Finding the right car insurance for your needs and budget can seem like a daunting task. With so many options, it’s hard to know where to start. Here in Greenville, North Carolina, costs vary widely among insurers. Fortunately, there are ways to make sure you’re getting the best deal. This guide will walk you through everything you need to know to get the cheapest car insurance quotes in Greenville, NC.

How Car Insurance Costs Are Calculated

Insurance companies use many factors to calculate your premiums. Here are some of the main ones:

-

Driving record: Infractions like speeding tickets, at-fault accidents, and DUIs will drive up your rates. A clean record will score you lower premiums.

-

Credit score: Insurers see drivers with poor credit as riskier and will charge more. Good credit means better rates.

-

Vehicle Premiums are based partly on the make model age and value of your car. More expensive or high-theft vehicles cost more to insure.

-

Coverage levels: Minimum liability insurance is cheaper than full coverage with collision and comprehensive. Higher deductibles also bring down premiums.

-

Demographics: Factors like your age, gender, marital status and where you live also impact rates.

-

Discounts: Most insurers offer ways to save, like bundling policies or being claim-free. Taking defensive driving can also score a discount.

Knowing these factors will help you shop smarter and find the best rate

Comparing Quotes is Key

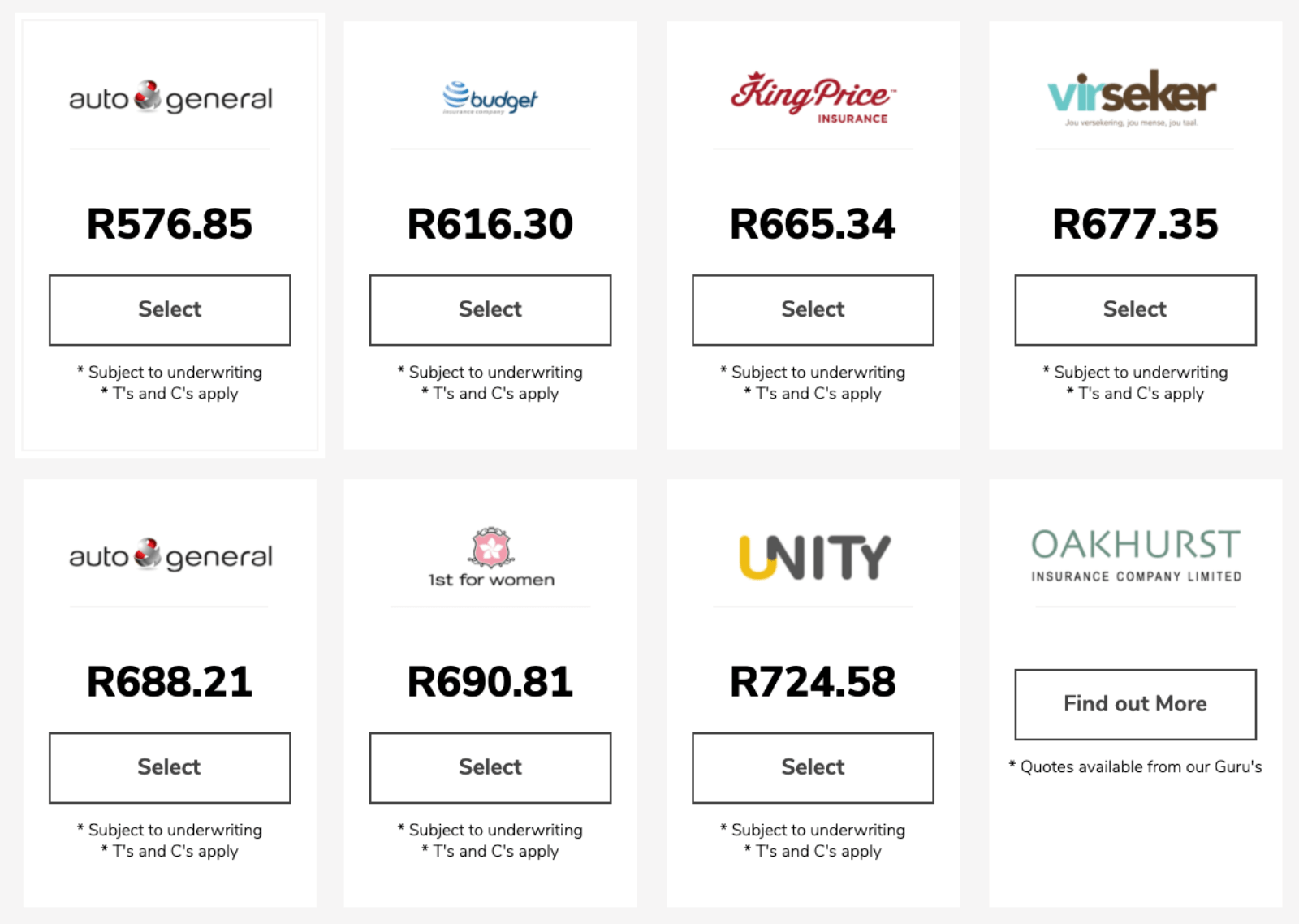

The best way to get the cheapest car insurance in Greenville is to compare quotes from multiple companies. Rates can vary dramatically, so it pays to get several quotes.

Here are some quick tips for effective quote comparisons

-

Get quotes from at least 3-5 different insurers. Include both national companies and local agents.

-

Compare the same coverage levels for the most accurate rate analysis.

-

Ask about all available discounts to maximize potential savings.

-

Consider bundle discounts for insuring multiple cars or adding renters or homeowners with the same provider.

-

Compare quotes every 6 months at renewal to ensure you still have the best rate as your profile changes.

Taking the time to compare multiple free quotes will help you find the cheapest rate and maximize savings.

Cheapest Car Insurance Companies in Greenville

Car insurance rates in Greenville average about $83 a month for full coverage, but costs vary significantly by insurer. Here are some of the most affordable insurers in Greenville based on sample quotes:

- Erie: Full coverage around $66/month on average

- Nationwide: Approximately $66/month for full coverage

- Midvale Home & Auto: Full coverage quotes around $72/month

- GEICO: Avg. $76/month for full coverage

As you can see, Erie and Nationwide offer some of the lowest rates in Greenville, making them a great place to start your search. But be sure to get quotes from several insurers for the best deal.

Ways to Save on Greenville Car Insurance

Beyond just comparing quotes, there are many ways Greenville drivers can save on their car insurance:

Boost your deductible: Going from a $500 to $1,000 deductible could save 15% or more. Just be sure you have savings to cover the higher out-of-pocket costs if you file a claim.

Ask about discounts: Every insurer offers discounts, so ask about all possible ways to save. Common discounts include good driver, low mileage, anti-theft devices, and more.

Improve your credit score: Better credit means better rates. Check your credit report for errors, pay bills on time, and pay down debts to boost your score.

Bundle insurance policies: You can save up to 15% for bundling auto with renters or homeowners insurance.

Take a defensive driving course: Completing an approved defensive driving course can earn you a discount of 5% to 15%.

Buy a low-profile vehicle: Opting for a used sedan over a new luxury SUV can save you significantly on premiums.

Drop unnecessary coverage: If your car is paid off, consider dropping collision and comprehensive to save.

How Auto Insurance Works in Greenville

Understanding the state laws governing auto insurance can help you make informed coverage decisions. Here are some key things to know:

-

North Carolina is an at-fault state, meaning the driver who causes the accident is liable for damages.

-

Minimum liability limits are 30/60/25, but 100/300/50 is recommended for better protection.

-

Uninsured and underinsured motorist coverage is optional but advised to protect yourself from uninsured drivers.

-

Comp and collision pay to repair your car but come with deductibles. Higher deductibles bring lower rates.

-

Rates for full coverage in Greenville average around $105/month but vary by driver.

Knowing the laws and average costs in Greenville allows you to tailor your policy and find the best rate.

Top Car Insurance Companies in Greenville

Greenville drivers have access to national insurers as well as some strong regional options. Here are the top picks:

State Farm: Popular for bundling discounts, student driver rates, and local agents

Allstate: Known for claim satisfaction and usage-based options to save

GEICO: National insurer with some of the lowest rates and tech tools for managing your policy

Progressive: Offers competitive rates and usage tracking to save with Snapshot program

Nationwide: Strong choice for bundling policies and discounts for safety features

Farm Bureau: Regional insurer with low rates, especially for rural drivers

Reviewing the leading insurers’ reputation, discounts and average rates can help guide your search for the right policy.

How Insurance Rates Change with Age

Your age is a key factor insurers use to set premiums. Teen drivers have astronomical rates, while middle-aged drivers enjoy the lowest rates. Here’s how rates trend by age in Greenville:

- Teens: $220/month for full coverage on average

- 20s: Around $135/month for full coverage

- 30s: Roughly $95/month for full coverage

- 40s: Approximately $85/month for full coverage

- 50s: $80/month for full coverage

- 60s: $110/month for full coverage

While teens have it worst, rates don’t start to go back up again until your 60s. Doing things like taking a defensive driving course can help offset rate hikes.

Why Comparing Quotes Is So Important

It bears repeating that comparing free quotes from insurers is the key to finding the best rate. Rates can vary by hundreds of dollars per year across companies for the same driver.

Here’s an example of how much quotes can vary:

- Geico: $156/month

- Allstate: $221/month

- Progressive: $211/month

- State Farm: $194/month

- Erie: $109/month

As you can see, Erie provides the lowest monthly premium in this example, at nearly $100/month less than Allstate for the same driver! This demonstrates clearly how important rate shopping is.

The best way to compare quotes is to enter your info once on a site like Insurify. You can get personalized quotes from dozens of top insurers to find the lowest rate match.

Key Takeaways

Finding the right coverage at the best price in Greenville requires some research. Here are a few key tips:

-

Shop and compare quotes from at least 3-5 insurers. Local and national brands may offer low rates.

-

Ask about all available discounts to maximize potential savings.

-

Consider bundling policies and raising deductibles to lower premiums.

-

Drive safely and maintain good credit to keep rates as low as possible.

-

Re-shop quotes at renewal to ensure your rate is still competitive.

Following these tips can help you find the cheapest Greenville car insurance rate to protect you on the road. Take the time to get multiple free quotes and you can drive with confidence you have the right policy at the lowest cost.

Find a Nationwide Insurance Agent in Norfolk, Virginia

No matter how cautious you are, you can’t control how other drivers act, especially when you’re stuck in rush hour traffic. The On Your Side Claims Service is helpful whenever you need to make a claim, which is one reason why Nationwide has a 2095% member satisfaction rating. Our Norfolk auto insurance agents are a great place to get information and easy, personalized insurance tips, whether you just want to ask a quick question about your chosen claim limits or you want to know more about Nationwide’s Vanishing Deductible® program.

In a big city like Norfolk, there are a lot of different types of homes and things that people own that need to be protected by a homeowners policy and personalized coverage from Nationwide. Standard coverage includes some things, but extra dwellings, liability, and flood insurance are some of the extra coverage options that other homeowners in the area choose. Our Norfolk home insurance agents can help you choose the right coverage for your home, no matter where it is, from the city center to the farthest outlying suburbs.

Theres a lot of life to live in a big city like Norfolk. But when it comes to life insurance coverage, it really helps put the essentials into focus. You want to be sure that your family will be taken care of if something happens to you. You want to make sure that if someone in your family gets a chronic illness that needs long-term care every day, it won’t put a huge strain on your finances. You want to know that you have one more egg in the nest for retirement savings. Talk to one of our Norfolk life insurance agents about the right policy for your household.

The main types of business insurance are similar to how the Norfolk economy has changed over the years. Since the citys founding, local businesses have looked for ways to insure their building and other property assets. Liability coverage wasnt far behind. Over time, vehicle and fleet insurance became a common requirement for protection. At the same time, there are more reasons than ever to experience an operating loss. Let one of our Norfolk business insurance agents be your Nationwide risk management specialist. They can help you no matter what threat your company faces.

10 Cheapest Car Insurance Companies in 2024

FAQ

Who has the cheapest auto insurance rates in NC?

How much is car insurance in Greenville, NC?

What is the cheapest legit car insurance?

How much is the average car insurance per month in North Carolina?

Who offers cheapest car insurance in Greenville NC?

20 year-olds in Greenville might want to consider Direct Auto who, on average, offers car insurance rates around $52.37 per month. Erie , North Carolina Farm Bureau , Utica National Ins Group and Auto-Owners Insurance Co are also in the top 5 cheapest rates available.

How much does car insurance cost in Greenville?

An at-fault accident can bump Greenville drivers’ rates to an average of $98 per month for liability coverage and $171 for full coverage. The data below outlines the average cost of auto insurance if you have an accident on your driving record. The below rates are estimated rates current as of: Saturday, June 1 at 12:00 PM PDT .

How do I find the cheapest auto insurance in Greenville?

To find the best cheap auto insurance in Greenville, North Carolina, compare quotes from multiple companies. The minimum auto insurance required in Greenville, North Carolina is 30/60/25 The cheapest auto insurance company in Greenville is Liberty Mutual Check for injuries and call for medical assistance if necessary.

What is the minimum auto insurance in Greenville?

The minimum auto insurance in Greenville is at least 30/60/25 in coverage to comply with North Carolina auto insurance laws. To find the best cheap auto insurance in Greenville, North Carolina, compare quotes from multiple companies. The minimum auto insurance required in Greenville, North Carolina is 30/60/25