Paying off credit card debt can feel like an uphill battle High interest rates make balances grow rapidly, and it’s easy to feel trapped under a mountain of debt. But with the right strategy and tools, you can make steady progress towards becoming debt-free. Wells Fargo’s credit card payoff calculator is an excellent free resource to help you do just that

How Credit Card Debt Grows

Let’s say you owe $5,000 on a credit card with an 18% interest rate. If you only pay the minimum due each month, which is usually around 2% of the balance or $25, it will take over 17 years to pay off the debt. In that time, you’ll end up paying nearly $5,900 in interest charges.

This happens because when you only make minimum payments, most of your payment goes towards interest fees and barely makes a dent in the principal balance. As a result, the remaining balance continues accumulating high interest charges every month. It’s a vicious cycle.

The Power of Payoff Calculators

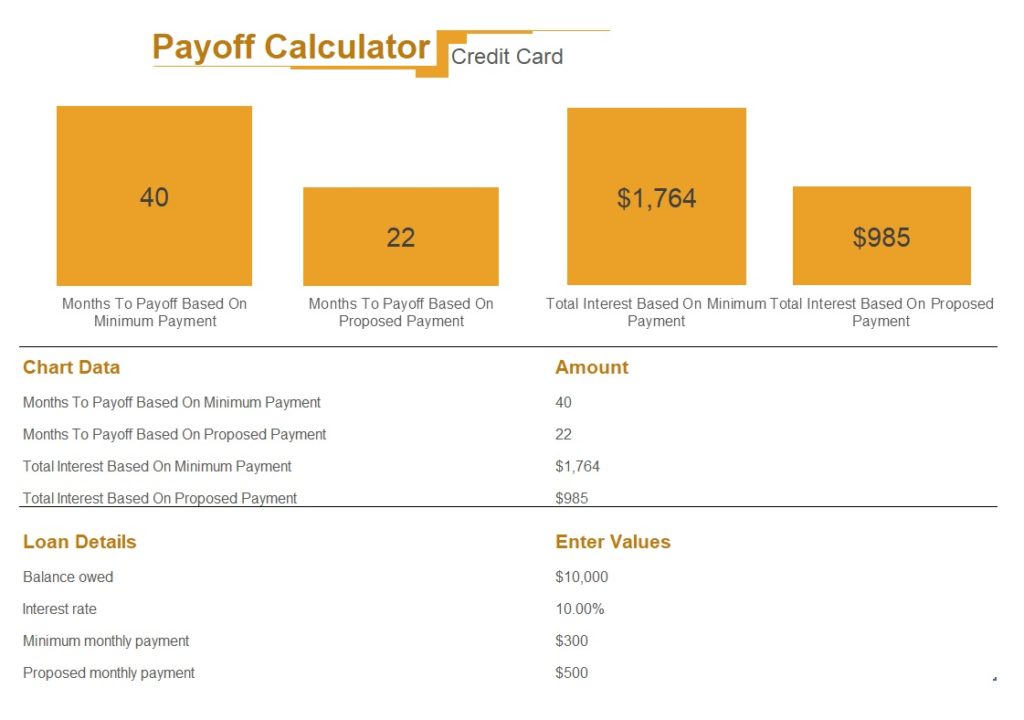

This is where payoff calculators come in handy. With Wells Fargo’s online calculator, you can see how increasing your monthly payment can drastically reduce the time it takes to become debt-free.

For example, if you raise your monthly payment on that $5,000 balance from $25 to $200, you’ll pay it off in just 2 years and 3 months while saving over $1,700 in interest. The calculator runs the numbers for you and creates an easy-to-understand payment schedule.

Payoff calculators demonstrate how making higher payments directly reduces the time spent trapped under debt They give you tangible goals to work towards and can help motivate you to pay more than the minimum due

Using Wells Fargo’s Payoff Calculator

Wells Fargo’s payoff calculator is very user-friendly. Here’s how to use it:

-

Go to https://www.wellsfargo.com/credit-cards/tools/payoff-calculator/

-

Enter your current credit card balance.

-

Enter your interest rate. This is the APR listed on your monthly statement.

-

Select whether you want to pay a set amount each month or pay down the balance by a certain date.

-

If paying a set amount, enter that dollar amount. If paying by a certain date, enter the number of months.

-

Click “Calculate” and view your customized payment schedule.

The calculator also lets you enter multiple cards to see the total payoff timeline. You can adjust the monthly payments to date and rerun the calculator to view different scenarios.

Strategies to Pay Off Debt Faster

In addition to making larger monthly payments, here are some other tips to pay off credit card debt faster:

-

Pay more than once per month. Making bi-weekly or weekly payments reduces interest charges.

-

Pay off highest interest cards first. Focus extra payments on the card with the highest APR.

-

Balance transfer to a 0% APR card. This pause on interest can help you pay down the balance.

-

Cut expenses. Freeing up room in your budget for extra debt payments is key.

-

Find other income. Side jobs and selling unused items gives you more money to put towards debt.

Stay Motivated With Small Milestones

Paying off significant credit card debt is a long-term project. To stay motivated along the way, set mini-goals and celebrate small wins, like:

- Paying off your smallest credit card balance

- Getting one card’s balance under a certain threshold

- Going up a percentage point in your credit score

- Sticking to your higher payment amount for 3 months straight

Finally, use Wells Fargo’s online payoff calculator regularly to track your progress. Seeing that finish line get closer month after month will inspire you to keep chipping away at that balance. Payoff calculators combined with smart strategies make becoming debt-free attainable.

About Author

I’m a personal finance writer who enjoys breaking down complex money topics into actionable advice that helps people save money and get out of debt. I specialize in making financial concepts simple and approachable through clear explanations and practical tips. When I’m not writing, you can find me outdoors hiking, biking and soaking up the sunshine.

Summary

-

Credit card debt grows rapidly when only minimum payments are made due to high interest rates.

-

Payoff calculators demonstrate how increasing monthly payments reduces time spent in debt.

-

Wells Fargo’s calculator is easy to use – simply enter balance, interest rate and desired payment.

-

Making extra payments, balance transferring, cutting expenses and earning more all help pay off debt faster.

-

Set mini-goals and use the calculator to track progress and stay motivated.

-

Smart strategies plus payoff calculators make becoming debt-free achievable.

How Long Will It Take to Pay My Balance?

If you have accumulated credit-card debt, you can use this calculator to estimate how long it could take you to pay off that debt based on your payment amount.

Assumptions:

- No additional charges are added to the balance.

- 12 equal billing cycles per year.

| My current credit card balance: | 0.00 |

| The annual percentage interest rate on your card: | 0 |

| The minimum amount required to pay only the interest: | 0.00 |

| Each month you plan to pay: | 0.00 |

| At that payment, the time required to pay off your balance: | 0 years |

| You will pay total interest of: | 0 |

This chart shows the number of years it would take you to pay off your balance based on the information you provided. You can substantially reduce the time needed to pay off your debt and your total interest paid by increasing monthly payments. If you feel your credit card interest rate is too high, you may want to consider whether you can transfer your balance to a lower-interest card.

How to Pay Off Your Maxed Out Credit Cards with ZERO Cashflow!!!| @JustJWoodfin

FAQ

How long to pay off $50,000 in credit card debt?

Does negotiating a credit card payoff hurt your credit?

How do I pay off my Wells Fargo credit card?

How many points do you get when you payoff a credit card?

What is the credit card payoff calculator?

The Credit Card Payoff Calculator gives you the tools you need to set a reasonable time-frame for paying off your credit cards. You can even print out the handy payoff amortization schedule to track your progress. Related: Why you need a wealth plan, not a financial plan. Remember: The less debt you have, the more you can invest in your future.

Is this credit card payoff calculator accurate?

This credit card payoff calculator is intended solely for general informational and educational purposes. The accuracy of this debt payoff calculator and its applicability to your personal financial circumstances is not guaranteed or warranted.

How do I pay off credit card debts each month?

There are multiple ways to approach paying off credit card debts each month. The Credit Cards Payoff Calculator uses a method known as the “Debt Avalanche method.” The calculator also assumes that no further transactions are made on any of the credit cards, minimum payments stay the same, and interest rates are static.

Can a credit card payment calculator help you pay off debts?

A credit card payment calculator like this one can help you estimate how fast you can pay off debts if you pay more than the minimum each month.

How long does it take to pay off a credit card?

While our Credit Card Payoff Calculator assumes an introductory APR of 18 months, some can be as low as 6 months. Who should get one? If you want to pay off your credit card debt faster, then a balance transfer credit card might be the best way to go about it.

What is a credit card payoff strategy?

This credit card payoff strategy focuses on psychological factors like motivation and incentive to keep people on track towards paying off their credit card debt. The two methods are similar in that the first priority is always to meet the minimum payments due for each credit card in order to avoid hefty fees.