Paying your monthly bills can feel like a chore. Writing checks, logging into multiple accounts, keeping track of due dates – it can be tedious and time consuming. Many people look for ways to streamline bill pay and earn rewards at the same time. Using a credit card to pay bills seems appealing since you can consolidate payments and potentially earn cash back or travel rewards.

But can you pay your electric bill with a credit card? What about other monthly bills like cable, internet, phone, and utilities? The answer is not so straightforward. While most service providers will accept credit cards, many will charge a fee that can outweigh the rewards you earn.

Let’s take a look at the pros and cons of paying bills with credit cards so you can decide if it makes sense for your situation,

The Benefits Of Paying Bills With A Credit Card

There are some advantages to putting your recurring expenses on a rewards credit card:

-

Earn cash back or travel rewards: The main incentive for using credit cards is to earn rewards based on your spending. Typical rewards rates range from 1-5% cash back or points/miles that can be redeemed for travel. Paying bills with a card allows you to earn rewards on expenses you’re already paying every month.

-

Consolidate payments: Instead of logging into multiple accounts and keeping track of different due dates, you can pay everything with one credit card bill each month. This streamlines the bill pay process.

-

Improve credit score Responsibly using a credit card and paying the balance off each month demonstrates good credit management. Over time, this can help build your credit score

-

Buyer protection: Credit cards provide more robust fraud protection and purchase protection than debit cards or bank transfers. You have the ability to dispute charges if needed.

-

Avoid late fees: Setting up autopay with your credit card ensures bills are paid on time every month, avoiding costly late payment fees.

Potential Downsides Of Paying Bills With A Credit Card

However, there are also some drawbacks to consider:

-

Service fees: While most service providers accept credit cards, many charge processing fees ranging from 1-5% of the transaction amount. These fees can eat into (or completely negate) any rewards you earn.

-

Risk overspending: It’s important to pay your credit card balance in full each month. But swiping a card makes it easy to overspend. Carrying a balance leads to interest charges that outweigh any rewards.

-

Higher utilization: More transactions means higher credit utilization if you’re not paying off the full balance monthly. High utilization can negatively impact your credit score.

-

Auto-pay issues: Linking bills to a credit card for automatic payments can be problematic if that card expires, gets lost/stolen, or has fraudulent activity. Missed payments lead to late fees.

What Bills Can You Pay With A Credit Card?

Not all monthly bills are equal when it comes to credit card acceptance. Here are some common expenses you may be able to pay with plastic:

Utilities

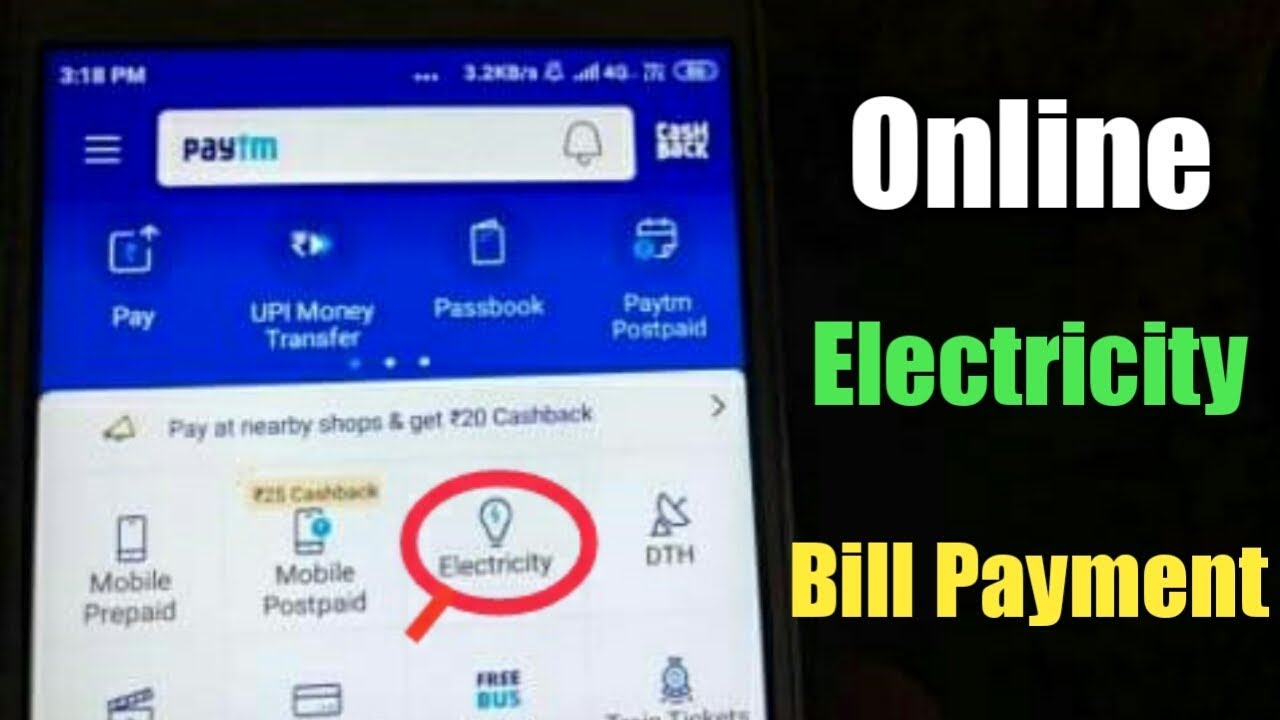

- Electricity

- Gas

- Water

- Waste management

- Home internet

- Cable TV

Most utility companies accept credit cards, though they usually charge processing fees of $2-5 per transaction. This can add up over a year. Compare any fees against potential rewards to see if it makes sense. Some third party payment services like Plastiq will pay your utility bill with a credit card for you, but also charge a 2.5% fee.

Insurance

- Auto insurance

- Home insurance

- Renters insurance

- Health insurance

Insurance carriers typically accept credit cards without fees. This makes insurance premiums ideal for earning rewards, especially if you pay for 6 or 12 months upfront. Just be sure to use a card that offers bonus rewards for insurance category spending.

Telecommunications

- Cell phone service

- Landline phone

- Internet service

Major telecom providers accept credit cards for monthly service charges. While fees are rare, always check your provider’s policy. Paying a year of cell service upfront can help you earn major rewards.

Subscriptions

- Music and video streaming

- App subscriptions

- Gym memberships

- Newspaper and magazine subscriptions

Recurring subscription charges are perfect for credit card rewards. Most subscription services accept cards without levying fees. Just be sure to set up autopay so you never miss out on rewards.

Rent/Mortgage Payments

Paying large bills like rent, mortgage, and auto loans with a card could earn huge rewards. But most lenders don’t directly accept credit card payments. You’ll need to use a third party service like Plastiq, which charges 2.5% in processing fees. Only consider this if your rewards outweigh the fees.

How To Choose The Best Credit Card For Bills

If you’ve decided paying bills with credit cards can work for you, follow these tips to maximize rewards:

-

Pick a card with an overall flat rate of at least 2% cash back or 2x points on every purchase. Avoid cards with rotating bonus categories, which may not align with your bills.

-

Consider bonus rewards of 3-6% cash back or 3-6x points for specific categories like groceries, gas, utilities, insurance, or streaming services if those are major expenses.

-

Compare any processing fees charged by service providers against potential rewards to determine if it’s worthwhile.

-

Focus on cards with no annual fee to avoid cutting into your rewards.

-

Make sure to pay the balance off each month to avoid interest charges. Set up autopay if needed.

-

Watch out for changes to credit limits and account numbers to avoid interrupted autopay.

-

Consider the value of purchase protection, extended warranties, and other card benefits beyond rewards.

The Bottom Line – Is It Worth Paying Bills With Credit Cards?

Paying monthly bills like utilities, cable, cell service, insurance, and subscriptions with a rewards credit card can make sense. You earn cash back or travel rewards on routine spending while streamlining bill pay. However, watch out for processing fees that eat into earnings. And always pay off the balance each month. Done responsibly, using credit cards to pay recurring expenses can be an easy way to maximize the value of your monthly budget.

Earn rewards for your spending

See your top credit card matches based on your credit profile and spending habits.

Get the right card to earn cash back or points on your purchases and maximize your perks.

Apply for rewards cards matched for you and that you’re more likely to qualify for.

What Utilities Can You Pay With a Credit Card?

While payment options may vary depending on your utility provider, you can usually pay the following utility bills with a credit card:

- Phone or cellphone bill

- Internet bill

- Cable bill

- Water bill

- Electric bill

- Gas bill

Debit Card vs Credit Card – What should I use on paying Bills, Online/Store shopping, ETC…

FAQ

Is it OK to pay utility bills with credit card?

Can I pay an electric bill using a credit card?

What bills Cannot be paid with a credit card?

Which is the best credit card for utility bill payment?

|

Partner Name

|

Card Name

|

Offer Details

|

|

SBI Bank

|

IRCTC SBI Card Premier

|

3 Reward points per ₹125 on Dining and Utility spends.

|

|

HDFC Bank

|

IndianOil HDFC Bank Credit Card

|

Earn 5% of spends as FP on shopping for groceries, utilities & bill payment

|

Can you pay utility bills with a credit card?

When life gets busy, you can easily forget to pay a bill or two. But fail to pay your utility bill and you could end up without essential services like electricity or water. To ensure your utility bills are covered every month, you can pay utility bills with a credit card, but there may be a convenience fee and other factors to consider.

Should I use my credit card to pay my bills?

You can also earn reward points in the process, if your credit card offers that benefit. Here are some pros and cons of using your credit card to set up automatic payments on monthly bills: Paying bills and utilities on a credit card helps you

How much does it cost to pay your electric bill?

According to the National Association of State Utility Consumer Advocates, those fees can range from $1.50 to $5.85 per transaction. If your electric company charged you $5.85 per transaction to pay your monthly bill with a credit card, you’d pay $70.20 per year just in fees.

Should I use my checking account to pay bills?

You should also use your checking account to pay bills in the following situations: Your provider charges a fee for paying by credit card. In most cases, you’ll pay more in credit card convenience fees than you’ll gain in card rewards and perks for using a credit card.

Do credit card rewards Pay for utility bills?

Card rewards outweigh extra fees: Your credit card rewards points or cash back can add up if you use your card to pay for utilities. If you had $4,000 per year in utility bills and used a card that offered 1.5% cash back on every purchase, you’d get $60 in cash back annually. But watch out for card fees.

Does paying utility bills with a credit card affect your credit score?

Depending on your utility charges, how many utilities you pay with the same card and your credit limit, it’s possible that paying utility bills with a credit card could push your credit utilization ratio too high. Using more than 30% of your available revolving credit can negatively affect your credit score.