Sending a one time payment for bills, loans, or other expenses through your Citizens Bank account is easy and convenient with the bank’s online and mobile bill pay options. This comprehensive guide covers everything you need to know about Citizens Bank one time bill pay including how it works, fees, and tips.

Overview of Citizens Bank One Time Bill Pay

The one time bill pay feature from Citizens Bank allows you to quickly and securely pay bills online even if you don’t have reoccurring payments set up. Key details include:

-

Make one time electronic payments to individuals or companies

-

Schedule current or future dated payments.

-

Avoid late fees by scheduling payments up to 18 months in advance.

-

Send expedited same day payments for urgent bills for a fee.

-

Accessible through online banking or the mobile app.

-

No signup required. Already included with eligible checking accounts.

Citizens Bank offers the flexibility of one time payments as well as reoccurring scheduled bill payments. It’s useful for periodic or irregular bills.

How Citizens Bank One Time Bill Pay Works

Using one time bill pay with Citizens Bank involves just a few simple steps:

-

Log in to your Citizens Bank account online or through the mobile app.

-

Access bill pay under the payments menu.

-

Enter the payee name, account number, and payment amount.

-

Select one time payment.

-

Choose the send on date for current, future, or expedited payments.

-

Confirm payment details and submit.

-

Funds are electronically debited from your Citizens Bank account and sent to the payee.

-

You can view pending and posted one time payments under payment activity.

It’s that quick and easy. No need to write and mail checks. Payments can be made to companies or individuals.

Citizens Bank One Time Bill Pay Fees

Citizens Bank does not charge any fees for standard electronic one time bill payments. You can send payments for free as long as you have sufficient funds in your account.

There are fees in certain situations:

-

Same Day Bill Pay – $10 per same day electronic payment

-

Overnight Check – $25 per overnight check payment

-

Insufficient Funds – $35 per transaction with insufficient available balance

Avoid fees by sending standard payments with a current or future delivery date and ensuring your account balance covers the payment amount before submitting.

Tips for Citizens Bank One Time Bill Pay

Follow these tips to save time and avoid issues when sending Citizens Bank one time bill payments:

-

Double check the payment amount, date, and delivery details before submitting. It can’t be canceled or changed once processed.

-

Know your account balance to ensure sufficient funds for one time payments and avoid fees.

-

For important payments, schedule a few days early or select expedited delivery to ensure on-time arrival.

-

Be sure to include the full accurate name, mailing address, account number, phone number, etc. when adding a new payee.

-

Save payees you may pay again in the future to your list for faster setup next time.

-

Check payment activity regularly to confirm payments are processed as expected. Report any issues immediately.

-

Set up account alerts to be notified of low balances or when a payment is processed.

-

Contact support right away if your payee says a payment was never received to resolve the issue.

Citizens Bank One Time Bill Pay vs Recurring Payments

While one time bill pay is good for periodic or irregular expenses, setting up recurring payments makes sense for bills with fixed regular due dates like loans, rent, utilities, etc.

One Time Bill Pay

-

Used for periodic or irregular bills

-

Must manually schedule each time

-

Flexible for changing amounts

-

Easy to set up payments to new payees

Recurring Payments

-

Better for fixed regular bills

-

Automatically pays set amount on schedule

-

Consistent automated payments

-

Need to update if bill amount changes

Evaluate your specific payment needs to decide which option may work better for your situation. Many people find combining both one time and recurring bill payments is the ideal solution.

Getting Set Up With Citizens Bank Bill Pay

Signing up for Citizens Bank bill pay just takes a few minutes. Simply follow these steps:

-

Log into your Citizens Bank online account or mobile app.

-

Locate bill pay under the payments menu.

-

Review and accept the terms and conditions.

-

Add payees you plan to send payments to.

-

Schedule one time or recurring payments as needed.

-

Send your first payment and you’re all set!

With bill pay, you’ll save time and hassle with paying bills while avoiding late fees. And the convenience of one time payments gives flexibility. Check if you already have bill pay access tied to your Citizens Bank account. Leverage this useful tool for simplified bill management.

Signing up for Online Banking

- It´s easy to enroll in Online Banking. If you have your account information or Social Security number, you can sign up online right now.

- To help our customers manage more of their finances online — in one place — Online Banking offers access to your investment accounts with Citizens Investment Services®. These accounts include:

- Accounts serviced by a Citizens Investment Services Financial Advisor

- Investments accounts you manage

- SpeciFi® digital advisor accounts

Online Banking also provides convenient access to the Wealthscape InvestorSM website, where you can execute transactions and obtain more detailed information on your investment accounts with Citizens Investment Services.

- If you have a Citizens Bank Checking account, you can request your ATM/Debit Card by calling 1-800-656-6561 or visiting your local branch. Business customers should call 1-877-229-6428.

- You can activate your debit card in a few different ways:

- Use the Citizens Mobile App*. Go to “Manage Cards” in the menu and it will bring you to where you can activate your debit card in the app*.

- Complete a purchase. Make an in-store purchase with your debit card using your PIN.

- Visit an ATM. Complete a transaction at any Citizens ATM with your debit card with your current PIN.

- By phone. Call 1-800-527-1800 and have your card and PIN handy to activate.

- It is Citizens Bank´s mission to ensure we always provide you with the best experience possible. While most browsers will allow you to access Online Banking, older versions may limit your ability to access some of the functions available. To ensure you get the most of your Online Banking experience, we recommend that use browsers with 128-bit encryption. Please see our Site Requirements for complete details and links to recommended browsers.

- With most browsers, you can determine the version by selecting the name of the browser from the navigation menu and clicking on “About (browser name).”

- You can begin using Online Banking immediately after you enroll.

- Citizens uses the highest level of encryption available today in order to keep your information safe. Encryption is the process by which information is translated into undecryptable code and then back to recognized information. We use a risk-based approach to every login attempt. As part of this approach, a one-time password will be requested for you to confirm should we find it necessary to further verity your identity. Please note that best-in-class security standards change over time. As such, we are no longer asking for security questions from you, since information used for those questions is often able to be found easily. Your security is our top priority.

- Yes. Please see the Citizens Online Guarantee page for complete details.

- You are the first line of defense for your Online Banking account security. Here are some helpful tips to protect yourself:

- Keep your password a secret – even from us!

- Click on Log Out when you’re done banking with us, whether online or in the mobile app.

- Create a unique password.

- Don’t reuse passwords.

- If you must write down a password, hide it where others won’t find it.

- If you are worried about a site being fraudulent, check the URL for the following:

- Short URLs: If the link is too short, dont use it. Scammers love to use links from shortening sites (e.g., bit.ly) because it bypasses security filters easily.

- Hijacked URLs: Review the link for any characters that do not belong. Scammers will take existing URLs and sneakily add characters that you may miss at first glance.

- Unknown URLs: If you dont recognize a URL, dont click on it.

- Misspelled URLs: If the URL has typos in it, stay clear.

If you need help, lets start a chat.

- Please start by retyping your password. If that doesnt work, heres how to create a new one:

- Go to citizensbank.com

- Click Log in

- Click Trouble logging in?

- Select I forgot my password

- Enter some info to verify your identity

- Create your new (easy-to-remember-but-hard-to-guess) password!

- By default, Online Banking has a timeout feature. If the system is idle for 10 minutes, the user is automatically disconnected after a 60-second countdown.

- Citizens uses a ??????Secure Socket Layer (SSL), also known as Transport Layer Security (TLS), to allow web browsers and servers to safely communicate online.

- Simply put, theyre an extra way to help you protect your sensitive data. SSL certificates are used to establish and maintain a secure connection and encrypt the data passing between your browser and our systems. Its designed to prevent anyone from intercepting or viewing your personal and account information. An EV certificate is the highest level of all SSL certificates. Its strict authentication process gives you the confidence to know that youre on the real Citizens website. To determine whether EV-SSL is working, look at the address bar of your browser. You should see a closed padlock icon.

- The security of your confidential and sensitive data (e.g., login info, social security, etc.) is a top priority and a key feature of our Online Banking. We use latest technology on the market, such as Secure Socket Layer (SSL), to make sure the information you provide is kept between us.

- After you enroll in Online Banking, we wont prompt you to change your password unless you forget it or get locked out of your account. However, as a best practice, we recommend that you change your password every 3 months.

- You should call Online Banking Customer Service at 1-800-656-6561. Business customers should call 1-877-229-6428.

General Features of Online Banking

- Online Banking gives you the power to access and manage nearly all your Citizens Bank accounts — from one place. You can review account history and current transactions, transfer funds between accounts (inside and outside the bank), place stop payments, request copies of statements, send customer service requests via secured email, pay bills, view s of cleared checks, access your checking, savings, and loan account statements online and much more. Personal Online Banking users can access their deposit accounts, loans and lines of credit, investment accounts with Citizens Investment Services, credit cards and mortgages. Business users have access to deposit accounts, overdraft lines of credit, some loans and lines of credit. Business customers may request that other business or personal accounts on which they have an eligible account ownership status be linked to their online profile.

- To make it easier and more convenient to access important account documents, such as statements, check s, electronic notices (eNotices), and 1099-INT and other tax forms, we put them all in one place: the Online Banking Document Center. To access the Document Center, log in to Online Banking and click the “DOCUMENT CENTER” tab.

- You can submit requests to change your physical address (primary street address) associated with your account from the convenience of Online Banking. You can also add separate mailing addresses for each of your accounts if you do not wish to have your account documents and cards mailed to your physical address. To submit an address change, click the Personal Information” link on the “Profile & Settings” page. Then scroll down to “Mailing Addresses” to make a change or addition. (Retail customers only)

- Yes. You can choose to have your account documents mailed to your physical address or add a separate mailing address for each account.

- Yes. Many types of account statements, including those for most deposit, line of credit, and loan accounts, are available in Online Banking under the “DOCUMENT CENTER” tab.

- In addition to account statements, in the Online Banking Document Center, you can easily locate check s, 1099-INT and other tax forms, and certain types of notices, including CD Maturity Notices and Overdraft/Insufficient Funds Notices.

- Yes. You can transfer from any eligible checking, money market, savings, or personal line of credit account you have linked to your profile. You can transfer money to any checking, money market, savings, personal line of credit, and most personal loan accounts. (In cases where account types are IRAs or other restricted products, transfers may not be permitted.) Please see the “Transfer Information & Capabilities” section of FAQs for more information.

- You can view up to 18 months of transaction history. (12 months of statement activity for personal credit cards)

- When you withdraw funds from an ATM or make a purchase with your debit card, the funds will be immediately removed from your available balance. Some networks update transactions real time while others do not. In general, ATM/Debit Card transactions will be reflected on the Online Banking Transaction History by the next business day.

- The running balance on your “Transaction History” page is similar to your check register: it indicates the balance in your account each time you have a deposit or withdrawal activity. Please note that the balance does not reflect holds, outstanding checks, and other transactions, which could cause the balance to be different from the bank´s balance on any given day. The bank does not use this balance as your available balance, and you should not, either.

- Accounts on which you have an ownership code that (generally) allows you withdrawal rights, may be included in your online profile. Accounts may or may not appear in your profile based on whether they have been designated as business or personal. Business owners may request eligible personal accounts be linked to their business profile by visiting a Citizens branch or calling us at 1-877-229-6428. If you dont see an account you expect to see, call us toll free at 1-800-656-6561 for personal accounts. For business accounts, call 1-877-229-6428.

- Up to 18 months of your statements are available online and can be retrieved immediately in Online Banking under the “DOCUMENT CENTER” tab. Simply use the Filter to select the account and timeframe for the statement you are requesting. Statements can be saved or downloaded any time for longer storage needs. If you wish to order a statement older than 18 months, simply click on the “Contact Us” link.

- Yes. You can click on the check number entry on your Transaction History and if an is available for that check, it will appear on screen. If a check is not available, you may order a copy by clicking “Contact Us” under “Help”, and either call or contact a chat representative. Fees may apply for check copy requests.

- Yes. You can download transactions from your account by clicking on the account. Then use the “Export” button and select your download criteria and format you need.

- You can add email addresses and mobile numbers to your alerts contacts list by visiting your “Personal Information” page located under “Profile & Settings”. Just be sure to go back to the “Alert Preferences” page when you want to apply your newly added contact information to the alerts.

- There is no monthly maintenance fee for Online Banking. There may be incidental charges and fees associated with Online Banking, such as those set out below, including, but not limited to, Account fees and charges you initiate by requesting stop payments, check copies, transfers outside the bank, or similar services.

- Online Banking displays your account information in real time based on transactions processed throughout the day, unless stated otherwise.

- Online Banking is available 24 hours a day, 7 days a week. The only exceptions are when system maintenance is being performed.

- Yes. Simply click on the “Site & Display Preferences” link under “Profile & Settings” and from there you can edit your account nickname, then click to “Save Changes”.

- In the rare event that the Online Banking system and all of our back-up systems were to go down, you can be comfortable that any transaction for which you have received a confirmation number has been completed. If you were in the middle of processing a payment when the technical difficulty occurred and had not yet received your confirmation number, you should review your “Pending Payments and Transfers” when the system comes back up. If the payment/transfer does not appear, then you should re-enter the transaction.

- Yes. Macintosh users have full access to Online Banking provided they are using up-to-date versions of Safari, Firefox, or Google Chrome.

- Absolutely. Just click the “DOCUMENT CENTER” tab while logged in to Online Banking to access available tax forms for each of your accounts. Available tax forms may include a 1098, 1099-C, 1099-INT, 1099-Q, 1099-R, 5498 and 5498-ESA. Please note, the Document Center only displays tax forms for Online Banking accounts, though other accounts may appear on a particular form. To ensure you have the right tax forms for each of your accounts, please check your mail.

- To access your tax forms, click on the “DOCUMENT CENTER” tab while logged in to Online Banking. From the “All Types” filter, select “Tax Forms.” Using the “All Accounts” filter, select the account from which you wish to receive the document. Then, using the “Timeframe” filter, select the time period for which you would like to view available documents.

- All tax forms are accessible for seven years from their year of origination. 1099-INT tax forms are available dating back to Tax Year 2016. All other tax forms are available dating back to Tax Year 2018.

- Here are some guidelines that can help you determine which tax form(s) you should expect to receive, if any. If a tax form is issued for your account, it will be posted to the Document Center by the date indicated — and mailed to you, if that’s what your paperless preferences indicate. If your account does not meet any of the below criteria, no tax form will be issued or added to Document Center.

If You… Youll Get This Tax Form Mailed/Posted By Paid $600 or more in interest or points on a mortgage 1098 January 31 Had $600 or more in debt canceled or forgiven 1099-C January 31 Received distributions from a Coverdell education savings account or 529 plan 1099-Q January 31 Earned interest income of $10 or more (not including IRAs) 1099-INT January 31 Received distributions from pensions, annuities, profit-sharing plans, retirement plans, IRAs or insurance contracts 1099-R January 31 Contributed to an IRA (traditional, Roth, SEP, SIMPLE or deemed) 5498 May 31 Maintained or contributed to a Coverdell education savings account 5498-ESA April 30 Keep in mind, Citizens Bank, N.A. doesn’t provide tax advice. You are solely responsible for any taxes that may be owed. Please consult your tax advisor.

How To Pay a Bill on Citizens Bank (Easiest way)

FAQ

Can online Bill Pay be used for one time payments?

Does Citizens Bank offer an online bill paying service?

What is the phone number for Citizens Bank one time payment?

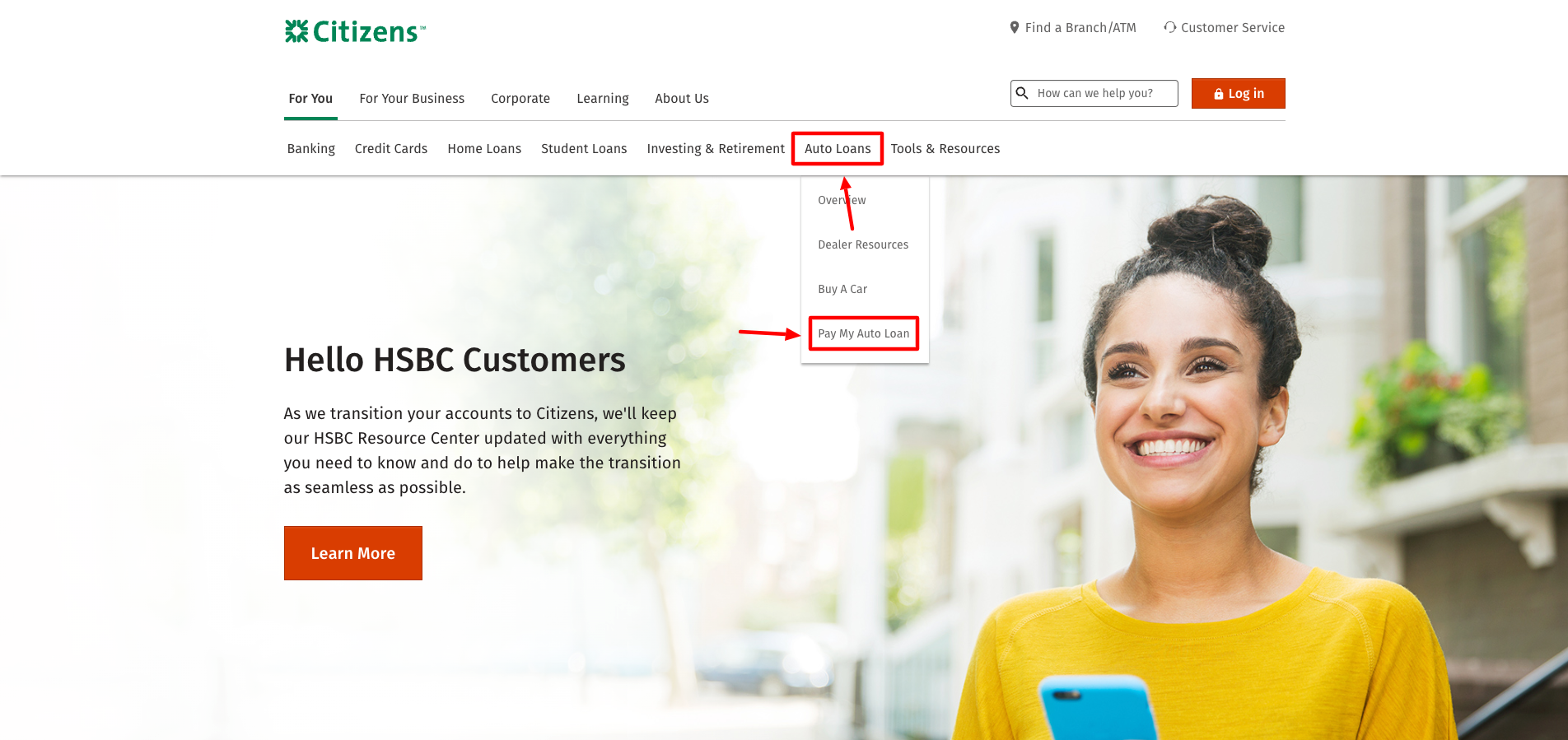

How to make a car payment online?

Can I make payments from citizens online banking?

Now, you can make payments directly from Citizens Online Banking and access information and tools to help you take even greater control of your loan. Already enrolled in Online Banking? You can log in now to make payments, see loan information, enroll in Auto Pay, or sign up for eStatements. Log In Not enrolled in Online Banking?

How does Citizens Bank pay my bills?

You’ll also get free access to bill pay through Citizens Bank. You can log in to your account and set up automatic bill payments to the companies you owe money to each month. Citizens Bank will take care of sending a check for you.

Does Citizens Bank & Trust offer online bill pay?

With Citizens Bank & Trust’s CheckFree Online Bill Pay you can receive convenient bill reminders and pay all your bills from one secure website. What could be easier than that? With Online Bill Pay, you can: Pay any bill, anytime. Schedule one-time and recurring payments, days, weeks or months in advance. Control when and how much you pay.

Does Citizens Bank charge a customer assistance fee?

A 3.5% Customer Assistance Fee is applied to all debit and credit card transactions. You may pay your bill at any Citizens Bank location or set up automatic bank drafts (a free service), or automatic credit/debit card payments (with a 3.5% customer assistance fee).

How do I use Citizens Bank online banking?

Register For Online Banking Install the Citizens Bank app on your phone or mobile device. Install “Citizens Bank Mobile” app from the Apple App Store. Install “Citizens Bank KY” app from Google Play. Do your banking using the app, or from any web browser.

How much does Citizens Bank have to pay in total?

Citizens Bank must pay $18.5 million in total, with about $11 million going towards consumer refunds and $7.5 million ($20.5 million – $11 million) in federal penalties.