Paying your monthly electricity bill can feel like a real drag. Writing checks, buying stamps, remembering due dates – it’s a chore. Wouldn’t it be nice if the payment just took care of itself each month? Well, with FPL Automatic Bill Pay, it can! This free service from Florida Power & Light Company (FPL) automatically deducts your bill from your bank account each month. The best part? You can enroll without paying any upfront deposit.

In this comprehensive guide, I’ll walk through everything you need to know about signing up for convenient, deposit-free FPL autopay.

Overview of FPL Automatic Bill Pay

FPL Automatic Bill Pay is a paperless, electronic payment program that offers FPL customers several advantages

-

No upfront deposit – Enroll for free without paying any deposit amount.

-

Pay automatically – Your monthly bill is deducted from your bank account on the date you choose.

-

Avoid late fees – Never miss a payment or due date again.

-

Save time – No more writing checks or going to the post office.

-

Get reminders – See your upcoming autopay amount on your FPL bill.

-

Monitor payments – Track your bill pay history online.

-

Go paperless – Reduce clutter without mailed paper bills.

-

Easy to cancel – You can opt out of autopay anytime.

Step 1: Check Eligibility for No Deposit

Most FPL residential customers can sign up for automatic payments without paying a deposit upfront. However, some scenarios may require a deposit:

- Past due bills or disconnections for non-payment

- Returned checks or failed electronic payments

- Bankruptcy within last 12 months

- New FPL account opened within the past 12 months

If you see a “deposit required” message when enrolling, you can still complete signup by paying a deposit via credit card. This deposit amount gets credited back on your FPL bill after 1 year of on-time autopay payments.

Step 2: Enroll in FPL Automatic Bill Pay

Enrolling in autopay is quick and easy:

-

Visit FPL.com and log into your online account

-

Under “My Account” select “Billing & Payment”

-

Choose “Automatic Bill Pay” and click “Enroll Now”

-

Pick the number of days after your billing date that you want payments withdrawn

-

Enter your bank account information

-

Agree to the terms and conditions

-

Submit your enrollment request

You’ll get a confirmation email once your autopay is set up. Bill pay will start at your next billing cycle.

Step 3: Make Any Outstanding Payments

When you enroll in automatic bill pay, FPL will include a “Do Not Pay” message on your next bill. This means you shouldn’t submit payment manually for that bill.

However, you’ll still need to pay any prior outstanding balance using your existing payment method before autopay kicks in.

So monitor your account after signup to pay off any remaining amounts due. This prevents getting overdue notices.

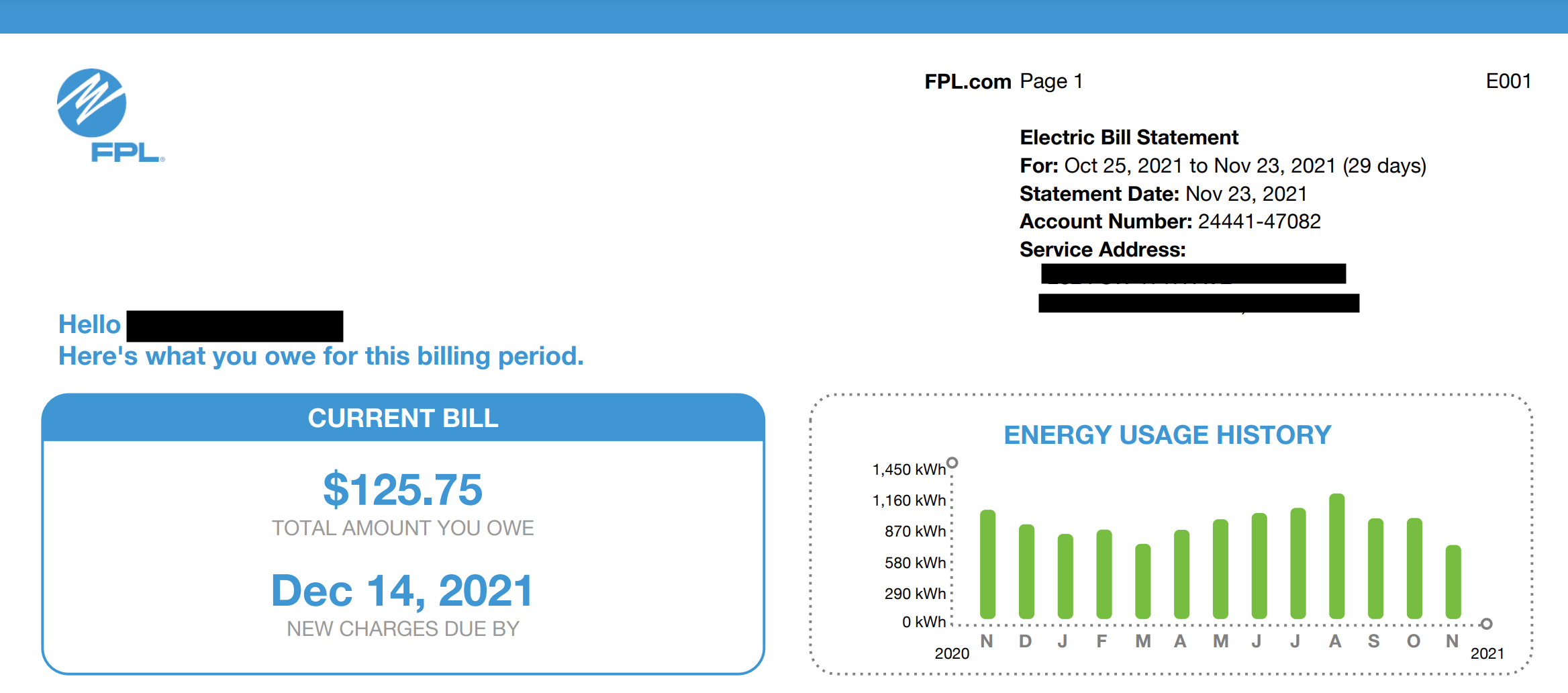

Step 4: Check Your Monthly Reminders

A key benefit of autopay is that you’ll get a reminder each month before the payment processes.

About 5 days before the withdrawal date, FPL will issue your new bill showing the autopay amount and date.

Review these reminders every month to ensure the amount looks accurate based on your power usage.

Step 5: Monitor Payments Online

Within 1-2 business days after the withdrawal date, you can verify online that autopay went through successfully.

On FPL.com, check your account’s “Billing & Usage” page. Here you can view:

- Transaction date and amount

- Confirmation that your bank account was debited

- Updated account balance reflecting autopay

Monitoring payments regularly is a smart way to catch any errors early.

Changing or Canceling FPL Autopay

You can easily make changes anytime to your autopay setup:

-

Change withdrawal date – Pick a new date each month for payments.

-

Update bank account – If your account details change, edit them under autopay settings.

-

Cancel autopay – You can opt out at any time online or via phone.

Autopay changes take effect starting your next scheduled payment. Any pending payments will still process as originally scheduled.

Get Started with Convenient, Automatic Bill Pay

Paying your FPL electricity bill doesn’t have to be a repetitive headache each month. Enrolling in Automatic Bill Pay means never having to worry about late or missed payments again!

Sign up today following the quick steps above to say goodbye to paper checks, due date stress, and late fees. FPL’s autopay makes managing your utility payments truly painless.

FPL Automatic Bill Pay is the most carefree way to pay

As an added bonus, when you enroll by March 15, you’ll receive a $50 Restaurant.com eGift Card to save up to 50% at select local restaurants.

Benefits of FPL Automatic Bill Pay:

- Set it up once, and your bill amount will be automatically withdrawn

- Receive your bill as a reminder before each payment is withdrawn

- Monitor your payments and view your statements on FPL.com

- Save time, postage costs and check writing

- It’s free!

- Log in or register at FPL.com

- Enter your bank info and choose your withdrawal date

- Provide some basic contact info and confirm your information.

When you sign up, you will choose how many days after your billing date your payment is withdrawn from your account (qualifying period). You can choose from 11 to 20 days.

You will know that you’re officially enrolled when you see “Do Not Pay” on your FPL bill along with the withdrawal date.

Which region would you like to access today?

Enroll by March 15 and receive a $50 Restaurant.com eGift Card to save up to 50% at select local restaurants.

Brad Garlinghouse: RIPPLE CRASH – What Will Happen Next?! XRP Price Prediction

FAQ

Is there a deposit required for FPL?

Does FPL offer auto pay?

How long does it take for FPL to take payment from bank account?

How does automatic bill pay work?

How long do I have to pay my FPL Bill?

You can choose from 11 to 20 days. For example, if your bill is issued June 10 and you select 11 days, then your payment would be withdrawn on June 21. FPL Automatic Bill Pay will begin with your next monthly bill that states “Do Not Pay.”

How does FPL automatic bill pay work?

Set your business paper-free with FPL Automatic Bill Pay and save time on processing paperwork plus money on postage. FPL securely withdraws your authorized payment automatically from your bank account monthly – and we work with your schedule.

How do I pay my FPL Bill?

Easily login to access and pay your bill anytime, anywhere with just a few taps. You can also stay organized with bill reminders and track your payment history with ease. Tap, pay, done Pay your bill for free by phone using your bank account – payment will post to your FPL account within minutes. Get the number

Can I discontinue FPL automatic bill pay?

We encourage you to remain on the program to continue to realize the many benefits of FPL Automatic Bill Pay. However if you still wish, you can discontinue FPL Automatic Bill Pay. Did you know? You can update your bank account information and continue on the program. Return to My Account Summary and stay enrolled.

Can FPL withdraw funds from my bank account?

You authorize FPL to withdraw funds from your bank account to pay the monthly FPL bills for the customer above unless and until FPL receives a written or verbal termination notice from you, allowing a reasonable amount of time for FPL and your bank to act on it.

When will my payment be posted to my FPL account?

Your payment will be posted within minutes to your FPL account.