Utility recovery systems allow property owners and managers to bill residents or tenants for individual utility usage. This is done through submetering or allocated utility expense recovery. While recovering these costs benefits property owners, it also means residents must pay periodic utility bills. Fortunately, utility recovery companies offer easy bill payment options. Here is an overview of paying your utility recovery systems bill.

Online Bill Pay

The most convenient way to pay a utility recovery bill is online through the billing provider’s website Companies like Utility Recovery Systems provide an online customer portal where you can view statements, see usage, make payments, set up autopay, and manage your account

Online payments can be made via credit card, debit card, e-check (direct bank account withdrawal), Apple Pay, Google Pay, and more. Some benefits of paying online include:

- Instant payment processing and confirmation

- Avoid late fees

- Review bill details and usage data

- Set up scheduled automatic payments

- Store payment methods for future use

- Access 24/7, no need to call during business hours

Online payments offer the quickest and easiest way to pay utility bills Customers can pay at any time before the due date right from their computer or mobile device

Phone Payments

While not as fast as online, paying utility bills by phone is another convenient option. Utility recovery companies have toll-free customer service numbers you can call to make a payment. After providing your account number or address, you can pay over the phone using a credit/debit card, checking account, or savings account.

Phone payments allow you to speak directly with a customer service agent if you have any bill questions. However phone lines are only open during business hours so online payment provides more flexibility if you need to pay late at night or on weekends. There may also be an additional fee for paying by phone.

Mail-In Payment

Traditional checks and money orders can also be mailed to the utility billing provider as payment. Your statement will provide a remittance mailing address to send your check or money order to. Be sure to include your account number and address on the payment to match it to your account.

Allow 7-10 business days for mailed payments to reach the billing processor and avoid any late fees. As with phone payments, there is less flexibility on when you need to mail it to ensure on-time delivery. However, paying by mail may be preferred by customers without online access or who don’t want to pay card transaction fees.

Drop Boxes

Some utility recovery companies have physical drop box locations where you can drop off check or money order payments. This allows you to pay in-person without having to go inside an office. Payments left in the drop box by the collection time will typically be processed same-day.

Drop box payments offer a secure way to pay without fees or the need to provide sensitive account details verbally over the phone. But availability of a drop box depends on the specific billing provider. Check your statement for drop box instructions and cutoff times in your area.

Retail Payment Locations

You may also be able to pay your utility recovery bill at local retail stores. Companies like Paymentus allow bills from various providers to be paid at thousands of pharmacies, grocery stores, convenience stores, and other payment kiosks. You will need your statement or account number and can pay using cash, pin debit, credit/debit cards, etc.

Retail locations allow you to pay in person with cash if needed. However, there may be a convenience fee. Verify with your utility billing company which retail outlets accept payments for your account. Payment networks like Paymentus also allow online payments from their website.

Automatic Payments

For worry-free bill payment, consider enrolling in automatic payments through your utility billing provider’s online account portal. This automatically withdraws the amount due from your specified bank account or credit card each month.

Automatic payments avoid late fees, free up time spent manually making payments, and give peace of mind knowing it’s handled each billing cycle. Make sure funds are available in the selected account on the withdrawal date. You can change or cancel scheduled auto-pay at any time through your online account.

Payment Extensions and Assistance

If you are unable to pay your utility recovery bill in full by the due date, contact the billing company right away to explain your situation and request an extension or payment plan. Most will work with customers facing financial hardship.

They want to help you maintain service and avoid sending past due accounts to collections. Be proactive in communicating before your account becomes delinquent. Ask what payment assistance or hardship programs may be available if you qualify.

Avoid Late Fees and Disconnection

It’s crucial to pay utility bills on time each month to avoid penalties like late fees, disconnection of service, collections accounts, and credit damage. Costly late fees ranging from $10 to $50 are typically assessed if payment is not received by the due date.

Accounts overdue by 60 days or more may have service discontinued until paid in full. Utility recovery providers must follow applicable state regulations related to disconnection processes. Having your utilities cut off creates major hassles and risks property damage.

Collections and Credit Impact

Severely past due utility accounts are eventually sent to collections agencies for recovery of the unpaid balance. This can severely hurt your credit score for up to 7 years. Collection accounts also incur additional recovery fees.

Avoid negatives on your credit report and extra collection fees by keeping your utility bills paid on schedule. If you cannot pay, ask for an extension or alternative payment arrangement before the account becomes delinquent. Maintain open communication with the billing company.

Payment Support Options

Reputable utility recovery companies want to help customers who may struggle with payments. Beyond payment plans and extensions, some available support options include:

- Budget or average billing: Spread costs evenly over the year

- Arrears management programs: Gradually pay down past due balance

- Emergency utility assistance funds and grants

- Low-income rate discounts

- Waiving late fees due to COVID hardship

Explore all payment support alternatives to avoid service disruption and send the account to collections. But act quickly at the first sign of difficulty paying, as options are more limited once past due.

Communication is Key

The most important thing is keeping in touch with your utility billing provider if you anticipate issues paying your bill. Don’t just ignore statements and let the account become seriously delinquent. Customer service agents can explain payment assistance available for your situation before an unpaid balance escalates out of control.

By maintaining open communication and leveraging the various payment methods available, paying your utility recovery bill can be fast, easy, and headache-free. Online payments provide the ultimate convenience, while other options like phone, mail, or in-person give flexibility. Setup automatic monthly payments for peace of mind. Seek help or payment arrangements from the billing company if needed. Staying current on utility bills avoids many costly penalties down the road.

Five Reasons Why You Need a Utility Recovery Program

There are two basic ways to capture the data needed for billing your residents for utilities. Submetering involves installing a meter between the master meter and the resident’s unit. These are often required by law during new construction. They can sometimes be installed in existing buildings as well. Submeters provide a fast ROI, often under 6 months.

When submeters cannot be installed, a ratio utility billing program may be a good alternative.

RUBS programs are a good method for allocating utility expenses in communities built before 1980 due to older plumbing configurations that may render submetering impossible or cost-prohibitive. RUBS programs will also provide an incentive for residents to conserve utilities since they are now paying a bill. Over time, having your master utility bills decrease up to 20% is common based solely on a resident’s conservation efforts.

A RUBS program provides protection to owners against escalating utility costs that negatively impact NOI and are a good alternative to rent increases since residents shopping for a new home are likely to compare rent costs across properties.

Is Utility Recovery Legal?

Utilities are regulated at multiple levels; each with its own set of rules. The first thing we do is check the regulations at the property address. For example, it’s common for new construction to be submetered so each resident pays for the utilities consumed inside their unit. If a property already exists, we examine the regulations and let you know what’s possible.

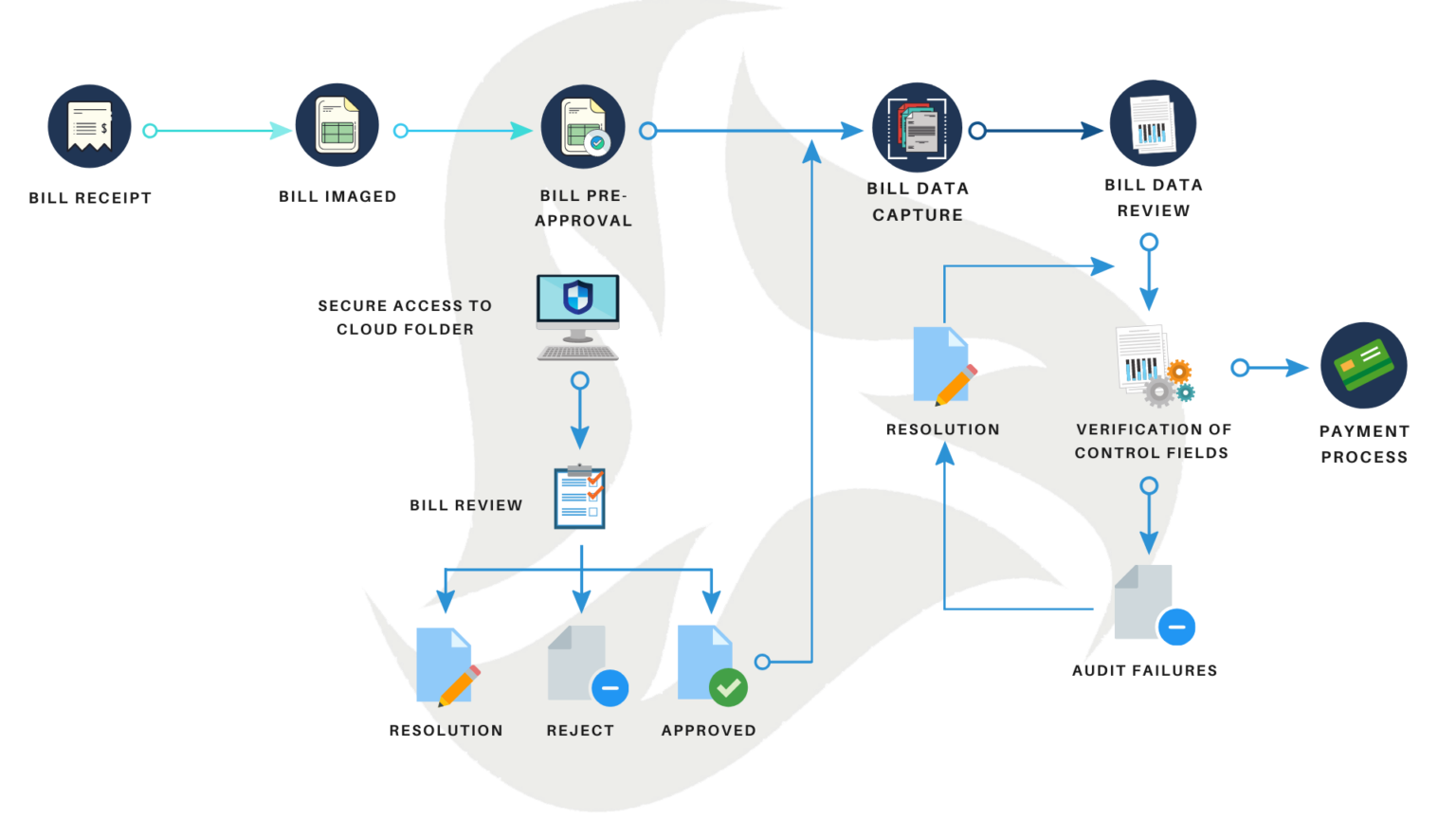

TriStem Utility Cost Recovery – How It Works

FAQ

What is utility cost recovery?

How do I pay my manatee utilities by phone?

What are bill paying services?

What is the phone number for Pinellas County utilities bill payment?