This page from your car insurance company tells you how much your coverage costs and what you get for that price.

Policygenius content follows strict guidelines for editorial accuracy and integrity. Learn about our editorial standards and how we make money.

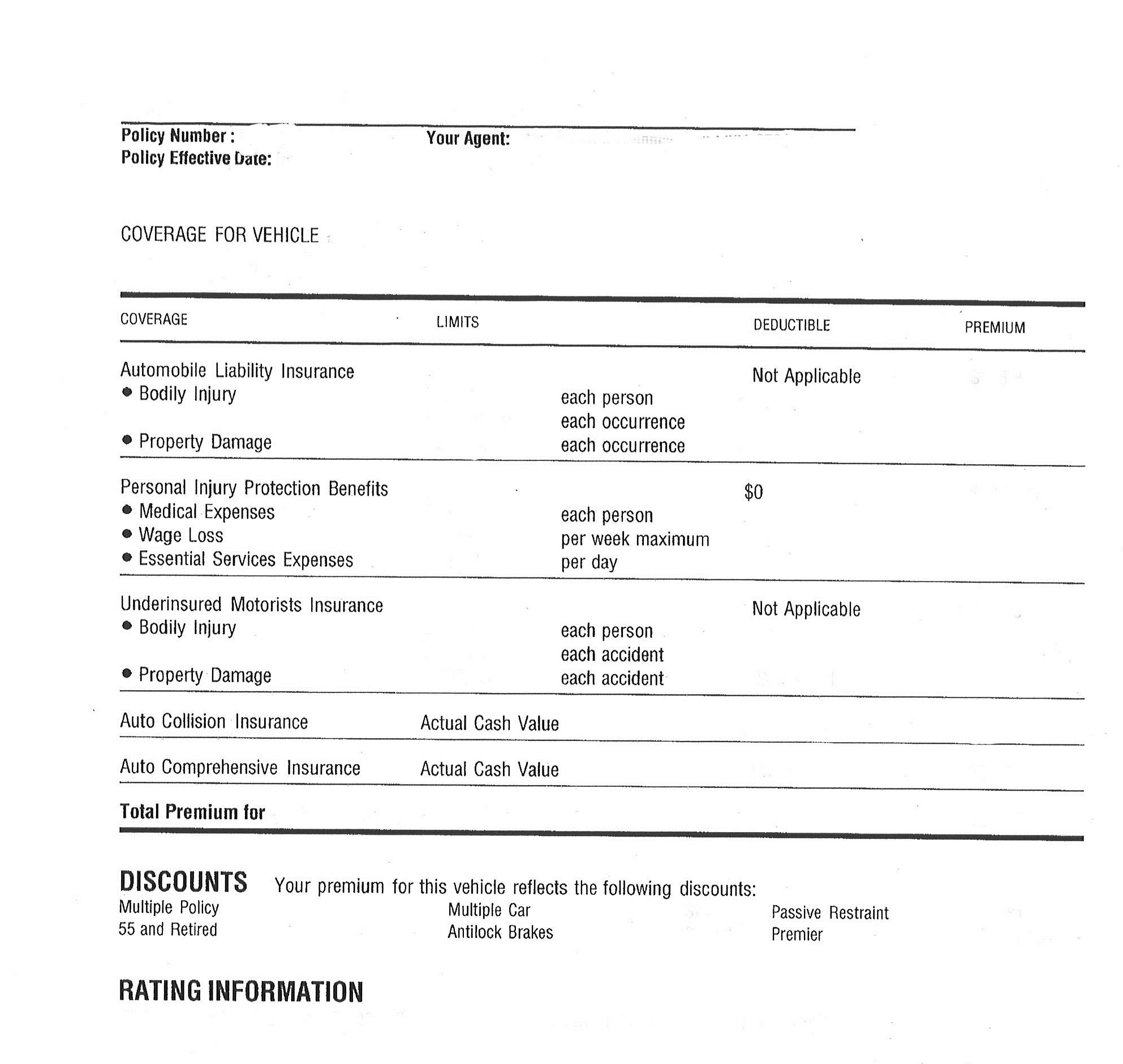

The first page of your auto policy is the “declarations page.” This page tells you about the basics of your policy, like how much your premiums are and what kind of coverage it includes. You can think of the declarations page as a summary of your auto insurance policy.

Your premium, how often you pay it, and the deductibles you have to pay for each part of your coverage are all listed on the declarations page, which is also known as the “dec page.” Along with your car’s make, model, and VIN, as well as its lienholder if you lease, it will also have this information.

The declaration page, also called the dec page, is the first page of your car insurance policy. It provides a summary of your coverage details, including the types of coverage you have, your coverage limits, deductibles, premium costs, and more. Reviewing your dec page is important to ensure you fully understand your policy. Let’s walk through a sample declaration page to understand what each section means.

Overview of the Dec Page

The declaration page acts as a snapshot of your policy. It is not exhaustive but includes the key information you need to know. Standard details on a car insurance declaration page include:

- Policy number

- Policy effective dates

- Names of insured drivers

- Vehicle details like VIN, make, and model

- Premium cost, payment schedule, fees

- Deductibles

- Types of coverage and limits

- Discounts

- Lienholder information if leasing

Below we’ll explore a sample dec page section-by-section to understand what the key parts mean.

Top Policy Details

The top of the dec page lists administrative information like:

- Policy Number: Your unique identifier needed when filing a claim

- Policy Period: The effective start and end dates, such as 6/1/2023 to 12/1/2023

- Previous Policy Number: For reference if renewing a policy

This section may also list your specific insurance company and agent’s contact details.

Policyholder Information

Next, the dec page will identify the main policyholder along with any other insured drivers on the policy. For each person it will include:

- Full name

- Age

- Address

If you have excluded certain household members from your policy, such as a child, their names may be listed here as well.

Vehicle Details

Your dec page will list all cars covered by your policy. For each vehicle, details will include:

- Year, make, and model: Such as 2022 Toyota Camry

- VIN: The unique 17-digit vehicle identification number

- Garaging address: Where the car is parked

If you have multiple vehicles insured they will each be itemized separately.

Premiums, Fees, and Payment Schedule

A major section of the dec page outlines your insurance costs:

- Overall premium amount

- Itemized premium costs: Breaks down premium for each type of coverage

- Fees: Any state fees or other charges

- Payment schedule: Such as monthly or quarterly installments

- Payment method: Such as automatic bank withdrawal

Review this section to ensure your premium matches your selected coverage.

Deductibles

The dec page lists the deductible amounts you agreed to pay out-of-pocket for certain coverages when you file a claim. Common car insurance deductibles include:

- Collision coverage: Such as $500 or $1000

- Comprehensive coverage: Typically $500 or $1000

- Uninsured motorist bodily injury: Often $500

Higher deductibles lower your premiums but mean more money you pay per claim.

Coverage Types and Limits

A major part of the dec page breaks down your specific car insurance coverages and associated limits. Standard auto coverages include:

- Liability insurance: Bodily injury and property damage per person/accident

- Personal injury protection (PIP): Medical expenses per person/accident

- Uninsured motorist: Bodily injury per person/accident

- Underinsured motorist: Bodily injury per person/accident

- Collision: Damage repairs up to cash value minus deductible

- Comprehensive: Damage repairs up to cash value minus deductible

The limit next to each coverage is the maximum payout the insurer will provide. Understanding your limits helps ensure you have adequate coverage.

Additional Coverages and Endorsements

The dec page will also list any supplementary coverages, endorsements, or riders you elected to add to your policy, such as:

- Roadside assistance

- Rental car reimbursement

- Accident forgiveness

Endorsements enhance or customize your policy for specific needs. Common endorsements include:

- Custom parts or equipment coverage

- Rideshare coverage

- Gap coverage

Discounts

Lastly, the dec page shows any discounts applied to your policy that helped lower your premium, such as:

- Safe driver discount

- Good student discount

- Multi-policy discount

- Anti-theft device discount

Use the Dec Page to Your Benefit

Carefully reviewing your car insurance declaration page helps you understand your policy coverage and costs. Make sure it accurately reflects the coverage you requested. Being familiar with your dec page makes it easier to file a claim and know what to expect. Use your declaration page to your benefit as an informed insurance policyholder.

Basic information on the car insurance declarations page

The information on a dec page about your car insurance policy will be basic and will be written in a way that sounds like a summary. It won’t go into great detail. The policy number is at the top of the dec sheet. You will need to use this number when you file a claim. Some dec sheets will also have the number of your old policy. This could change often because you may need to get a new policy every six months to a year.

Below are additional types of details you’ll find on a car insurance declarations page:

Details about your policy, such as the length of your car insurance policy, will be on the declarations page. The period of time starts on one date (the effective date) and ends on the other date (the end date). These dates will each be written as a precise day, month, and year. Most policies have a start time that is one minute after midnight on the policy’s start date.

Premiums and deductibles

Your declarations page will tell you how much your premiums are and how often you need to pay them (monthly, bi-annually, or annually). Your premium is based on many things, such as your age, gender, where you live, your driving record (like if you’ve had a DWI or DUI or other traffic violations), the type of car you drive, and how often you drive it. The most important factor in determining your car insurance premium is how much you’ll need in coverage.

In order for your insurance company to pay the rest of your claim, you have to pay a certain amount first. This is called the deductible. On your declarations page, a deductible will be written next to the types of car insurance coverage that apply. However, you may not have to meet a deductible for all types of coverage. Typical deductibles are between $100, $500, and $1,000.

Auto Insurance Declaration Page

FAQ

What is the declaration page of a car insurance policy?

What is a declaration letter for car insurance?

Is a declaration page the same as a certificate of insurance?

How to read a dec page?

What is an auto insurance declarations page?

An auto insurance declarations page is an overview of your car insurance policy, but it doesn’t contain all the fine points. Those are laid out in other sections of the policy, which go into much greater detail. Your car insurance declarations page will contain information about: When the policy is valid. What vehicles are covered.

Who is on the auto insurance declarations page?

The auto insurance declarations page will describe all the relevant parties to the policy. These people will be: The named insured. Usually, that’s you, the person buying the policy to insure your car. It may also be anyone else who drives the car, such as your children or spouse.

How do I get my car insurance declarations page?

There are a few ways to get your car insurance declarations page: When you first purchase a car insurance policy, your provider will either mail or email you a copy of your policy documents, including the declarations page.

What is an insurance policy declaration page?

An insurance policy’s declaration page is an overview of your insurance policy. It outlines personal information about who is insured, as well as coverage details and effective dates. Although policies vary, the following items are typically included on a declaration page: