Instead, it operates under an at-fault system. This means the person responsible for causing the accident is liable for any injuries and losses that result.

If you were injured in a car crash in Texas, you can pursue compensation from the at-fault party.

Texas uses an at-fault auto insurance system rather than a no-fault system. This means the driver responsible for causing an accident is liable for damages So how exactly does this work and what does it mean for Texas drivers? This guide explains everything you need to know about Texas being an at-fault state.

What is the Difference Between At-Fault and No-Fault Insurance?

There are some key differences between at-fault and no-fault car insurance laws:

- At-fault states – The at-fault driver must pay for damages they cause in an accident Their liability coverage pays out claims, Fault must be determined,

- No-fault states – Each driver’s own insurance covers their losses, regardless of fault. Designed to speed up claims and reduce litigation. Still may determine fault for serious cases.

- Choice no-fault states – Drivers can choose either at-fault or no-fault coverage. Gives flexibility in coverage and claims process.

So in at-fault states like Texas, the responsible party pays. In no-fault states, your own insurer pays no matter who was at fault.

Is Texas an At-Fault or No-Fault Auto Insurance State?

Texas is an at-fault state for auto insurance. This means if you cause an accident, you are responsible for paying for any resulting property damage or injuries to others. Your liability coverage will pay out damage claims.

After an accident in Texas, fault must be determined to establish who pays. The at-fault driver’s insurance company will then cover losses like:

- Bodily injury claims

- Hospital bills

- Lost wages

- Disability

- Pain and suffering

- Property damage

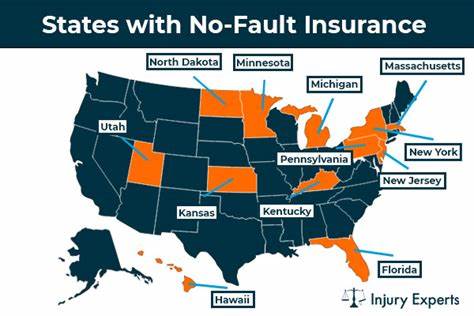

Around 38 states in total use an at-fault insurance system including Texas. Only 12 states use a no-fault system.

How is Fault Determined in Texas?

Determining fault is a key part of the claims process in Texas since the at-fault driver must pay damages. Fault is determined through evidence like:

- Police accident reports

- Eyewitness statements

- Photographs from the accident scene

- Traffic camera footage

- Expert accident reconstruction analysis

- Medical reports detailing injuries

Police typically make an initial fault determination based on factors like weather, road conditions, traffic controls, and accounts from drivers and witnesses.

Accident lawyers and insurance claims adjusters also evaluate evidence to establish fault. Ultimately a judge or jury makes the final fault ruling if a lawsuit is filed.

What if I’m Partially at Fault in Texas?

Texas uses a modified comparative negligence rule to determine compensation if you are partially at fault for an accident. Here’s how it works:

- If you are 51% or more at fault, you cannot recover any damages from other liable parties.

- If you are less than 51% at fault, your compensation is reduced by your percentage of fault. For example, if you are 30% at fault, your payout is reduced by 30%.

So you can recover damages if you are partially at fault, but the amount is reduced based on your share of responsibility. It aims to distribute liability fairly in each situation.

No-Fault Car Insurance in Other States

While Texas uses an at-fault system, here is how no-fault insurance works:

- Your own insurer pays your damages, regardless of fault. Designed to be faster and avoid litigation.

- Still need to buy liability coverage to pay for damage you cause to others.

- 12 states currently have mandatory no-fault insurance systems including Florida, New York, and Michigan.

- No-fault states require drivers to carry personal injury protection (PIP) coverage to pay medical bills and lost wages after an accident.

- Lawsuits are restricted but possible if a serious injury threshold is met, at which point fault gets determined.

So while no-fault aims to provide faster claim payments, at-fault and no-fault both have pros and cons for drivers.

How Might No-Fault Impact an Accident Claim?

No-fault insurance can simplify and accelerate the claims process since your own insurer pays regardless of fault. However, it also limits the ability to sue a negligent driver.

Potential advantages of no-fault insurance:

- Faster payment of medical bills and lost income

- Lower litigation costs

- Less need to determine fault

Potential disadvantages of no-fault:

- Restricted ability to sue an at-fault driver

- Required to carry PIP coverage

- Potential for higher premiums

- Lower payouts for pain and suffering damages

Under no-fault, compensation for serious injuries still requires determining fault. But for minor accidents, no-fault gets benefits paid quicker.

Does No-Fault Insurance Lower Rates?

In theory, no-fault insurance should lower premium costs due to reduced lawsuits between drivers. However, average car insurance rates are actually similar in no-fault and at-fault states.

For example, Michigan is a no-fault state with average annual premiums of $2,738 which is higher than the national average. Texas, an at-fault state, has average premiums of $1,620 – well below the national rate.

So while no-fault reduces some litigation costs, additional required coverage like PIP can offset potential savings. Rates ultimately depend most on factors like driver density, accident frequency, medical costs, state laws, and competition.

The Bottom Line on Texas Being an At-Fault State

To summarize key points:

- Texas uses an at-fault car insurance system, not no-fault

- The negligent driver must pay for any damages and injuries they cause

- Fault is determined through police reports, witnesses, photos, video footage, and other evidence

- You can still recover damages if partially at fault, but the payout will be reduced

- No-fault states pay through your own policy and restrict lawsuits but have tradeoffs too

So while no-fault has some benefits, Texas continues using a traditional at-fault auto insurance model. Understanding these laws is crucial when filing an injury claim after an accident.

How an Attorney Can Help in Texas

Dealing with insurance claims after an accident in an at-fault state like Texas can be complex. An experienced personal injury attorney can help by:

- Gathering evidence to show fault

- Negotiating a fair settlement

- Filing a lawsuit against the at-fault driver if needed

- Making sure claims are submitted on time before legal deadlines expire

Having skilled legal representation maximizes your chances of obtaining the maximum compensation you deserve under Texas at-fault laws. Consider consulting with an attorney before signing any settlement agreements with insurers.

What If I Am Partly At Fault for the Accident?

Texas follows the modified comparative negligence rule. If you are found to be partly responsible, your compensation will be reduced by your percentage of fault. However, you cannot recover compensation for your losses if you’re 51 percent or more at fault. A Houston car accident attorney will build a solid case to hold the at-fault party accountable for their actions so that you can recover what you deserve.

What Is the Difference Between At-Fault and No-Fault States?

At-fault states, like Texas, make the driver who caused the accident pay for the injuries and damages. Their insurance company must pay for medical bills, property damage, and other costs. But in a no-fault state, the insurance company for each driver pays for their client’s damages, even if they weren’t at fault for the accident.

Is Texas a Fault or No-Fault State for Car Insurance? | Accident Attorney Explains

FAQ

What does it mean that Texas is a no-fault state?

Who is at fault in a car accident in Texas?

Is Texas a 50/50 state car accident?

What happens if someone who isn t on your insurance crashes your car Texas?