As a driver in Kentucky, you’re required by law to carry proof of current auto insurance coverage in your vehicle at all times. That proof comes in the form of an insurance card issued by your provider. But what happens if you’re pulled over and can’t produce your card when asked?

Failure to show current proof of insurance during a traffic stop can lead to fines fees, and other penalties in Kentucky. In this comprehensive guide we’ll explain the state’s requirements, penalties for non-compliance, and steps you can take if you’ve been cited for not having your insurance card.

Kentucky’s Insurance Card Law

Under KRS 30439-117, all motorists in Kentucky must carry proof of liability insurance coverage in their vehicle. This serves as evidence that you have the state-required minimum levels of coverage for potential accidents and injuries

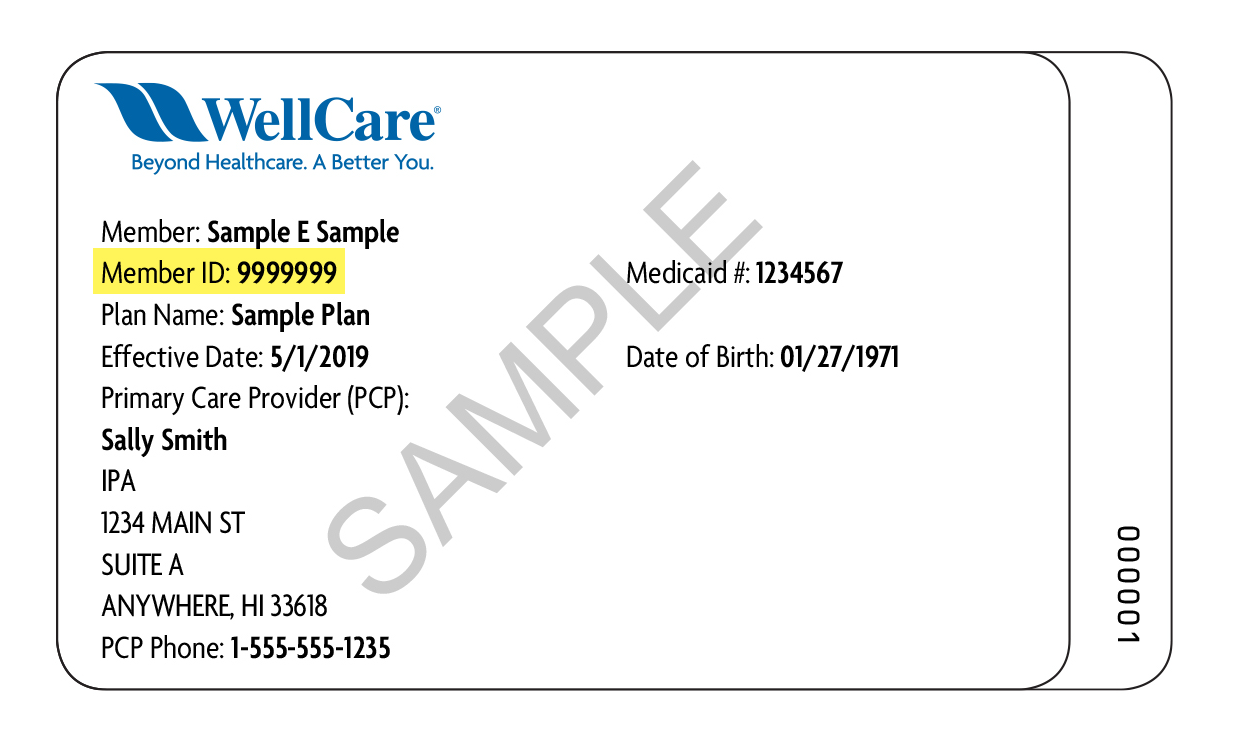

When stopped by law enforcement, you must show your current insurance card when asked. The card must have:

- Your name

- Vehicle make, model, and VIN

- Policy number

- Effective/expiration dates

- Insurer name

E-insurance cards on your phone are acceptable, but you must be able to display the full card with all required details. Failure to produce adequate proof of coverage when required is a violation of Kentucky law.

Penalties for No Insurance Card in Kentucky

If you’re unable to show current proof of auto insurance during a traffic stop or accident scene, you’ll face the following consequences in Kentucky:

-

Fine – You’ll be fined $250 for failure to produce your insurance card. KRS 534.040 sets this as the standard penalty.

-

Court Costs – In addition to the fine, you’ll pay at least $143 in mandatory court costs.

-

No License or Registration Suspension – Unlike driving uninsured entirely, failure to show proof does not trigger any license/registration suspensions.

-

No Points on License – Kentucky’s point system for moving violations does not assign any points for failure to produce an insurance card alone.

-

No Jail Time – This violation does not carry potential jail time under Kentucky law.

So you’re looking at $393 in mandatory financial penalties, but no suspension of driving privileges or risk of jail. However…

-

If you’re also driving uninsured, much stiffer penalties will apply once this is discovered. Law enforcement may investigate your insurance status further after a card failure.

-

Multiple no-card offenses may lead to increased fines at the judge’s discretion.

How to Resolve a No Insurance Card Citation

If you do get cited for not having proof of insurance, here are some tips for resolving it:

-

Show Your Card – If you actually have current insurance but just didn’t have the card with you, show up to court on your date with your card in hand. The judge may dismiss the citation when you prove coverage.

-

Provide Policy Documents – Even without your card, policy documents with your name/vehicle/policy number can also prove you were insured. Bring anything you have.

-

Explain Your Circumstances – Be honest with the judge about why you didn’t have your card. Temporary vehicles, recently purchased policies, accidents damaging your card, and other circumstances could warrant leniency.

-

Request Driving School – In lieu of points, ask the judge if you can attend traffic school to avoid increased insurance rates.

-

Pay Fines – If you truly failed to have active insurance during the violation, then you’ll have to pay the $393 in penalties. Resolve it quickly to avoid escalation.

-

Acquire Insurance – If you drive uninsured regularly, get valid auto insurance ASAP to avoid future issues. Provide your new policy documents to the court.

As long as you approach the process cooperatively and transparently, you have a good chance of minimizing the repercussions from a no-insurance-card ticket in Kentucky.

How to Avoid Violations

To steer clear of this issue in the first place, be vigilant about following Kentucky’s insurance requirements:

✔️ Verify Card Details – Check that your card shows all the required information – your name, vehicle, policy dates, etc. Request a new one if anything is missing.

✔️ Keep it Accessible – Store your insurance card in your glovebox, center console, or other easily accessible spot in your vehicle. Avoid stashing it in the trunk.

✔️ Grab it When Driving – Make it part of your routine to take your insurance card out when you get in your vehicle and place it within reach.

✔️ Set a Reminder – Use your phone calendar to set an annual reminder to get your new insurance card when your policy renews.

✔️ Take a Photo – Snap a picture of your card as a backup in case the physical copy gets lost or damaged. But the photo alone usually won’t suffice.

✔️ Update Cards Promptly – Get a new insurance card right away if you change vehicles, insurance companies, or policies. Don’t drive until it’s updated.

Staying organized with your insurance documents makes it much easier to comply with Kentucky’s requirements. But if you do get cited, don’t panic – handle the process responsibly and you can resolve the violation reasonably.

Above all, maintaining active auto insurance and carrying your card is critical to driving legally and avoiding serious penalties in Kentucky. Work closely with your insurance agent or company to ensure you have the proper proof at all times.

REGULATION AND REQUIREMENTIf your vehicle has a current, active registration, you must maintain insurance on that vehicle. If you do not plan to keep your registration current, you must turn in your license plate to the County Clerk’s office and cancel your insurance without penalty. Some owners of seasonal vehicles such as motorcycles or RVs are accustomed to dropping the insurance on these vehicles during the months they are not being driven. To avoid penalties for lack of insurance, the owners of these vehicles must turn in their license plate to the County Clerk’s office before canceling their insurance policy when it is time to put the vehicle back on the road, secure proof of insurance, and present the proof to the County Clerk. The clerk’s office will allow the vehicle to be registered at that time. Like seasonal vehicles, owners with Historic license plates sometimes drop the insurance while the vehicle is not being driven but fail to surrender the license plate to the County Clerk’s office. This will cause an uninsured notice to be mailed because the Division of Motor Vehicle Licensing records a registered vehicle without an insurance policy being reported each month. To avoid penalties for lack of insurance, turn in the license plate to the County Clerk’s office before canceling the insurance policy. When the time comes to get the vehicle back on the road, present proof of insurance to the County Clerk’s office, and the vehicle can be registered.

Attending College Inside or Outside Kentucky

Active Duty Military: Active duty military members can use insurance from another state to title and register any car in their name here in Kentucky. If when you register your car at the County Clerk’s office, it’s written down as a regular personal policy instead of a military personnel policy, the car will be marked as possibly not having insurance. Not because the insurance company has to send the Division of Motor Vehicle Licensing a list of insured VINs every month, but because they choose not to. The Insurance System can’t find a match because Kentucky doesn’t need to report military insurance policies every month. Show proof of your active military service (pay stub, ID) to the County Clerk’s office if you are currently on active military duty and receive an uninsured notice letter. This will fix the problem.

Temporarily Living Outside of Kentucky: If you register your car in Kentucky, you must get insurance from a company that is allowed to do business in Kentucky and keep that insurance on the car.

YOU MUST HAVE INSURANCE

An owner may not operate a vehicle in Kentucky until insurance has been obtained. The law says that a person whose vehicle registration has been taken away because they don’t have insurance on their vehicle In addition, the vehicle owner and driver are subject to a fine of $500. 00 to $1,000. 00, up to 90 days in jail, or both. All motor vehicle owners in Kentucky must carry minimum liability coverage. This means liability coverage of $25,000. 00 for all claims for bodily injury damages sustained by any one person and not less than $50,000. 00 for all injuries to people’s bodies caused by an accident, plus $25,000 00 for all property damage as a result of any one accident. Alternatively, a policy with a single limit of $60,000. 00 is acceptable. In addition, the policy must provide basic reparations benefits unless the insured vehicle is a motorcycle. Per.

Want Your Case Dismissed? Don’t Accept a Plea.

FAQ

Does Kentucky accept digital proof of insurance?

What is the fine for no insurance in KY?

What is the statute 304.39 117 in Kentucky?

What is Kentucky insurance requirements?