Bill pay is a convenient way to pay bills directly from your Bank of America account. With just a few clicks you can schedule one-time or recurring payments to businesses, individuals, or even credit cards. However you may have questions about how bill pay works before getting started. This comprehensive article will cover the most frequently asked questions about Bank of America’s bill pay service.

What is Bank of America Bill Pay?

Bill pay allows Bank of America customers to pay bills directly from their checking money market savings or credit card accounts. You can schedule one-time future payments or set up recurring payments to ensure bills are paid automatically. Bill pay can be accessed through Bank of America’s online banking or mobile app.

Key features include

- Pay bills from checking, savings, credit cards

- Schedule one-time or recurring payments

- Pay individuals or businesses

- Set up reminders and confirmations

- Accessible on web and mobile

Bill pay is free to use for Bank of America customers enrolled in online banking. It offers convenience and control over payments.

How Do I Enroll in Bill Pay?

To start using bill pay, you first need to enroll in Bank of America online banking if you haven’t already. The steps are:

- Go to bankofamerica.com and click “Enroll Now” for online banking.

- Enter your account information and create an online banking username and password.

- Accept the online banking terms and conditions.

- Once enrolled, log into your online banking account.

- Select the “Bill Pay” tab and accept the bill pay terms and conditions.

Once you accept the bill pay terms, you can begin adding payees and scheduling payments immediately. Make sure you have your latest bills available to reference account numbers and payment addresses.

What Types of Accounts Can I Pay Bills From?

You can pay bills from the following Bank of America accounts:

- Checking accounts

- Money market savings accounts

- Credit cards

- Home equity lines of credit

So whether you want to pay from your checking, savings, or credit card, bill pay has you covered. Business accounts are also supported.

What Bills Can I Pay?

Bank of America bill pay allows you to pay almost any type of bill, including:

- Utilities – gas, electric, water, cable, etc.

- Mortgage and rent payments

- Car loans and leases

- Insurance bills – auto, health, home, life

- Federal, state and local taxes

- Credit cards – Bank of America or other issuers

- Retail store cards and loans

- Gym and club memberships

- Childcare and tuition

- Charitable donations

- Friends and family – pay an individual

You can add any business or individual with a mailing address as a payee, provided they accept mailed payments.

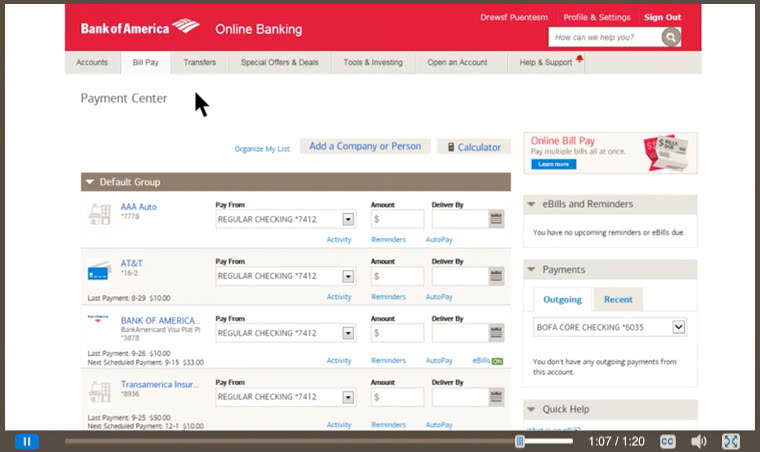

How Do I Schedule Payments?

Scheduling one-time or recurring payments is simple in Bank of America’s bill pay platform. Just follow these steps:

- Select “Bill Pay” and choose the account to pay from.

- Click “Pay a Company or Person” and enter the payee name.

- Enter the payee details including account number, address, etc.

- Enter the payment amount and delivery date.

- For recurring payments, choose the frequency and duration.

- Review and submit the payment.

Remember to schedule the payment at least 5 business days before the due date to allow for processing time. You’ll get a confirmation email when the payment is sent.

Are There Limits on Bill Pay Payments?

Bank of America does not limit the number of bills you can pay through their bill pay service. You can pay as many payees as you want from a single account.

The maximum bill payment amount is $100,000 per transaction. However, other limits may apply temporarily if you’ve recently changed your account number or had fraudulent activity.

Is Bank of America Bill Pay Safe to Use?

Yes, Bank of America bill pay is extremely safe and secure to use. It utilizes top-level 256-bit SSL encryption to protect your financial information. Other safety practices include:

- Secure login using username, password, and multi-factor authentication.

- Account alerts to notify you of suspicious activity.

- $0 liability fraud protection in case of unauthorized payments.

- Advanced verification requirements for adding new payees.

You have the same level of protection against fraud using bill pay as you do for any other online banking activity.

What Are eBills in Bill Pay?

eBills allow you to receive billing statements electronically through Bank of America’s bill pay platform. When you enroll in eBills with a payee, you’ll receive the eBill in your bill pay account instead of a mailed paper statement.

Benefits of eBills include:

- Paperless billing reduces clutter

- View statements sooner than mailed bills

- Reminders and notifications when a new eBill arrives

- Store statements securely for up to 18 months

- Access eBills anywhere on mobile or web

Enrolling in eBills takes just a few clicks once the payee is set up. Most major companies like utilities, banks, and credit card issuers support eBill delivery.

Can I Cancel a Bill Payment?

You can cancel a scheduled or recurring bill pay payment at any time before the payment date. Just log into your account, locate the payment under “Pending Payments” and click cancel.

For a same-day payment, you typically have until 7:00 PM PT to cancel. If it’s a future dated payment, just cancel anytime before the scheduled date. However, you cannot cancel a payment on the day it is in process.

How Do I Edit a Bill Payment?

To edit a scheduled bill payment amount or date, follow these steps:

- Go to “Pending Payments” and select the payment.

- Choose “Edit Payment” and change the details as needed.

- Review and save the edited payment.

You can edit a bill payment up until 7:00 PM PT on the day before the payment date. Just be aware that changing the amount may require re-verifying the payee.

How Do I Get Bill Pay Support?

If you need help with Bank of America’s bill pay service, you have several options:

- Call customer support at 800-432-1000.

- Send a secure message through online or mobile banking.

- Visit a local Bank of America financial center.

- Access the bill pay FAQ site for self-service help.

Support agents can help with enrollment, scheduling payments, resolving errors, and any other bill pay questions you have.

The Bottom Line

Bank of America’s online bill pay provides a fast, easy way to pay bills directly from your Bank of America accounts. Whether you need to set up one-time or recurring payments, bill pay has you covered.

If you have any other questions about Bank of America bill pay, visit their FAQ page or contact customer service. Bill pay can save you time and give you peace of mind that bills are always paid on time.

Bank of America -How to Set Up Online Bill Pay

FAQ

How does bill pay work at Bank of America?

How long does it take Bank of America to process bill pay?

Are there any disadvantages to online bill pay?

What is the limit on Bank of America bill pay?

How do I use bank of America’s Online bill pay?

First-time Bill Pay users will need to enroll in Online Banking and accept Bank of America’s Online Banking terms and conditions. Once you have enrolled, log in to Online Banking and select the Bill Pay tab (you will also be asked to accept the terms and conditions associated with using Bank of America’s online Bill Pay).

What is Bank of America bill pay?

Bill Pay is an online service that allows you to pay your bills through Bank of America’s Online Banking. You can set up one-time payments, schedule future payments or create recurring payments from your checking, money market savings account, SafeBalance Banking® account or from your Home Equity Line of Credit. Footnote What are eBills?

Does Bank of America have a bill pay option?

The bill pay option in the Bank of America Mobile App helps make things easy. Terms and conditions apply. The Zelle related marks are used under license from Early Warning Services, LLC. Mobile Banking requires that you download the Mobile Banking app and is only available for select mobile devices. Message and data rates may apply.

How do I schedule a bank of America bill payment?

Schedule bill payments from your Bank of America deposit account with just a few taps or clicks. You can pay utility bills, a Bank of America credit card or other credit cards and more – and get immediate confirmation that your payment has been scheduled. Screens simulated for illustrative purposes only. Actual experience may differ.

When can bank of America credit card payments be paid?

Note that Bank of America credit card payments from a Bank of America account, personal or small business, can be paid any day of the week. If you have a SafeBalance Banking account, all bill payments will be subtracted from your balance on the day you have selected the bill to be sent to the biller.

Does Bank of America charge a fee for online banking?

There is no fee for Online Banking when you have a Bank of America account, however, there may be other fees associated with your account. Is it possible to check my account information online without signing up for Online Banking? No. For security reasons, you must enroll in Online Banking to access your account information online.