 24 hours a day, 7 days a week. With this free service you can: Review the Online Banking Access Agreement of Terms and Conditions.

How does landmark bill pay work?

Landmark’s Bill Pay will give you the flexibility of structuring payments to fit the way you live. Payments may be set up on a one time, weekly, bi-weekly, semi-monthly or monthly basis. Pay anyone from the paperboy to any credit card company online instead of writing checks. Save money on check order fees.

What services does landmark National Bank offer?

Time for schoolbooks and streamlined finances. Open your personal Checking or Saving Account online! Apply online, or check today’s rates. Resources for you to learn more about your banking services. Landmark National Bank offers friendly and professional banking services. Learn more about our personal, mortgages, and business banking options.

What is Landmark Credit Union digital banking?

Landmark Credit Union’s Digital Banking experience is personalized, intuitive and empowers you to meet your financial goals. Check all your accounts online with one convenient dashboard, including Landmark accounts and accounts at other financial institutions. Need to send money to another Landmark member?

How do I access my landmark account?

Download our mobile app from the Apple app store or Google play store. Log in with your username and password. Add any account alerts to stay on top of your Landmark accounts and keep them secure.

Why should you choose landmark National Bank?

When it comes to handling your personal finances, you need a bank that’s with you everywhere you go. At Landmark National Bank, our online and mobile banking features give you the flexibility to bank anywhere you want, anytime you want. If you have a smartphone, tablet, or computer with internet access, you can manage your money with ease.