Paying your Shopify bill is an important part of running your online business. Shopify provides a reliable and secure ecommerce platform, but you need to stay on top of your billing to avoid any disruption to your store. In this comprehensive guide, I’ll walk you through the various ways you can pay your Shopify bill and tips for managing your payments properly.

Overview of Shopify Billing

Before getting into the specific payment methods, let’s first understand Shopify’s billing system.

-

Shopify bills you on a monthly basis based on the plan you selected when signing up This can be either a monthly recurring charge or a one-time setup fee

-

The billing date is determined by the date you signed up for Shopify. So if you signed up on the 15th of the month, your bill will be generated on the 15th of every month.

-

Shopify sends you an email notification when the bill is ready. The bill needs to be paid by the due date, usually 7 days later, to avoid account suspension.

-

In addition to the subscription costs, you may also incur additional charges for apps, themes, shipping labels, and transactions. These get added to your main Shopify bill.

-

Taxes and shipping costs are calculated and billed separately,

Now that we’ve covered the key billing concepts, let’s look at how you can actually pay the Shopify bill through different payment methods.

Paying With a Credit Card

The most popular way businesses pay their Shopify bill is with a credit card. Here are some tips on using credit cards:

-

Shopify accepts all major credit cards including Visa, Mastercard, American Express, Discover, and JCB.

-

You can enter your credit card details under Billing in your Shopify admin. This card will be charged automatically on your billing date.

-

Make sure there are sufficient funds available on your card to cover the bill amount. Shopify will retry the charge if the first attempt fails.

-

An alternate card can be set up as a backup payment method if your primary card fails.

-

Shopify charges credit card fees depending on the region and card type. This gets added to your bill amount.

-

You can update the credit card info anytime before the next billing cycle. The new card will be charged going forward.

-

Consider using a dedicated business credit card to keep expenses separate from personal spending.

Paying With a Debit Card

If you prefer to pay directly from your bank account, here is what you need to know about using debit cards on Shopify:

-

Shopify accepts debit cards that are co-branded with Visa, Mastercard, or Amex. Pure debit cards without a credit card logo are not supported.

-

Make sure your daily purchase and withdrawal limits allow the debit card to cover the Shopify bill amount.

-

Some banks may treat Shopify billing as a cash advance which can trigger additional fees and interest charges. Check with your bank first.

-

Debit cards tend to have lower spending limits so ensure sufficient balance is available to avoid failed payments.

-

As with credit cards, you can enter the debit card details under Billing and Shopify will bill it automatically.

-

Keep the card info updated to avoid disruptions if the card gets renewed/replaced. Shopify will decline expired or invalid cards.

Using Shopify Balance

Shopify Balance allows you to fund your account and pay future bills from the Balance:

-

Balance can be added via credit/debit cards, bank transfers or crypto like USDC. Currently, Balance is available in select countries like Canada, UK, Ireland, Australia etc.

-

Any unused Balance at billing time is automatically used to pay your Shopify fees. You don’t have to do anything extra.

-

If the Balance doesn’t cover the full bill, the remaining amount will be charged to your card on file.

-

Shopify sends out alerts when the Balance is running low. You can then top it up to avoid failed payments.

-

There are no transaction fees for paying with Balance. It’s a cost-effective way to prepay your bills.

-

The Balance does not expire and carries forward as long as you have a Shopify account. It gets refunded if you close your account.

Paying Through PayPal

PayPal is another payment option you can use to pay Shopify bills:

-

Connect your PayPal account in Shopify Billing settings. When the bill is ready, you’ll get an option to pay via PayPal.

-

PayPal currently supports payments for US, UK, French, Italian and Spanish Shopify merchants. More countries are being added.

-

Choose PayPal when you check out the bill. You’ll be redirected to log into PayPal and confirm the payment.

-

The funds get instantly transferred to Shopify and your bill shows as paid. No need to wait for transfers or checks to clear.

-

PayPal provides buyer and seller protection for any issues with your Shopify payment. You can raise a dispute within 180 days.

-

Similar to Balance, PayPal helps avoid failed payments due to insufficient funds on your cards.

-

If you have an PayPal balance at bill time, it is used first before charging your linked funding sources.

Tips for Managing Shopify Payments

Here are some additional tips for managing your Shopify billing and payments:

-

Set payment reminders in your calendar to pay bills on time and avoid account suspension.

-

Look out for email and in-app notifications about upcoming bills and failed payments.

-

Review billing reports regularly to identify major expense items and see if any adjustments need to be made.

-

If you anticipate delays in payment, reach out to Shopify support beforehand to see if an extension can be arranged.

-

Consider an annual plan for bigger discounts if you have high monthly bill amounts.

-

Take advantage of Balance, PayPal, and other prepaid options to manage cash flow.

-

Have a backup card or payment method set up to avoid disruptions.

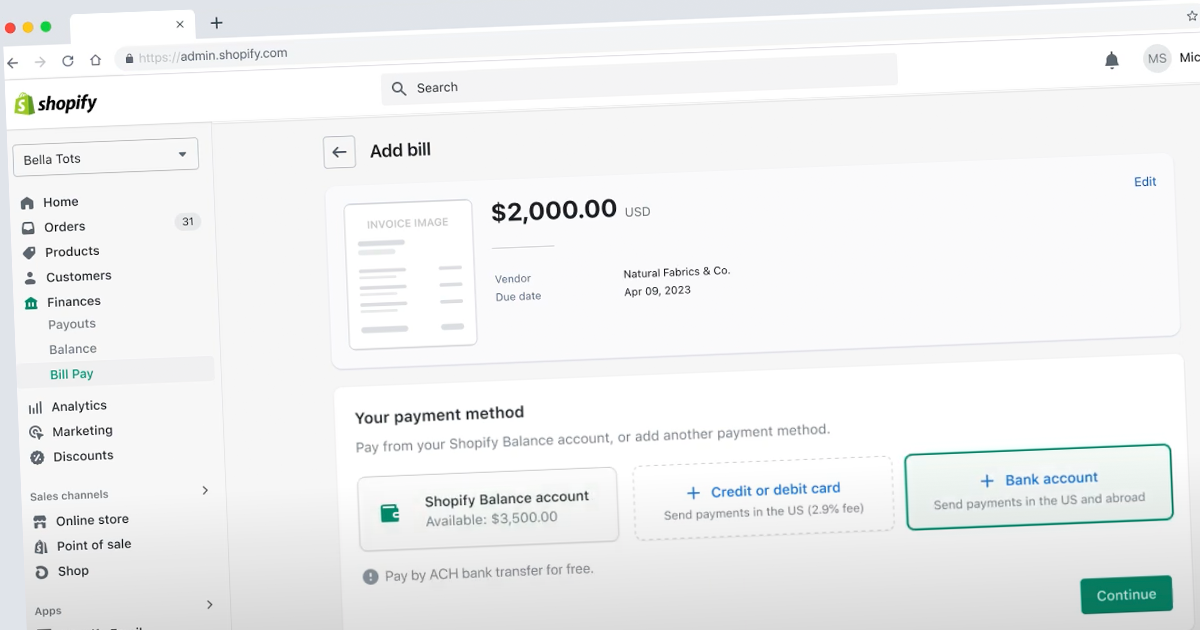

Pay and manage your business bills with Shopify Bill Pay

FAQ

How do I pay my Shopify subscription manually?

How do I pay my Shopify bill with a balance?

How do I pay for my Shopify account?

What is Shopify Bill Pay?

Shopify Bill Pay is a business payments solution powered by Melio that lets you easily schedule, pay, and manage all your business payments from the same platform where you run your business*. You can pay business bills from your Shopify Balance account, debit/credit card, or ACH bank transfer, even if vendors don’t accept that form of payment.*

Does Shopify bill pay integrate with bank accounts?

While Shopify Bill Pay seamlessly integrates with accounts for all-in-one financial management, it’s not a must. You can make payments the way you want, including: debit/credit card, ACH bank transfer, and wire transfer. Are there any fees?

How to save money with Shopify?

Keep working cash on hand to fund growth or investments by leveraging a credit card to make payments. Skip subscription fees, pay for free 3 with Shopify Balance or domestic transfer, and combine bills to save on transaction fees. Seamlessly automate your bills in your Shopify admin, so you can get back to the bigger picture. 1.

Does Shopify accept credit card payments?

Shopify has its own payment provider, Shopify Payments, which integrates directly with your checkout. If your business is eligible for Shopify Payments: You only pay the credit card rate without additional third-party transaction fees. Your customers can enter their payment information at checkout without leaving your online store.

How do I set up Shopify Payments?

Your customers can enter their payment information at checkout without leaving your online store. You can set up Shopify Payments right from your Shopify admin instead of having to log in to another website or account. You can view your payouts in real-time, right from your Shopify admin.

Do Shopify Payments charge transaction fees?

When you use Shopify Payments, you aren’t charged third-party transaction fees for orders that are processed through Shopify Payments, Shop Pay, Shop Pay Installments, or Paypal Express Checkout, and you aren’t charged transaction fees on manual payment methods such as cash, cash on delivery (COD), and bank transfers.