Dealing with repossession of your vehicle can add a ton of stress on your life. You will want to ease up on some of the stress since your finances are still uncertain.

Getting your car repossessed can be an extremely stressful and challenging situation. Not only do you lose your vehicle but it can also have lasting impacts on your finances and credit. One common question that arises is does a repo affect your car insurance?

The short answer is yes a repo can negatively impact your car insurance in a few key ways

- It can raise your insurance rates

- It can cause non-renewal or cancellation of your policy

- It can make it more difficult to find affordable coverage

However, the specifics depend on your individual situation. In this comprehensive guide, we’ll explore how repossession affects car insurance and what you can do to protect yourself.

How Repossession Impacts Your Insurance Rates

One of the biggest concerns is that a repo will cause your car insurance rates to skyrocket. There are a few reasons why this tends to happen:

- Credit checks: Most insurance companies run credit checks when determining your premiums. A repo will damage your credit, leading to higher rates.

- Higher risk: You may be seen as a “higher risk” customer after a default on your car loan. This results in higher premiums.

- Lapses in coverage: If you stop paying for insurance during the repossession, this gap in coverage can increase costs.

According to insurance industry estimates, your rates can go up by 20-30% or more after a repo. However, some states have laws limiting the use of credit in rate-setting. This helps protect consumers from excessive increases.

Non-Renewal or Cancellation Risks

In some cases, a repossession could even prompt your insurer to non-renew or cancel your policy altogether. This leaves you scrambling to find replacement coverage.

Insurers may decide you are too high-risk after a default on your auto loan and don’t want to continue coverage. Make sure you read all notifications from your provider to avoid an unexpected cancellation.

Difficulty Finding New Affordable Coverage

The repossession and credit impacts may also make it challenging to find affordable coverage from a new insurer. You’ll likely see much higher quote ranges as companies view you as riskier.

Make sure to compare lots of quotes and look for providers that specialize in non-standard auto insurance. This helps those with financial challenges access the required coverage.

How Long Does a Repo Affect Insurance Rates?

Now for some good news. While a repo causes initial rate hikes, the impact diminishes over time. Here’s a look at how long a repo can affect your car insurance prices:

- 1 year: The most significant impact, with maximum rate increases

- 3 years: Rates start to improve as repo ages on credit report

- 5-7 years: Minimal impact as repo drops off credit history

So if you can stick with the same provider, you may see rates decline after a few years if you maintain good insurance habits. Of course, this varies by state and company.

Tips to Save on Insurance After a Repossession

Here are some tips to get the lowest possible insurance rates if you’ve had a car repossessed:

- Improve your credit: Work on correcting errors on your credit report and pay bills on time. This slowly helps improve your score.

- Ask about discounts: Look for ways to offset the rate hike through discounts like multi-policy, safe driver, etc.

- Raise deductibles: Opting for higher deductibles saves money upfront on premiums.

- Limit miles driven: Driving fewer miles lowers risk and saves you money.

- Drop extras: Remove addons like rental reimbursement to pare back the policy.

- Maintain coverage: Don’t allow any gaps that would further increase costs.

Our Final Take – How Repossession Impacts Car Insurance

To summarize, a car repossession can significantly affect your auto insurance rates and options due to the hit to your credit. You’ll likely pay higher premiums and have difficulty finding affordable coverage immediately after the repo.

However, the impact diminishes over time as the default ages on your credit history. Within 5-7 years, it has minimal effects on your rates. By maintaining insurance diligently, improving your credit, and employing cost-savings tactics, you can overcome the challenges posed by a car repossession.

Careful research, comparison shopping, and working with providers experienced in non-standard markets are key to getting the required coverage at the best available price. With persistence and responsible financial habits, you can move forward successfully despite the repossession.

Are You Still Paying for the Vehicle?

If your car is still leased or you are still making payments on it, you still need insurance. This is because you don’t really own the car yet; the dealership or financing company still owns some of it until you pay it off.

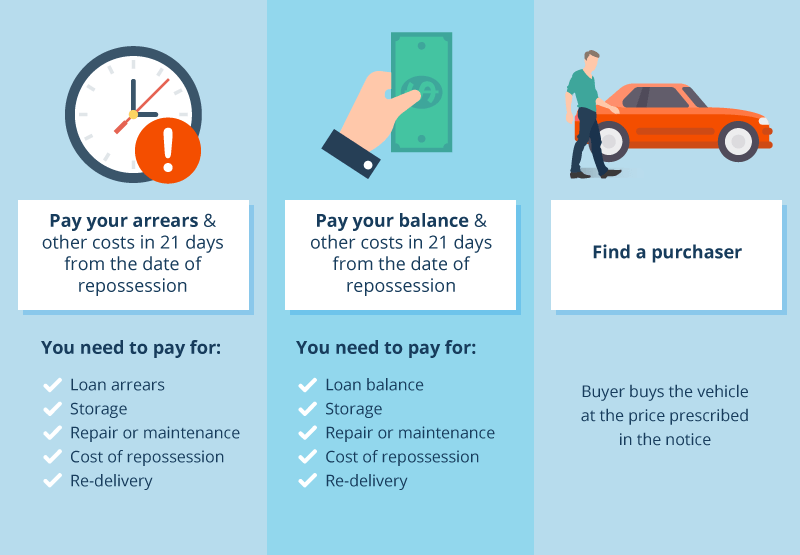

Lenders will take back the car and sell it to make up for their losses following repossession.

What Do I Do After a Repossession?

The best thing to do if your lender takes back your car but your insurance is still active is to keep the basic liability coverage.

Sometimes a repossession company will insure the vehicles they take, so your coverage may become redundant. Be sure to speak with the repossession company to see if they have insured the vehicle or not.

(in)Voluntary REPO: how giving a car back works and impact on credit score

FAQ

How long does a repo affect you?

Will a repossession affect buying a car?

How much damage does a repo do to your credit?

What happens if repo never finds car?