Paying bills is a regular part of running any business. However you may not always be able to pay the full amount due on a bill by the due date. QuickBooks provides a simple way to make partial payments on bills so you can pay what you can, when you can.

Overview of Paying Bills in QuickBooks

Within QuickBooks you manage and pay bills in the Accounts Payable section. Here are the key steps in the bill payment process

-

Enter bills – When you receive a bill from a vendor, you enter it into QuickBooks including amount due and due date. This creates an open bill

-

Review open bills – You can run an A/P Aging Summary report to see a list of all unpaid bills and how long they have been outstanding.

-

Select bills to pay – Based on available funds, you select which open bills to pay and the payment amount.

-

Record partial or full payment – Within the Pay Bills window, you assign partial or full payments to bills and select a payment method.

-

Print checks – For checks, QuickBooks can print paper checks or export an e-check file. For credit card bills, QuickBooks enters the payment transaction.

-

Reconcile – As checks or payments clear your bank, you reconcile to match them to recorded payments in QuickBooks.

When to Use Partial Bill Payments

Partial payments allow you flexibility in managing cash flow. Here are some examples of when you may need to make a partial payment:

- You can’t afford to pay the full balance due but want to pay as much as possible to reduce late fees.

- You dispute certain charges on the bill and want to pay the undisputed amounts only.

- The vendor allows installment payments (e.g. paying $500 a month on a $2,000 bill).

Making regular partial payments shows vendors you are committed to paying in full eventually.

How Partial Payments Impact Aging Reports

When you make a partial bill payment, the aging of the remaining balance resets as of the payment date. For example:

- Bill Date – 1/1/22, Amount – $1,000, Due Date – 1/30/22

- Partial Payment – 2/15/22, $500 paid

- Remaining $500 resets aging to 0 days as of 2/15/22

This reflects that payments were applied timely. Only the unpaid amount continues aging each day.

Steps to Pay Bills Partially in QuickBooks

Follow these steps to make a partial bill payment in QuickBooks:

-

Select “Vendors > Pay Bills” from the menu.

-

Click the “Show all bills” option to see bills due or overdue.

-

Select the bill you want to partially pay.

-

Enter the partial payment amount in the “Amount to Pay” column for that bill.

-

Click the checkmark in the “Partial Payment” column for that bill row.

-

Choose your payment method – check or credit card.

-

Select Pay Selected Bills.

-

Verify payment was recorded correctly. The open bill balance reduces by the partial payment amount.

-

Repeat additional partial payments until the bill is fully paid.

The steps are the same whether you are in QuickBooks Online or Desktop.

Tips for Managing Partial Payments

-

Pay the oldest bills first – Set the aging report to “oldest to newest” and pay the oldest bills to avoid late penalties.

-

Focus payments on high-interest bills – Pay down high-interest bills aggressively to reduce expensive finance charges.

-

Communicate with vendors – Let vendors know when you send partial payments and when you expect to pay the balance.

-

Don’t let balances drag – Follow up partial payments with additional payments promptly. Don’t let large unpaid balances accumulate.

-

Automate recurring bills – Set up memorized transactions to automatically generate scheduled partial payments.

The Benefits of Partial Bill Payment

-

Improves cash flow – Pay what you can afford out of current cash balances. Defer the unpaid balance to future periods.

-

Avoids late fees – Partially paying on time prevents penalties and hits to your credit rating.

-

Maintains vendor relations – Shows good faith effort to pay within account terms. Vendors appreciate predictable payments.

-

Provides flexibility – Allows you to choose payment amounts and timing rather than an all-or-nothing single payment.

-

Customizes payment schedule – Work with vendors to set up installment schedules that fit your cash capacity.

-

Maximizes available discounts – Partial payments allow you to take advantage of early payment discounts that may otherwise be missed.

Partial Payment Versus Credit Memos

A partial payment simply means paying less than the full amount on a bill. A credit memo is when the vendor issues you a credit that reduces the amount you owe on their bill. Reasons a vendor may issue a credit memo:

-

To refund an overpayment previously made

-

To offset disputed or returned items

-

To provide a volume or promotional discount

A credit memo reduces the original bill amount. A partial payment pays a portion of the original amount due. In QuickBooks, credit memos function similarly to partial payments in reducing the unpaid bill balance.

Key Reports for Tracking Partial Payments

QuickBooks provides several reports to help you manage open bills and unpaid balances when making partial payments:

-

A/P Aging Summary – See all unpaid bills by age

-

Unpaid Bills Detail – List all bills with balances remaining

-

Open Invoices Report – Unpaid customer invoices over custom date range

-

Accounts Payable Graph – Visual graph of payables over past year

-

Vendor Balance Summary – Total payables balance for each vendor

Syncing Bill Payments Across Users

With QuickBooks Multi-User mode, multiple people can enter bill payments. As one user enters a partial payment, the open balance automatically updates for other users. Syncing avoids overpaying bills.

You can also email bill payment forms. The payment details pre-populate in the form. Users simply enter payments against open bills in the form to sync across QuickBooks.

Integrations with accounts payable automation software also allow seamless collaboration between finance staff as bills move from approval to partial payment.

Automating Recurring Partial Payments

Many vendors allow recurring partial payments, such as $500 per month for 6 months. You can automate these in QuickBooks using memorized transactions.

Set up a memorized transaction to automatically enter a $500 partial payment on the 1st of each month to that vendor. Automation saves time and ensures scheduled payments always process reliably.

You can memorize transactions for both bills and payrolls to process recurring partial or full payments on any schedule you specify.

In Summary

Whether due to cash flow limitations, disputed charges, or installment agreements, most businesses need to make partial bill payments at times. QuickBooks provides an easy interface to quickly designate partial payment amounts to split bills.

Automating recurring partial payments through memorized transactions saves significant time. Key reports give you insight into unpaid balances so you can follow up with additional payments. Partial payments allow flexibility to take advantage of discounts, maintain vendor relations, and avoid late fees while paying what you can as funds become available.

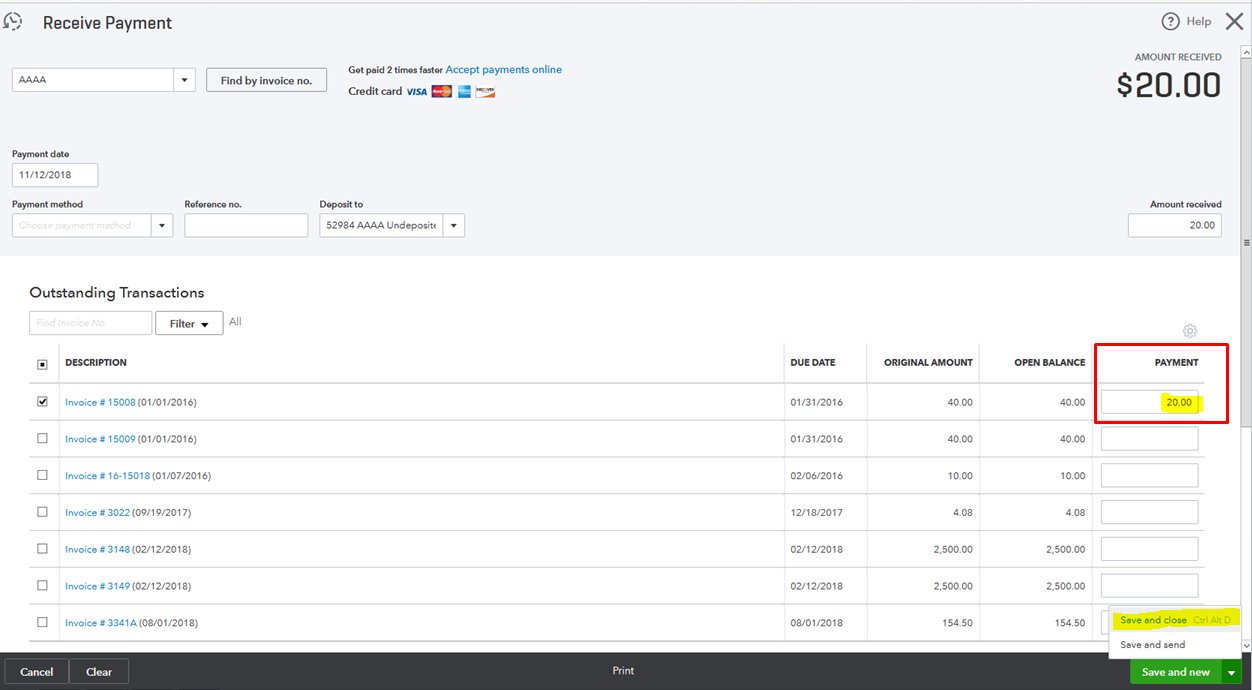

Recording a partial payment

- Log into your QuickBooks Online account.

- Click the “+” icon and select “Receive Payment”

- In the “Customer” dropdown, select the customer’s name to display their open invoices.

- In the “Outstanding Transactions” section, check the box next to the relevant invoice.

- Now, in the “Payment” column, you enter the partial payment amount received.

- Choose the appropriate “Payment Method” (e.g., credit cards, bank transfer).

- You can now select the “Deposit to” account where the payment will be recorded.

- Finally, you click “Save and Close” to record the payment.

- You can click the pencil icon to adjust any additional payment details if required.

credit: Intuit

Stop spending your day sending emails, estimates, and invoices.

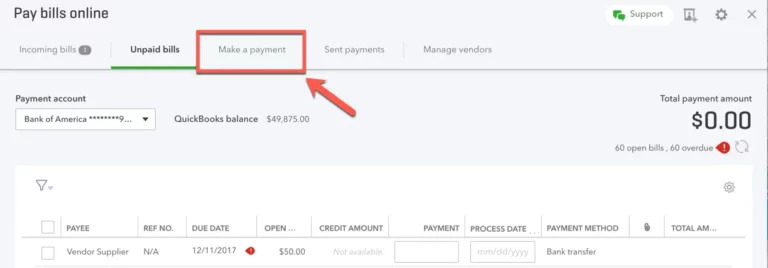

To pay vendors in QuickBooks Online, follow these steps:

- Access the vendor’s invoice by navigating to your Bill pay online widget.

- Select “Make a payment” and enter the partial payment amount or the amount you wish to pay initially.

- Choose how you want to pay, whether it’s a bank transfer or credit.

- Review and confirm your payment details by double-checking your amount and payment information.

- Submit the payment.

- Record the partial payment. QuickBooks Online automatically records this against the invoice.

- Keep an eye on the outstanding balance.

- For any remaining payments, repeat these steps for the rest of the payments.

How to make a partial bill payment in QuickBooks

FAQ

Can you make a partial payment on a bill in QuickBooks?

How do I split a bill payment in QuickBooks?

Does QuickBooks accept partial payments?

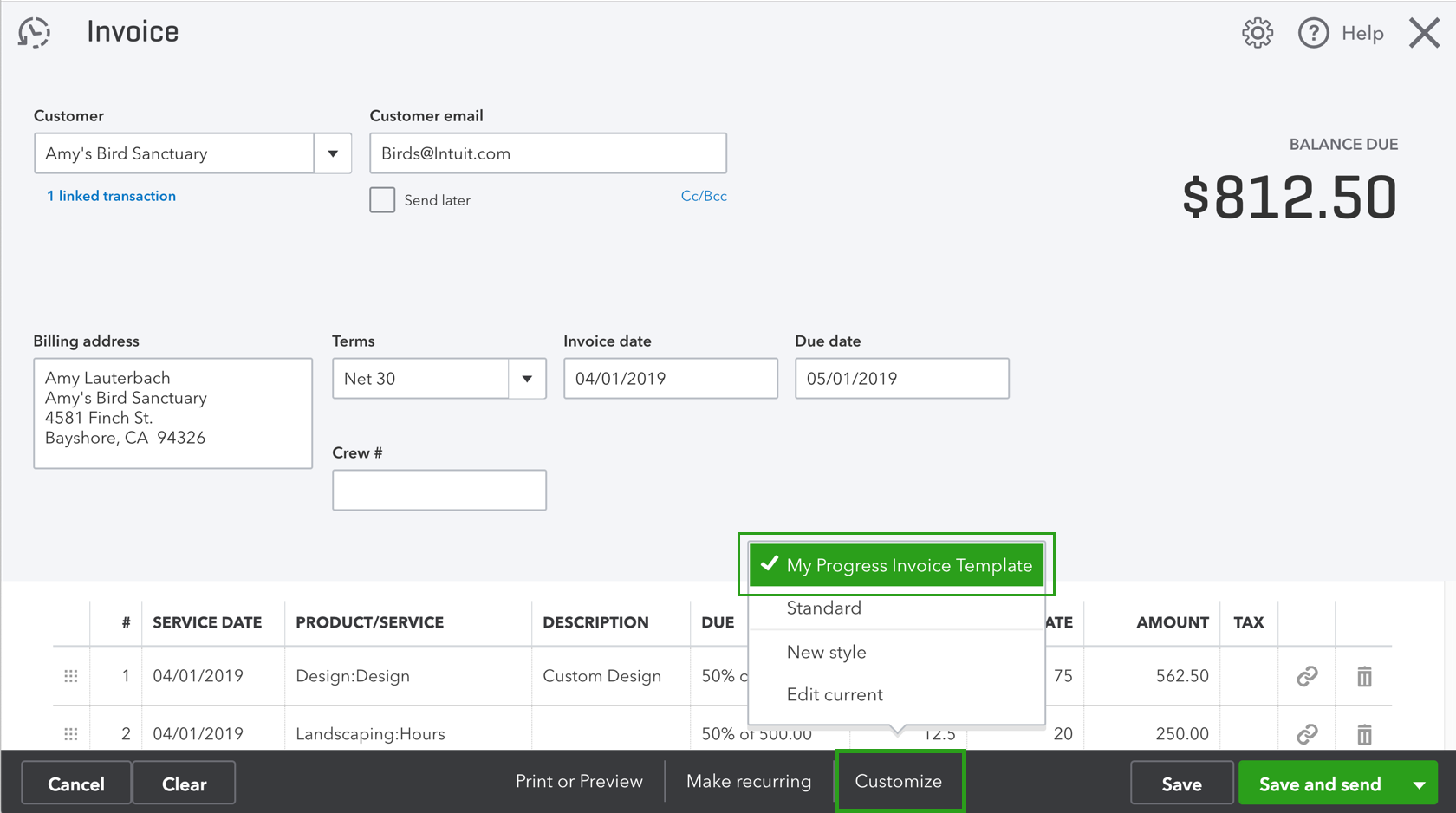

How do I bill 50% of an invoice in QuickBooks?

How do I receive a partial payment in QuickBooks?

Log in to your QuickBooks account. Click the “+” icon and select “ Receive payment.” Enter the customer’s name to bring up their open invoices. Select the relevant invoice by checking the box next to the invoice you’re receiving a payment for. In the “Payment” column, input the partial payment amount. Click on “Customers” and then receive payments.

How do I make a partial payment?

Select “Make a payment” and enter the partial payment amount or the amount you wish to pay initially. Choose how you want to pay, whether it’s a bank transfer or credit. Review and confirm your payment details by double-checking your amount and payment information. Submit the payment. Record the partial payment.

How to pay bills partially in QuickBooks Online?

Let’s go over how to pay bills partially in QuickBooks Online: From the left menu, click Expenses > Bills. Find the bill you want to partially pay and click the Action button. Select Pay Bill. In the Pay Bill window, enter the amount of the partial payment. Make sure it’s less than the total bill amount.

Is there a way to make a partial payment against a bill?

Is there a waybto make a partial patyment against a bill? assuming you have entered the bill, use pay bills, select the bill and overwrite the payment amount to reflect what you will actually pay, the bill will stay open for the balance due Only if the bills all belong to the same vendor, check them all off and make the payment in pay bills

Why should you allow partial payments in QuickBooks?

Partial payments provide flexibility. You can allocate funds to different aspects of the event without compromising on quality or vendor relationships. When you allow partial payment on QuickBooks, it builds trust among your vendors. This leads to better service and possibly favorable terms in the future.

How do I add a partial payment to an invoice?

In the “Payment” column, input the partial payment amount. Click on “Customers” and then receive payments. In the “Receive from” field, enter the customer’s name to display all open invoices. Select the specific invoice to apply the payment to.