Paying your property taxes is an essential responsibility as a homeowner in Cook County, Illinois. The Cook County Treasurer’s office makes the process straightforward by providing multiple payment options. Read on to learn the different ways you can pay your Cook County property tax bill conveniently and on time.

Overview of Cook County Property Taxes

Cook County encompasses Chicago and over 130 suburbs. Property taxes pay for essential services like schools police infrastructure, and more across the county’s municipalities.

Property taxes are levied based on a property’s assessed value. In Cook County, bills are issued twice yearly – around March and August. The Treasurer mails bills to homeowners and collects payments on behalf of all taxing districts.

It’s crucial to pay your property taxes fully by the due dates to avoid penalties. The Treasurer’s website states “Failure to make a property tax payment by the due date will result in the accrual of interest and charges at the rate of 1.5 percent per month.”

Ways to Pay Your Cook County Property Tax Bill

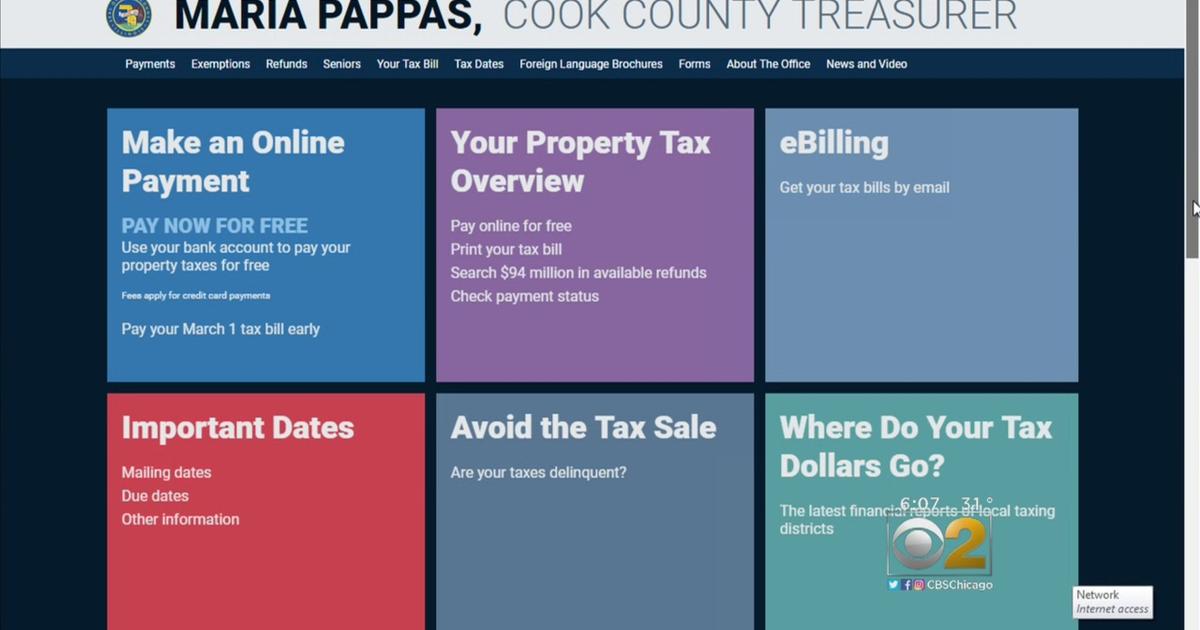

The Cook County Treasurer’s office provides various convenient payment options

Online Payment

The easiest way for most people to pay is online through the Treasurer’s website. You’ll need your Property Index Number (PIN) and payment amount. The site accepts credit cards, debit cards, or electronic checks from a bank account.

- Fast, 24/7 payment processing

- Avoid mailing delays and trips to the Treasurer’s office

- Pay installments or full year amount

- Get instant payment confirmation

Mail a Check

Mail your payment to:

Cook County Treasurer’s Office

P.O. Box 805438

Chicago, IL 60680-4116

Write your PIN on the check. Allow 5-7 days for mail delivery.

Pay In Person

Bring payment to the Cook County Treasurer’s Office at:

118 North Clark Street, Room 112

Chicago, IL 60602

They accept cash, checks, credit/debit cards, and money orders.

Auto-Pay Options

Set up recurring automatic payments from your bank account through the Treasurer’s website. Or enroll in monthly auto-debit of your checking account.

Pay at Chase Bank

Make property tax payments at any Chase location nationwide. Bring your bill or know your PIN.

Community Banks

Over 100 community banks in Cook County accept property tax payments. Check the Treasurer’s website for a list.

Key Property Tax Due Dates

Mark your calendar with these important Cook County property tax deadlines:

- 1st installment – Typically due around March 1

- 2nd installment – Typically due around August 1

- Annual full payment – Due around March 1

Check your bill for precise due dates. The Treasurer charges 1.5% monthly interest on late payments.

What to Do If You Can’t Pay on Time

If you’re unable to pay your property taxes on time, quickly contact the Cook County Treasurer’s office to ask about a payment plan. Their staff can help eligible homeowners set up a monthly installment schedule to get back on track.

You may also qualify for property tax exemptions and deductions to reduce your bill amount, such as the homeowner exemption.

Act right away if you anticipate issues paying – don’t let penalties and fees accumulate! The Treasurer’s office provides resources to help taxpayers manage payments.

Avoid the Tax Sale

Thousands of Cook County properties become delinquent and sold at auction when taxes go unpaid. Once in the tax sale, redemption is extremely difficult and cost prohibitive.

Don’t lose your property equity and ownership rights. Prioritize paying your property taxes fully and on time, or immediately get help if you fall behind.

Know Your Property Tax Bill Details

Review your bill closely and understand:

- Property Identification Number (PIN)

- Tax year

- Installment amounts and due dates

- Breakdown of taxes levied by districts

- Exemptions applied

- Outstanding balance or overpayment

Report errors immediately to the Cook County Assessor’s office. File appeals by the deadlines specified on your bill.

Check the Treasurer’s website for bill copies if you misplace yours.

Use the Treasurer’s Payment Calculator

The Cook County Treasurer’s payment calculator estimates your monthly payment amount to pay off delinquent taxes by a target redemption date. This helps determine affordable payment plans.

Additional Resources

The Cook County Treasurer’s website offers videos, brochures, and other useful resources to guide you through the property tax process. Contact their helpful staff with any questions.

Staying on top of your property tax obligations is key to maintaining your home ownership. Pay your Cook County property tax bill securely online, by mail, or in person using the convenient options provided by the Treasurer’s office.

Treasurer Maria Pappas, Cook County – Understanding Your Tax Bill – 2019 Second Installment

FAQ

Can you pay Cook County taxes online?

When can I expect my Cook County property tax bill?

How do I find my Illinois property tax bill?

At what age do you stop paying property taxes in Illinois?

How can I pay a Cook County tax?

Cook County taxes can be paid online at cookcountytreasurer.com, at any Chase Bank in Illinois, at more than 100 community banks if the taxpayer is an account holder, by mail, or at the treasurer’s office at 118 N. Clark St., Room 112,, Chicago. To pay in person or by mail, please include the payment stub from your tax bill. Online and bank payments may take up to five business days to process. Cash payments can be made at the treasurer’s office.

What is the Cook County property tax portal?

Latest News The Cook County Property Tax Portal, created and maintained by the Cook County Treasurer’s Office, consolidates information from the elected officials who take part in the property tax system and delivers Cook County taxpayers a one-stop customer service website.

How do I pay my Cook County property tax in 2022?

The due date for Tax Year 2022 First Installment was Monday, April 3, 2023. The easiest and fastest way to pay your Cook County Property Tax Bill is online. If you are unable to pay online, you may pay at any of the nearly 400 Chase Bank locations in Illinois, including those located outside of Cook County. Check the hours of your branch.

Where can I find Cook County Treasurer’s bills?

The Cook County treasurer’s first round of bills were mailed on March 1 and are available online at cookcountytreasurer.com.