Having a good credit score is crucial if you want to buy a house. Your credit score determines whether lenders will approve you for a mortgage and the interest rate you’ll pay. So what credit score do you need to buy a house? Is a 713 credit score good enough?

The short answer is yes, you can buy a house with a 713 credit score. While it’s not high enough to get the very best mortgage rates, a score of 713 is generally considered good credit and meets the minimum requirements for most mortgage lenders.

What Credit Score Do You Need to Buy a House?

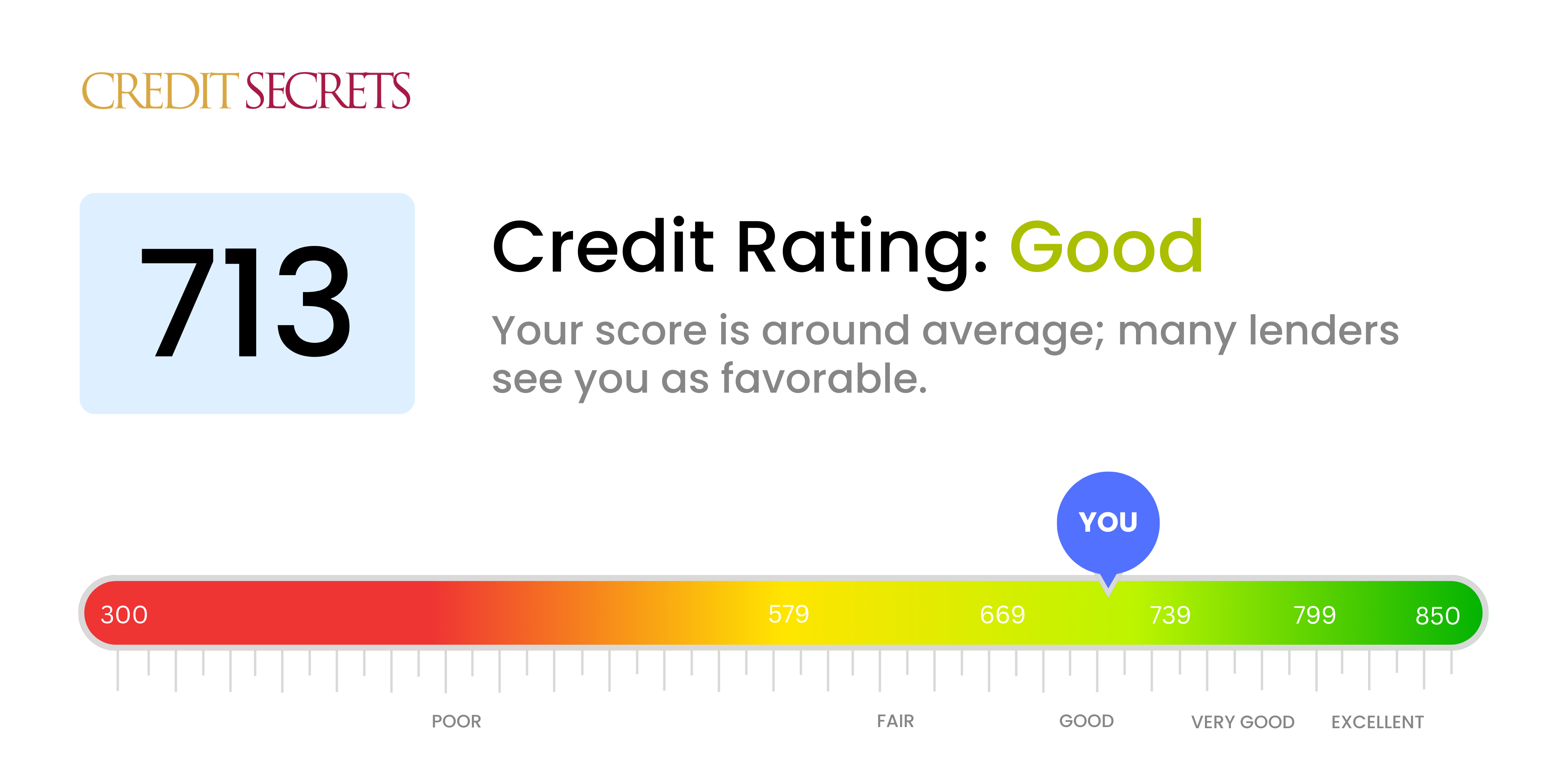

The most common credit scoring model used by mortgage lenders is the FICO score which ranges from 300 to 850. The higher the better when it comes to your FICO score.

Here’s a general overview of the FICO credit score ranges:

- 800-850: Exceptional

- 740-799: Very Good

- 670-739: Good

- 580-669: Fair

- 500-579: Poor

So a FICO score of 713 falls into the good credit range. But what’s the minimum credit score needed to qualify for a mortgage?

According to mortgage expert Zillow the minimum credit score to buy a house depends on the type of mortgage

- Conventional loans: 620-660

- FHA loans: 500-580

- VA loans: 580-620

- USDA loans: 580-620

- Jumbo loans: 680-700

As you can see, a credit score of 713 exceeds the minimum requirements for all common mortgage types. You should have no problem getting approved.

However, while a 713 FICO score meets the basic eligibility criteria, it’s still on the lower end of the “good” credit tier. To get the very best mortgage rates and terms, it’s recommended to have a score of at least 740.

713 Credit Score Mortgage Interest Rates

With a 713 credit score, you can expect to pay a higher interest rate than borrowers with excellent credit scores of 750+ according to myFICO. Here are some example interest rates:

- 740+ credit score: 2.875% interest rate

- 713 credit score: 3.125% interest rate

- 680 credit score: 3.375% interest rate

- 620 credit score: 3.625% interest rate

The interest rate difference of just half a percentage point between a 740 score and a 713 score adds up to thousands of dollars in extra interest payments over the life of a 30-year mortgage.

While a 713 credit score meets the minimum requirements for most lenders, you’ll get better mortgage rates with a higher score. Even boosting your score to the mid-720s could make a noticeable difference.

How to Improve Your Credit Score Before Buying a House

If you have time before applying for a mortgage, take steps to boost your credit score above 713. This will expand your lending options and help you qualify for a lower interest rate. Here are some tips:

- Pay down credit card balances: Keep balances low on revolving credit accounts.

- Become an authorized user: Ask a family member with good credit to add you.

- Limit hard inquiries: Don’t open new credit accounts.

- Check for errors: Dispute any inaccuracies on your credit reports.

- Pay all bills on time: Payment history is a major factor in your score.

Also consider getting a credit builder loan, which will help build your credit history. Or open a secured credit card and make on-time payments.

Within 6-12 months of focused effort, it’s realistic to improve your credit score to the 720s or higher.

What Other Factors Do Mortgage Lenders Consider?

While your credit score is important, it’s not the only criteria lenders evaluate. They also consider:

- Income – Proof you can afford the monthly payments.

- Debt-to-income ratio – Total debts versus gross monthly income.

- Down payment amount – Larger down payments lower your risk.

- Employment history – Steady income from the same job.

Bringing a large down payment to the table can help make up for a lower credit score. But improving your score should be top priority before applying for a mortgage.

Should I Wait to Buy a House?

A 713 credit score meets the minimum requirements for most mortgage programs. However, it’s on the lower end of the “good” credit range. You may want to wait 6-12 months to improve your score before buying a house.

Here are some pros and cons to consider:

Pros of waiting:

- Improve your score to get better mortgage rates

- Boost your chances of getting approved

- Have time to save more for a down payment

Cons of waiting:

- Home prices could increase

- You may miss out on low inventory

- Interest rates could rise

Weigh these options carefully as you decide the best timing for your home purchase. Speak with a trusted mortgage professional for guidance specific to your financial situation.

While a 713 credit score is sufficient, a higher score in the 720s or 730s will qualify you for lower rates and ensure a smoother mortgage approval process. Take time to boost your credit if you can, but buying now with 713 is definitely achievable. Be sure to compare multiple lender quotes to find the best rates available.

The Bottom Line

Yes, you can absolutely buy a house with a credit score of 713. This FICO score falls within the good credit range and meets eligibility for conventional loans and government-backed mortgages like FHA, VA and USDA loans.

However, a higher score between 740-780+ is ideal to unlock the lowest mortgage interest rates. If possible, spend 6-12 months improving your credit before applying for a home loan. This can save you thousands over the life of your mortgage.

A 713 credit score is adequate to qualify, but higher is better when it comes to buying a house. Review your full credit profile, income, assets and debts. With a solid application and some rate shopping, you can buy a home now with confidence.

Keep your credit utilization low

A key factor in your credit score is your credit utilization ratio—the percentage of your available credit that you’re using. Aim to keep this ratio below 30%. This demonstrates to lenders that you’re not overly reliant on credit and can manage your finances responsibly.

Credit score versus credit history

Your credit score reflects, in a single number, your reliability as a borrower. This summary of your credit history helps simplify borrowing, but your score doesn’t tell the whole story.

Credit scores can be low for a lot of reasons. Maybe you prefer paying cash over using credit; maybe you’re too young to have a credit history; or perhaps you carry high balances.

Mortgage lenders understand that a low credit score doesn’t always mean you’re high-risk. Because of this, they consider your entire credit history as represented in your credit report rather than just your FICO score.

Even if your score is on the lower end, maintaining a “respectable” credit history can be vital for meeting the credit score to buy a house and getting your loan application approved.

Do You Really Need A Credit Score To Buy A House?

FAQ

Is 713 a good credit score for a mortgage?

A 713 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to get started is to get your free credit report from Experian and check your credit score to find out the specific factors that impact your score the most.

What credit score is needed to buy a 300k house?

You can buy a $300,000 house with only $9,000 down when using a conventional mortgage, which is the lowest down payment permitted, unless you qualify for a zero-down-payment VA or USDA loan. Different lenders have different rules, but typically they require a 620 credit score for conventional loan approval.

What loan rate can I get with a 713 credit score?

| CIBIL Score | Salaried / Professional | Non-Salaried |

|---|---|---|

| 800 & above | 8.35% | 8.35% |

| 799 to 750 | 8.50% | 8.50% |

| 700 to 749 (Including -1 & 1 to 5) | 9.15% | 9.20% |

| 650 to 699 | 9.45% | 9.45% |

What credit score is needed to buy an $180000 house?

You generally need a credit score of at least 620 to qualify for a conventional mortgage, though every lender is different.

Can you get a mortgage with a 620 credit score?

While you can get approved for a mortgage loan with a 620 credit score—and even lower in some cases—it’s generally best to have a score in the mid-to-upper 700s. Having a higher credit score can help you secure a lower interest rate and monthly payment.

Is a 713 credit score a good credit score?

A 713 credit score is considered a good credit score by many lenders. “Good” score range identified based on 2023 Credit Karma data. A credit score is a number that lenders use to help assess how risky you might be as a borrower. Credit scores are based on credit reports, which contain information about your credit history.

How much does a 713 FICO score affect your credit score?

Credit mix accounts for about 10% of your credit score. 39% Individuals with a 713 FICO ® Score have credit portfolios that include auto loan and 31% have a mortgage loan. Public records such as bankruptcies do not appear in every credit report, so these entries cannot be compared to other score influences in percentage terms.

What credit score do you need to buy a house?

The minimum credit score needed to buy a house can range from 500 to 700, but will ultimately depend on the type of mortgage loan you’re applying for and your lender. While it’s possible to get a mortgage with bad credit, you typically need good or exceptional credit to qualify for the best terms.

Can a credit score of 700 get a mortgage loan?

A credit score of 700 might not guarantee approval for a mortgage loan. Although having a 700 credit score is good, lenders consider more than just your credit score to determine eligibility. You may still want to work on improving your credit scores to save on interest.

Can I buy a home with a credit score of 700?

With a credit score of 700, you can buy a home, but lenders will review several factors to determine your eligibility for a mortgage. Learn more.