Paying off credit card debt can feel like an uphill battle. High interest rates ensure balances continue creeping higher, no matter how much you pay each month. But credit card payoff calculators make it easy to see exactly when you’ll be debt-free.

I’ve used payoff calculators from Bankrate Calculator.net and Barclays to create debt payoff plans. By adjusting variables like monthly payment and interest rate I optimized repayment strategies.

While each calculator works a bit differently they all provide the key information you need to take control of credit card balances. Read on to learn how these tools can help you pay off your credit cards faster and save on interest.

How Credit Card Payoff Calculators Work

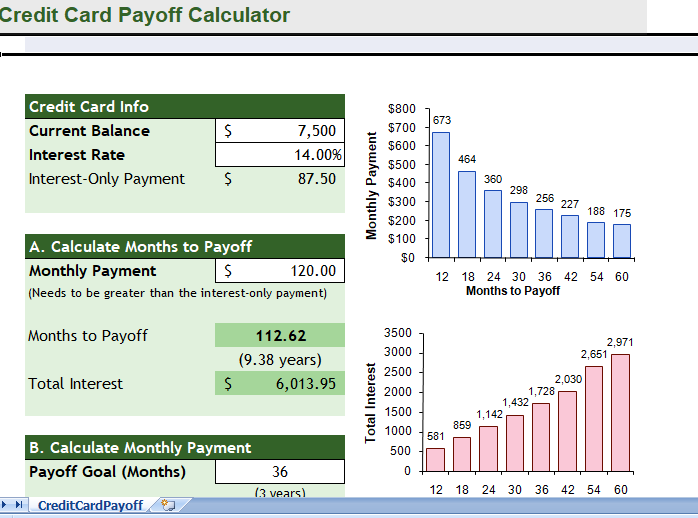

Credit card payoff calculators take your current balance, interest rate and monthly payment to estimate a payoff timeframe. Most also calculate interest paid over this period.

To use a payoff calculator, you’ll need to enter:

-

Current balance – The total owed on the credit card account. You can find this on your monthly statement.

-

Interest rate – This is the annual percentage rate (APR) charged on the balance. Check your statement for the current rate.

-

Minimum payment – The minimum you must pay each month, as shown on your statement.

-

Additional payment – Any extra you choose to pay above the minimum.

With this information entered, the calculator projects your payoff timeframe. It also compares interest paid when making minimum payments versus extra payments.

For example, let’s say you owe $5,000 on a credit card with a 19% interest rate and $100 minimum monthly payment.

If you continued paying just the minimum, the balance would take over 7 years to pay off and accrue $2,524 in interest.

But by paying an additional $100 per month, the balance is gone in just over 2 years with only $573 in interest.

Features of Credit Card Payoff Calculators

While the basic inputs are the same, some payoff calculators have unique features. Here are some to look for:

Multiple cards – Add details of several credit cards to optimize repayment across all accounts.

Set target payoff date – Choose your desired payoff timeframe and the calculator figures the monthly payment needed.

Account for promotional rates – Factor in lower teaser rates on balance transfer or introductory APR offers.

Amortization schedule – See month-by-month breakdown of balance, interest and payments.

Recommend payment increase – Calculator suggests how much extra to pay each month to meet a payoff goal.

Auto loan and mortgage calculators – Some calculators work for all types of installment loans, not just credit cards.

How to Get the Most from Payoff Calculators

To make the most of credit card payoff calculators, follow these tips:

-

Enter updated balances and rates each month as these change over time.

-

Experiment with higher payments to see the time and interest savings. Even an extra $20 or $50 per month makes a difference.

-

Use multiple card calculators to balance payments across all accounts, focusing on highest rate cards first.

-

Set a target payoff date and work backwards to determine the monthly payment needed to meet this goal.

-

Re-check the calculator whenever you receive a credit limit increase or APR change on an account.

-

Compare amortization schedules with and without extra payments to stay motivated.

-

Use projected payoff dates to plan balance transfer or consolidation applications.

-

Confirm promotional rate expiration dates and plan repayment accordingly.

-

Rerun the numbers whenever your financial situation changes to adjust payments if needed.

Credit Card Payoff Calculators To Try

Now that you know how payoff calculators work and how to use them effectively, here are some top choices to try:

Bankrate Credit Card Payoff Calculator

The Bankrate payoff calculator allows input of multiple credit cards with unique balances, rates and minimum payments for each.

It projects the months to payoff and total interest paid for each card individually and combined. You can enter a set monthly payment for optimized repayment across all accounts.

The calculator also models balance transfer cards with 0% intro APRs. And it provides tips for choosing the best balance transfer offers.

Try the Bankrate Credit Card Payoff Calculator here.

Calculator.net Credit Card Payoff Calculator

This Calculator.net tool produces an amortization schedule detailing balance, interest and payments month-by-month until the balance is paid in full.

It allows input of up to 20 different cards with varying balances, rates and limits. You can rank the accounts by interest rate to target the highest rate cards first.

The calculator recommends the optimal monthly payment to pay off all balances by a target date. This goal date along with desired monthly budget can be adjusted to generate a custom payoff schedule.

Use the Calculator.net Credit Card Payoff Calculator here.

Barclaycard Repayment Calculator

Barclaycard’s repayment calculator is simple to use. It includes just one card’s balance, interest rate and minimum payment amount.

You can model either making the minimum payment or a fixed payment each month. Or choose to pay off the full balance in one month.

The tool projects how many months to payoff under each scenario and the total interest expense. This highlights the money saving benefit of paying above the minimum when possible.

Access the Barclaycard Repayment Calculator here.

Take Control of Your Credit Card Debt

Credit card debt can feel overwhelming. But payoff calculators make it easy to see the light at the end of the tunnel.

They provide clarity on exactly when balances will disappear while helping you save money on interest payments. Use these tools to take control of your credit card debt and pay it off sooner.

Fix your payment based on what you can afford

If you can afford this month’s minimum payment amount, try fixing your future payments at the same amount, or more if you can.

This way your payments will always be above the minimum amount (as long as you don’t spend more on your card) and you’ll save on time and interest as your balance decreases.

Compare paying the minimum to a fixed amount

The example shows how much interest it would cost and how much time it would take to clear a balance of £2,500 on a card with a 28.9% annual interest rate. This assumes that there is no further spend on the card.

- Minimum payment of £78 – youd be charged £5,009 in interest and it would take 26 years and 11 months to clear your balance

- Fixed payment of £78 – youd be charged £1,763 in interest and it would take 4 years and 7 months to clear your balance

- Fixed payment of £108 – youd be charged £987 in interest and it would take 2 years and 9 months to clear your balance

Note: these results are a guide, calculated on approximate minimum payment rates which vary by provider and product. We assume no additional spend on the card, no fees are incurred and the same static interest rate is paid on all balances.

Before you go ahead and fix your monthly payments, here are a few things to think about:

- If you don’t think you can fix your monthly payments at the moment, you can always make additional payments whenever you’re able to. You can make a payment from your UK bank account, through the Barclaycard app or online servicing.

- If you fix your payments and carry on spending on your card, check your fixed amount regularly because you may want to increase the fixed amount to make sure it still meet your needs.

- If you fixed your payment with a Direct Debit, but your monthly balance means this isn’t enough to cover your minimum payment, we’ll automatically take your minimum amount. We’ll let you know if this happens.

How to calculate credit card interest

FAQ

How long will it take to pay off $20,000 in credit card debt?

How long will it take me to pay off $30,000 in credit card debt?

How long would it take to repay a $2000 credit card debt at a 19% interest rate by making only the minimum required payment of $25 month?

What is a credit card payoff calculator?

A credit card payoff calculator can help you know when you will pay off your credit card debt so that you can plan your payments with a pre-determined amortization schedule and pay off your debt faster. Why should you pay off your credit card debt? To get on the path to financial security and freedom, you should first get out of debt.

How do I pay off credit card debts each month?

There are multiple ways to approach paying off credit card debts each month. The Credit Cards Payoff Calculator uses a method known as the “Debt Avalanche method.” The calculator also assumes that no further transactions are made on any of the credit cards, minimum payments stay the same, and interest rates are static.

How long does it take to pay off a credit card?

While our Credit Card Payoff Calculator assumes an introductory APR of 18 months, some can be as low as 6 months. Who should get one? If you want to pay off your credit card debt faster, then a balance transfer credit card might be the best way to go about it.

What is a credit card payoff strategy?

This credit card payoff strategy focuses on psychological factors like motivation and incentive to keep people on track towards paying off their credit card debt. The two methods are similar in that the first priority is always to meet the minimum payments due for each credit card in order to avoid hefty fees.

How do you calculate the time to pay off a credit card?

principal = PMT − (P × r) The principal payment is equal to the monthly payment minus the interest payment. To calculate the time to pay off a credit card, start with using these formulas to calculate the interest and principal for the first payment. Then, subtract the principal paid from the principal balance to find the remaining balance.

Should I pay my Barclaycard balance in full?

You must pay at least the minimum monthly payment (estimated to be £ 5). Paying the balance in full each month means you pay no interest on what you’ve borrowed. By only making minimum payments, you’ll pay more in interest, fees and charges on your Barclaycard than towards paying back what you’ve borrowed.