Paying bills is a necessary but often tedious task. Fortunately technology has made paying bills much easier through online bill pay services. These services allow you to view manage, and pay all your bills from one place, saving you time and hassle. Many offer the ability to pay bills online for free.

In this article, we’ll explore the top free online bill pay services available in 2023. We’ll look at how they work, their key features, and help you determine which is the best fit for your needs.

What is Online Bill Pay?

Online bill pay refers to services that let you pay your monthly bills through a website or app rather than mailing checks or paying bills individually on each company’s website.

With online bill pay, you provide details on the bills you want to pay This includes info like the company name, account number, and payment amount The service then pulls these details to create a centralized dashboard where you can view all your bills in one place and schedule payments.

Many banks and credit unions now offer free online bill pay services for account holders. There are also third-party bill pay apps and sites that let you pay bills online for free or very low cost.

Benefits of Free Online Bill Pay

There are many advantages to using a free online bill pay service:

-

Convenience – View and pay all bills in one place, Avoid logging into multiple sites

-

Efficiency – Schedule one-time or recurring payments. Automate bill payment process.

-

Organization – Keep track of bill due dates and payment history.

-

Cost savings – Avoid late fees by paying on time. No postage cost.

-

Security – Payment info encrypted. Less risk than mailing paper checks.

-

Accessibility – Pay bills 24/7 through website or mobile app.

-

Budgeting – Review all bills in one place to better track spending.

Top Free Online Bill Pay Services

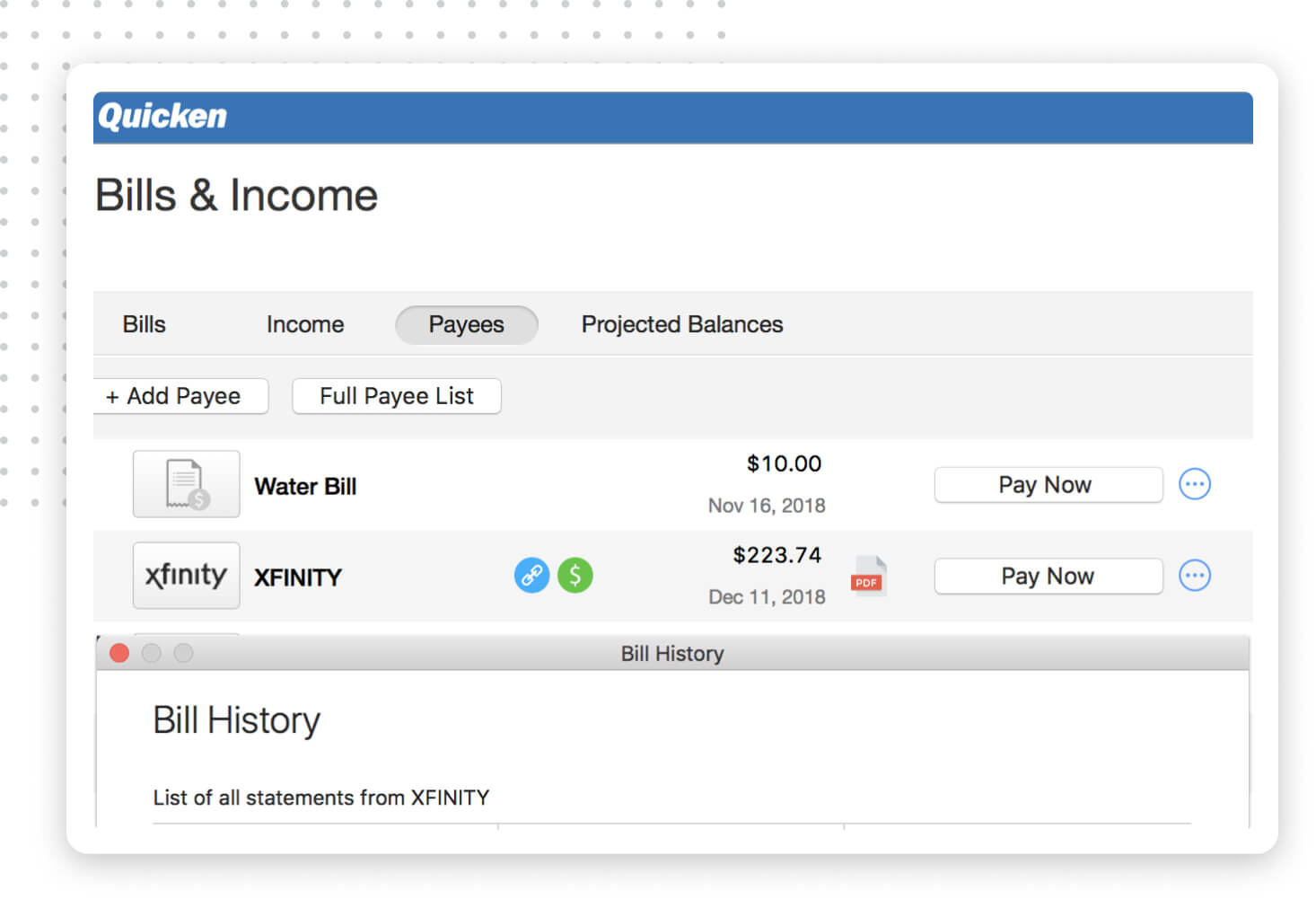

Now let’s explore some of the top free online bill pay services available today and their key features:

1. MyCheckFree

MyCheckFree is offered by Fiserv, one of the largest bill pay processors. It has no monthly fee and allows you to pay bills from your checking account for free.

Key Features:

-

Pay over 16,000 billers

-

Schedule one-time or recurring payments

-

Receive email alerts when new e-bills arrive

-

CheckFree Guarantee reimburses late fees up to $50

2. Western Union

Western Union’s online bill pay also has no monthly fee. You can pay bills through their website, mobile app, by phone or in-person.

Key Features:

-

Pay bills with credit/debit card or cash

-

Schedule payments up to a year in advance

-

Access 55,000+ retail agent locations

-

Available billers include mortgages, utilities, loans, insurance

3. Banks and Credit Unions

Many banks and credit unions offer free online bill pay to account holders. This lets you pay bills directly from your checking account.

Key Features:

-

No monthly fee or charge per payment

-

Schedule one-time or recurring payments

-

Make same-day payments for urgent bills

-

Payees receive electronic or paper checks

-

Avoid fees by ensuring sufficient account balance

4. Doxo

Doxo is a free bill pay app for iOS and Android devices. It has over 45,000 supported billers.

Key Features:

-

Organize bills into folders and set reminders

-

Pay bills with credit/debit card or bank account

-

Receive alerts for due date reminders

-

Sync bills and payments across devices

-

Digital copy of bills archived in app

Choosing the Best Free Service for You

With many great free options, choosing the best online bill pay service takes some consideration:

-

Account requirements – Do you need a checking account or credit card?

-

Supported billers – Does the service support all your billers?

-

Features – Do you want mobile access, reminders, records storage?

-

Payments – Do you prefer paying from an account or card?

-

Access – Is website access sufficient or do you want a mobile app?

Take stock of your payment habits, billers, and financial accounts and priorities. This will help you determine the free online bill pay service that best fits your needs and makes bill payment as simple as possible.

Get Started with Online Bill Pay

Paying bills doesn’t have to be a chore with online bill pay services. Avoid late fees, save time and hassle, and simplify bill payment by signing up for one of these top free services.

Try setting up a few billers to start. Once you get the hang of online bill pay, you can add more companies to make all aspects of bill payment stress-free. See why millions have made the switch and enjoy the ease and convenience online bill pay provides.

What is bill pay?

Bill pay is a service offered by many banks and credit unions that lets you set up automatic payments for bills. If you juggle rent or a mortgage, cable and electricity bills, credit card payments and more, online bill pay can save time and help you avoid late fees.

Online bill pay also allows you to manage your payments to various companies — all in one place. There’s no need to pay a Verizon bill on Verizon’s website, a Wells Fargo credit card with Wells Fargo bill pay, then write a check to your landlord. Instead, you could do it all from your financial institution’s website or mobile app.

An added bonus: Many banks and credit unions guarantee your payments will arrive on time and will reimburse your late fee if they don’t.

How does bill pay work?

How online bill pay works is straightforward: Log in to your bank account, navigate to its online bill pay feature, then select the provider you would like to pay. If you haven’t paid the provider through online bill pay before, you’ll need to add it by choosing it from a list or by plugging in the account number and billing address, then authorizing your bank to send payments for you.

» Looking for an online-friendly account? Check out NerdWallet’s favorite online checking accounts.

Payments can be sent by your bank electronically or via paper check, so you can pay even if the biller isn’t online — virtually eliminating the need for a checkbook. You can also choose a one-time payment or set up a recurring one.

Many banks offer basic bill pay service for free with their checking accounts. If you’re trying to minimize unnecessary fees, signing up for free bill pay service is a good way to keep track of your accounts and avoid charges for missing or late payments.

Many merchants and service providers offer the option of letting you receive an e-bill, or an electronic version of your paper bill, into your online bill pay account. If an e-bill arrives, you can have your bank alert you by email, text message or push notification via the bank app. Typically, you can choose whether to pay the entire balance, just the minimum due or another amount. You can even opt to have your bills paid automatically.

» Considering a cash management account? See our top picks for these high-APY checking-savings hybrids

SoFi Checking and Savings

4.00%SoFi members with Direct Deposit or $5,000 or more in Qualifying Deposits during the 30-Day Evaluation Period can earn 4.00% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Direct Deposit amount required to qualify for the stated interest rate. Members without either Direct Deposit or Qualifying Deposits, during the 30-Day Evaluation Period will earn 1.20% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Only SoFi members with direct deposit are eligible for other SoFi Plus benefits. Interest rates are variable and subject to change at any time. These rates are current as of 12/3/24. There is no minimum balance requirement. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet.

Forbright Bank Growth Savings

4.60%Annual Percentage Yield (APY) is accurate as of 11/19/2024. APY may change at any time before or after the account is opened. Available only online.

Barclays Tiered Savings Account

4.50%4.50% APY for $0 to <$250k; 4.80% APY for $250k+ balance

U.S. Bank Smartly® Savings

$0These cash accounts combine services and features similar to checking, savings and/or investment accounts in one product. Cash management accounts are typically offered by non-bank financial institutions.These cash accounts combine services and features similar to checking, savings and/or investment accounts in one product. Cash management accounts are typically offered by non-bank financial institutions.

Betterment Cash Reserve – Paid non-client promotion

4.75%*Current promotional rate; annual percentage yield (variable) is 4.25% as of 11/8/24, plus a .50% boost available as a special offer with qualifying deposit. Terms apply; if the base APY increases or decreases, you’ll get the .50% boost on the updated rate. Cash Reserve is only available to clients of Betterment LLC, which is not a bank; cash transfers to program banks (www.betterment.com/cash-portfolio) conducted through clients’ brokerage accounts at Betterment Securities.

$0CDs (certificates of deposit) are a type of savings account with a fixed rate and term, and usually have higher interest rates than regular savings accounts.CDs (certificates of deposit) are a type of savings account with a fixed rate and term, and usually have higher interest rates than regular savings accounts.

Synchrony Bank CD – Limited-time offer ends 12/9/24

4.30%Annual Percentage Yield (APY) is subject to change at any time without notice. Offer applies to personal non-IRA accounts only. Fees may reduce earnings. For CD accounts, a penalty may be imposed for early withdrawals. After maturity, if your CD rolls over, you will earn the offered rate of interest in effect at that time. Visit synchronybank.com for current rates, terms and account requirements. Member FDIC

Marcus by Goldman Sachs High-Yield CD

4.10%4.10% APY (annual percentage yield) as of 11/08/2024

Federally insured by NCUA

Alliant Credit Union Certificate

4.10%Annual Percentage Yield (APY) is accurate as of 11/21/2024

1 yearChecking accounts are used for day-to-day cash deposits and withdrawals.Checking accounts are used for day-to-day cash deposits and withdrawals.

Capital One 360 Checking

0.10%Advertised Annual Percentage Yield (APY) is variable and accurate as of 07/01/2024. Rates are subject to change at any time before or after account opening.

Deposits are FDIC Insured

$0Money market accounts pay rates similar to savings accounts and have some checking features.Money market accounts pay rates similar to savings accounts and have some checking features.

Discover® Money Market Account

QuickBooks Online: Electronic Bill Payments

FAQ

What is the free app to pay bills?

Is online bill pay free?

Is there another service like mycheckfree?

How does checkfree bill pay work?

What is a bill payment service?

A bill payment service is a platform that lets you schedule and pay bills through a website, mobile app or phone. Most banks and credit unions offer online bill pay for their customers, and you also can use a third-party bill payment service to manage your finances.

What is the best online bill payment service?

Bill pay services can make paying monthly bills easier and save time and money. The best online bill payment service is one that allows you to pay all of your bills in one place, safely and securely, with minimal or no fees. MyCheckFree is an online payment center that’s powered by Fiserv.

Are online payments free?

Finally, free online payments to more than 120,000 billers with your linked bank account. Break free from the burden of payment delivery fees. Payments are free of delivery fees when paid with a linked bank account. With over 120,000 billers (and growing), you can easily manage and pay all your bills from just one app.

Do banks offer online bill pay?

Most banks and credit unions offer online bill pay for their customers, and you also can use a third-party bill payment service to manage your finances. These services are convenient and easy to use and typically come with additional services like due date reminders, account alerts and payment tracking.

Where can I pay my bills online for free?

Most banks and credit unions today offer online bill pay for free or as part of your account’s monthly fee. For instance, Bank of America and Wells Fargo have top-rated online bill payment services that allow you to schedule or automate payments. You can access these services online or through the mobile app.

What is online bill pay & how does it work?

With online bill pay, there is no waiting around for paper statements to come in or the possibility of missing a bill invoice in the mail. Best of all, most of these bill pay services are provided by banks for free as part of their online checking account services. Paying Bills Online