The products shown on this page are mostly or entirely from our advertising partners. They pay us when you click on one of their links and then do something on our site. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and heres how we make money.

In our life insurance reviews, our editorial team considers the customer and the insurer. These are some of the factors we take into account:

Policies offered. There are many types of life insurance on the market, and they fall into three key categories:

Financial strength. We use AM Best ratings to confirm an insurer’s long-term financial stability and ability to pay claims. For life insurance, NerdWallet typically recommends considering insurers with ratings of A- or higher. Here’s the breakdown:

Complaints. Based on three years of data from the National Association of Insurance Commissioners, these ratings are based on how many complaints about a company there were compared to its size. The best life insurance companies have fewer than the expected number of complaints.

Buy online. This indicates whether an insurer allows you to apply for and buy a policy completely online.

Members of credit unions can buy life insurance from TruStage. The company works with more than 3,200 credit unions in the U.S. S. TruStage is owned by CMFG Life Insurance Co. and is part of the CUNA Mutual Group family of brands. Policy options are straightforward, with limited riders and low coverage caps.

It’s easy to get term, whole, or guaranteed issue life insurance online. You don’t even have to go through a medical exam. Once you’re approved, coverage will kick in as soon as you pay the first premium.

TruStage auto insurance partners with Liberty Mutual to offer policies to credit union members But how does TruStage really stack up for quality and affordability? This comprehensive guide examines the key pros and cons to determine if TruStage is a good choice for your auto coverage needs.

Overview of TruStage Car Insurance

TruStage auto insurance policies are primarily underwritten by Liberty Mutual, This large national insurer provides standard auto coverage options like

- Liability insurance

- Collision coverage

- Comprehensive coverage

- Uninsured/underinsured motorist protection

Some unique extras only Liberty Mutual offers are also available with TruStage including

-

Better Car Replacement – Get a 1-year newer car with 15,000 fewer miles if your vehicle is totaled.

-

Lifetime Repair Guarantee – Guaranteed repairs for life at Liberty Mutual’s network of shops if you own your car outright.

So TruStage auto insurance gives access to Liberty Mutual’s full slate of coverages and benefits. Discounts like multi-policy, multi-car, and credit union membership savings can potentially reduce premiums as well.

Pros of Choosing TruStage Car Insurance

What are the advantages of choosing TruStage for your auto policy?

Repair Network – The lifetime repair guarantee at Liberty Mutual’s network of shops provides peace of mind for vehicle repairs. This perk is unique to Liberty Mutual.

Credit Union Discounts – Bundling your auto policy with TruStage as a credit union member can unlock additional savings through member-only discounts.

Added Coverages – Options like better car replacement and disappearing deductibles offer protections other insurers may not provide.

Choice of Payment Plans – Pay for your full 6-month or 12-month policy upfront or in installments. Lots of flexibility.

Cons of TruStage Auto Insurance

However, there are some potential drawbacks to weigh as well:

Claims Satisfaction – TruStage clients have below average claims satisfaction scores according to J.D. Power ratings. The claims process may not be smooth.

Customer Service Ratings – Similarly, Liberty Mutual scores below average in most regions for overall customer service satisfaction in independent surveys.

Rates May Not Be Lowest – While discounts help, TruStage’s rates don’t always beat competitors. Shopping around is key.

Not TruStage’s Own Brand – The policies are underwritten by Liberty Mutual, not TruStage itself. TruStage acts more as a broker.

How Much Does TruStage Auto Insurance Cost?

TruStage does not provide average rate data. Auto insurance costs vary drastically based on your personal situation, including:

- Age of drivers

- Driving records

- Location

- Type of vehicle

Some typical benchmarks for annual premiums:

- Minimum coverage: $622

- Full coverage: $2,014

Getting a free TruStage quote is the best way to see potential rates for your specifics. Just visit TruStage.com or call 1-855-483-2149. Provide details on all your drivers and vehicles to get the most accurate rate assessment.

Available Discounts to Lower Your Premium

Taking advantage of available discounts is crucial to lower your TruStage insurance costs. Discounts to ask about include:

- Multi-policy – Bundle home or other insurance with TruStage

- Multi-car – Insure more than one vehicle on the same policy

- Credit union member – For bundling insurance with your credit union

- Good driver – For a clean driving history

- Good student – If you have a student on your policy maintaining a B average

- Pay in full – For paying your entire 6-month or 12-month premium upfront

How Does TruStage Handle Claims?

Understanding how well an insurer handles claims is pivotal in choosing coverage. So how do TruStage and Liberty Mutual rank?

-

Scored below average in J.D. Power’s 2023 U.S. Auto Claims Satisfaction Study

-

Earned 2 out of 5 stars from customers for claims process in ConsumerAffairs reviews

-

Received a high volume of complaints according to the NAIC 2022 consumer complaint index

This data suggests the claims process may not live up to customers’ expectations compared to other top insurers. Make sure to get specifics on resolution timelines when you inquire about a policy.

Is TruStage Financially Stable?

While customer satisfaction could be better, Liberty Mutual has strong financial standing to pay out claims:

- Rated A (Excellent) by A.M. Best for financial strength

- $48 billion in assets and $477 million in net income

So once a claim is approved, you can have confidence it will be paid. The backend process is solid despite frontend hiccups for some clients.

Who is TruStage Best Suited For?

TruStage auto insurance makes the most sense for these drivers:

-

Credit union members – bundling insurance with your existing accounts provides convenience and added savings

-

Fans of Liberty Mutual’s extras – the repair guarantee and better car replacement may appeal to some customers

-

Those open to provider change at renewal – compare TruStage quotes to see if they beat your current rate

For the best prices and customer service, also get quotes from auto insurers like State Farm, Allstate and GEICO to compare. But TruStage warrants consideration for the credit union tie-in and access to Liberty Mutual’s offerings.

TruStage Insurance: The Final Take

TruStage auto insurance provides a viable option for credit union members to handle multiple financial needs through their credit union. While customer satisfaction scores are not the best, the financial strength is there to pay claims.

Make sure to ask about all available discounts to find the lowest TruStage rate possible. And compare quotes from other top insurers while shopping to ensure you find the right balance of price and service. Consider both TruStage and other leading national and regional brands while protecting your vehicle and finances.

Frequently Asked Questions (FAQ)

Q: Is TruStage good for life insurance?

A: Yes, TruStage life insurance tends to get positive reviews for affordable pricing and helpful customer service. Term life policies are issued by highly-rated CMFG Life Insurance Company.

Q: Who is the parent company of TruStage insurance?

A: TruStage products are offered by TruStage Insurance Agency. The agency primarily underwrites policies through Liberty Mutual, though other partners may be used in some states.

Q: What insurance companies does TruStage use?

A: For auto insurance, TruStage mainly partners with Liberty Mutual as the underwriting insurance company. Life insurance policies are issued by CMFG Life Insurance.

Q: Is TruStage Insurance reliable?

A: TruStage itself is a legitimate insurance agency. And its underwriting partners like Liberty Mutual and CMFG Life are established insurers with excellent financial strength ratings. So you can rely on TruStage for reliable coverage.

Q: What types of discounts are available from TruStage?

A: Typical TruStage discounts include multi-policy, multi-car, credit union membership, good driver, good student, and pay-in-full discounts. Ask your agent about any others that may apply.

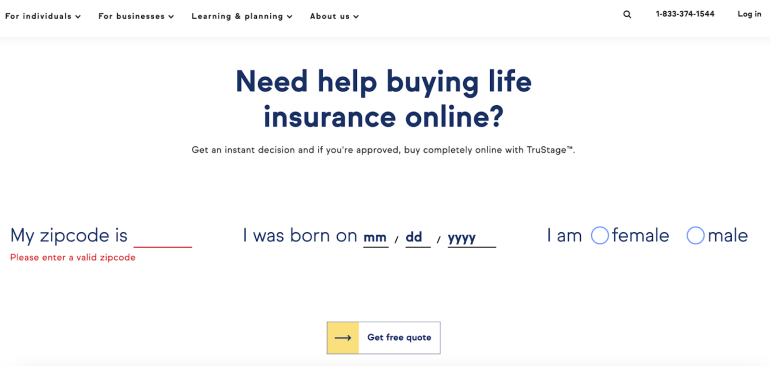

What it’s like to apply for a policy with TruStage

You can start an application with TruStage online or over the phone. You’ll need to enter your ZIP code, date of birth, and the sex of the person you want to cover for life insurance on the website in order to get a quote.

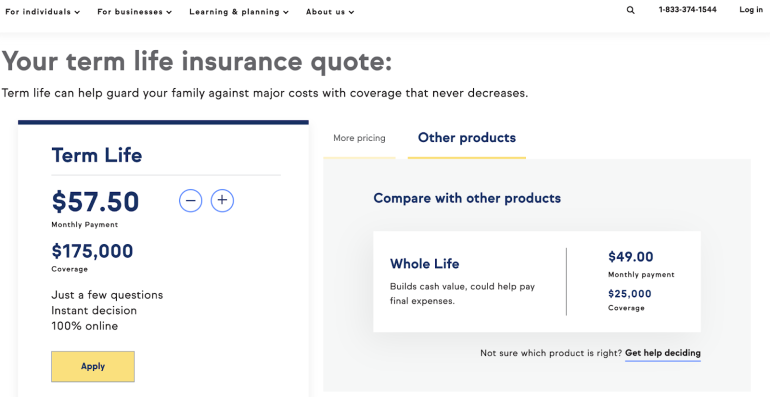

You will get a simple quote for term life insurance and a quote for other types of coverage to help you decide which one is best for you.

After you click “Apply,” you’ll be asked to list beneficiaries and give information about your medical history, tobacco use, driving record, and criminal record. After you fill out the medical and lifestyle questionnaire, TruStage will need your personal and payment information to finish the application.

If you need help filling out the application, you have the option to call a representative.

Screenshot captured by our editorial team on June 27, 2024.

Screenshot captured by our editorial team on April 22, 2024.

TruStage customer complaints and satisfaction

NerdWallet looked at data from the National Association of Insurance Commissioners and found that over the past three years, TruStage has had a lot more complaints than a company its size should have.